The UK faces a critical need for public development projects, but the traditional model for financing these projects, the Private Finance Initiative (PFI), has come under fire. PFI, implemented between 1997 and 2010, was successful in delivering over 700 construction projects, but its complexity and lack of flexibility ultimately proved problematic.

While PFI's core concept was sound, its rigid structure often hindered progress. Long, complex contracts made it difficult to adapt projects to evolving needs, turning the model into a barrier rather than a facilitator. The model's inherent complexity also led to disputes over maintenance costs and responsibilities, particularly when public authorities lacked experience with the PFI structure.

The new Labour government, determined to revive the UK's construction sector, has introduced a National Wealth Fund, aiming to inject billions of pounds into projects across the country. This ambitious plan intends to attract substantial private investment, with a goal of leveraging £3 of private funding for every £1 of taxpayer money. While the National Wealth Fund represents a significant step towards revitalizing infrastructure, it also highlights the strain on the public purse, which already carries a historically high level of debt.

This scenario creates a compelling case for exploring new models of public-private partnerships (PPPs). A revamped PFI structure, one that alleviates the burden on taxpayers and attracts institutional investors seeking long-term, liability-matching investments, could prove transformative.

An Alternative Approach: The NPD Model

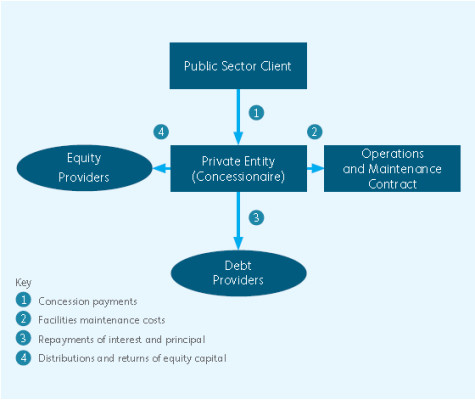

Fortunately, a successful alternative to PFI already exists: the Non-Profit Distributing (NPD) model. Introduced by the Scottish government in 1990, NPD has proven effective in delivering new infrastructure projects, primarily in education, health, and transportation sectors.

The NPD model differentiates itself from PFI by prioritizing public value over profit. While the private sector remains integral in designing, building, financing, and occasionally operating infrastructure, any profits generated by the project company are reinvested directly into the project. This structure ensures that public funds are directed towards the intended purpose and that long-term costs are minimized.

Addressing PFI's Shortcomings

The NPD model tackles several of PFI's drawbacks. It promotes a collaborative approach, sharing risks and rewards between public and private partners, fostering efficiency and cost-effectiveness. Public authorities gain greater control over project management and can prioritize public needs. This addresses a major concern with PFI, where the private sector was perceived to exert disproportionate influence on the delivery of public services. Additionally, NPD offers greater flexibility than traditional PFI contracts, making it better suited for complex projects that evolve over time.

A Win-Win for Everyone

A remodeled PFI structure, incorporating the strengths of the NPD model, offers substantial benefits for all stakeholders.

The construction industry stands to gain significantly. A revived PFI would create a long-term pipeline of projects, allowing the industry to plan effectively, invest in productivity enhancements, and stabilize its workforce. This would address concerns about fluctuating work loads and encourage investment in innovation and training.

The public sector would benefit from increased efficiency and cost-effectiveness in delivering essential services. The NPD model's emphasis on value for money and public need aligns with government priorities, ensuring that taxpayer funds are used effectively and transparently.

For institutional investors, a new PFI framework provides a viable opportunity to deploy capital aligned with long-term liability-matching obligations. This model offers a stable, predictable return on investment, ensuring that investors can confidently contribute to essential infrastructure projects.

Fostering Collaboration and Transparency

For a new PFI/PPP structure to truly succeed, a robust collaborative approach is paramount. Clear performance metrics must be defined, and project outcomes must be meticulously tracked to ensure value for money and tangible public benefit. Open communication and knowledge transfer are crucial for building trust and acceptance among the public.

The NPD model offers a potential solution to the limitations of traditional PFIs. By embracing collaborative principles and prioritizing public value, NPD could enable a more sustainable and successful approach to UK infrastructure delivery in the long term.

A Brighter Future for the UK?

A renewed PFI structure based on the NPD model holds the potential to transform the UK's approach to infrastructure development. By fostering collaboration, promoting efficiency, and ensuring public value, this model could not only revitalize the construction industry but also contribute to a more prosperous and sustainable future for the UK.

The UK's economic landscape is evolving, and the need for innovative solutions is evident. A well-designed and well-managed PFI, drawing inspiration from the success of the NPD model, could be the key to unlocking the potential for growth and prosperity in the years to come.