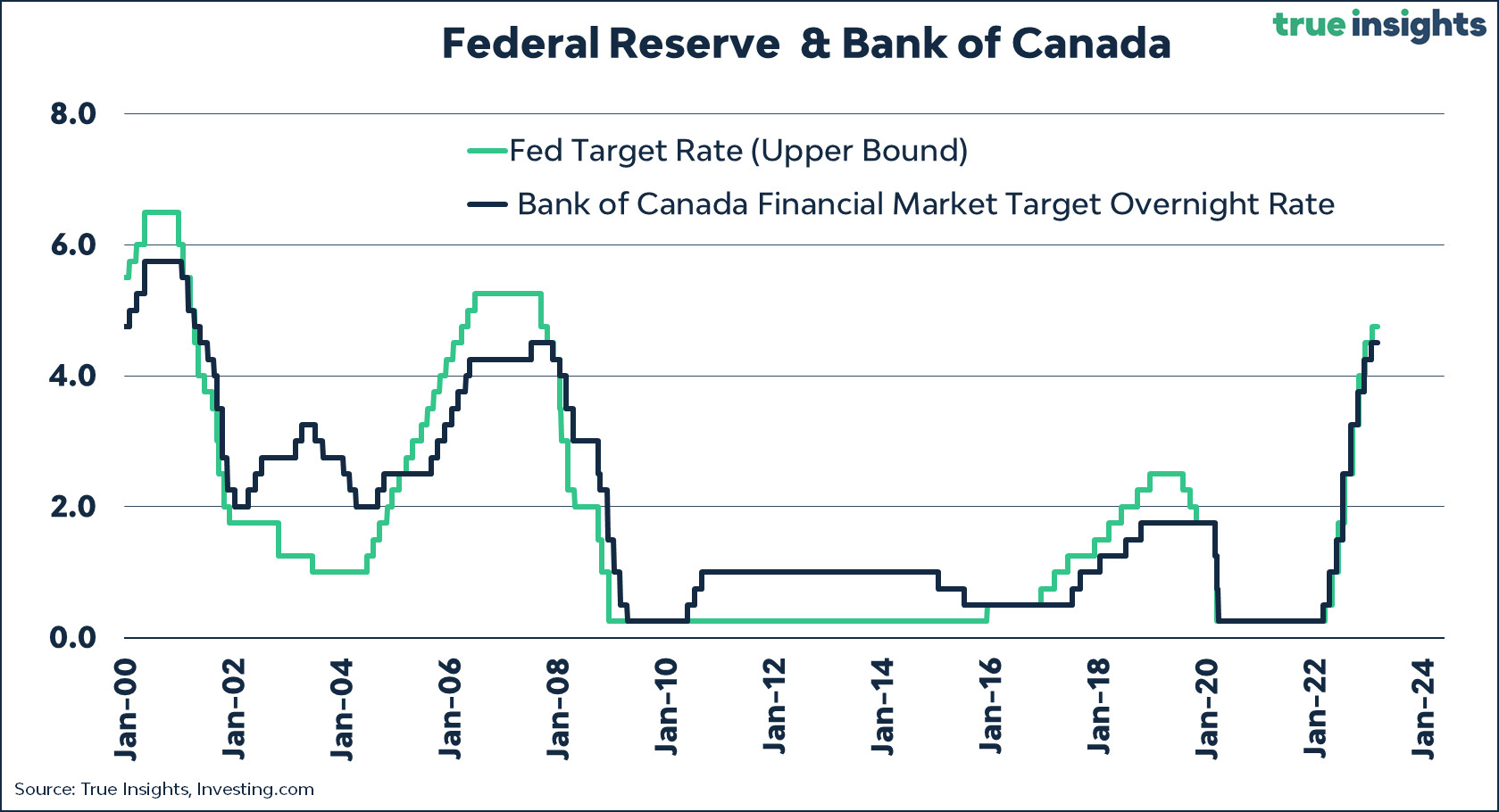

The Bank of Canada announced Wednesday that it is cutting its benchmark interest rate by a quarter of a percentage point, bringing the target overnight rate to 4.25%. This is the third consecutive rate cut since June, as the central bank continues its efforts to normalize its balance sheet.

The decision to lower rates was driven by the ongoing decline in inflation, which fell to 2.5% in July. The Bank of Canada's preferred measures of core inflation have been hovering around 2.5% on average, indicating that overall inflationary pressures are easing.

The Bank of Canada has also noted the recent slowdown in the labor market. While employment has been relatively flat in recent months, wage growth remains high compared to productivity growth. The central bank's statement also highlights the potential for the economy to weaken further, with some preliminary indicators suggesting that economic activity may have slowed in June and July.

The Bank of Canada's decision to cut rates is good news for homeowners, particularly those with variable-rate mortgages. The rate cut will lead to lower monthly payments, providing some relief from the financial strain that many households have been facing in recent years.

What Does the Rate Cut Mean for Canadians?

The Bank of Canada's decision to lower rates comes as welcome news for many Canadians, particularly those struggling with high debt levels. The latest cut is expected to lead to lower rates on mortgages, car loans, and personal loans, providing much-needed financial relief.

Homeowners

The most immediate beneficiaries of the rate cut are homeowners with variable-rate mortgages. According to Alexandre Bélanger, district manager for mobile mortgage specialists at TD Bank, most lenders will either pass the reduction directly onto borrowers or increase the amount allocated to principal in monthly payments. Bélanger calculated that a 0.25% rate reduction equates to roughly $50 in savings per month on a $400,000 loan.

Homeowners with fixed-rate mortgages will not see immediate benefits, but the rate cuts should provide greater negotiating leverage when it comes time to renew their mortgages. With the Bank of Canada signaling that further rate cuts are likely, those with fixed-rate mortgages expiring in the coming months will have a better chance of securing lower interest rates.

Businesses

The rate cut is also good news for businesses, particularly small and medium-sized enterprises (SMEs) that rely on financing to operate. Lower interest rates will make it more affordable for businesses to borrow money, which could lead to increased investment and economic growth.

Economy

The Bank of Canada's decision to lower rates is a sign that the central bank is concerned about the potential for economic weakness. The rate cuts are intended to stimulate economic growth by making it cheaper for businesses and individuals to borrow money. However, the Bank of Canada has also acknowledged that inflation could fall too quickly, which could create challenges for the economy.

Looking Ahead

While the Bank of Canada's recent rate cuts provide some relief, the path of interest rates remains uncertain. The central bank will be closely monitoring inflation and economic data to assess the need for further rate adjustments. In its statement, the Bank of Canada indicated that it is prepared to lower rates more quickly if needed.

The next decision on the Bank of Canada's target overnight rate is scheduled for October 23, 2024. The central bank will also release its next full projection for the economy and inflation, along with an analysis of related risks, in its report released on that date.

Conclusion: The Rate Cuts Are a Step in the Right Direction, But More Is Needed

The Bank of Canada's decision to cut interest rates is a positive step towards easing the financial strain on many Canadians. The rate cuts are a clear sign that the central bank is concerned about the economic outlook and is prepared to act to support growth. However, the economic challenges facing Canada are far from over. The Bank of Canada will need to continue to monitor inflation and economic data closely, and may need to take further action to ensure a healthy recovery.

The rate cuts, while a positive step, are likely not enough to offset the ongoing impact of high inflation and rising interest rates. The full impact of the rate cuts will take some time to be felt, and the Bank of Canada's efforts to support the economy will need to be carefully calibrated to avoid exacerbating existing financial pressures.