Interest Rates Cut: A Sign of Relief for Borrowers?

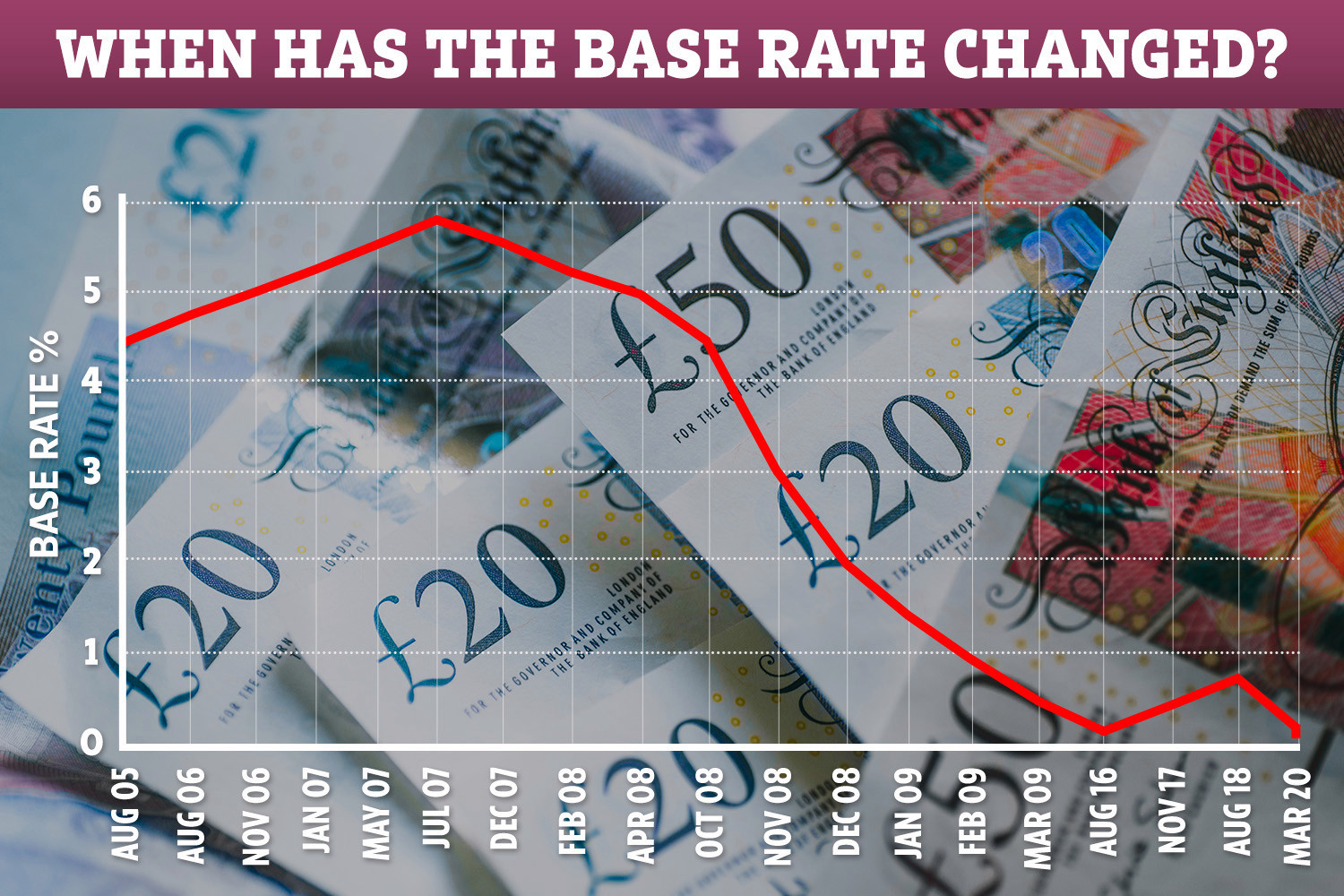

The Bank of England has cut interest rates for the first time since the start of the Covid pandemic, a move that could provide much-needed relief to households grappling with high borrowing costs. The central bank's Monetary Policy Committee (MPC) voted by a narrow majority to reduce the base rate by a quarter of a percentage point to 5%, ending a year of record-high interest rates.

The decision was made after inflation held steady at the Bank's 2% target for the second consecutive month in June, leading financial markets to anticipate a rate cut. While some economists predicted a close call due to concerns about persistently high inflation, the MPC ultimately decided to ease the pressure on borrowers.

The Impact on Households and Businesses

The rate cut is expected to have a significant impact on households and businesses across Britain. The sharp rise in mortgage repayments over the past year, following 14 consecutive interest rate increases from a record low of 0.1% in December 2021, has put immense pressure on borrowers. This cut could bring some respite, with major banks already indicating potential reductions in mortgage rates to as low as 3%.

However, the Bank of England has cautioned against expecting large reductions in borrowing costs in the coming months, highlighting lingering economic risks. Governor Andrew Bailey emphasized the importance of keeping inflation low and avoiding hasty or excessive interest rate cuts, stating that the goal is to support economic growth and the prosperity of the country.

A Divided MPC and Political Reactions

The decision to cut rates wasn't unanimous, reflecting the complexity of the economic situation. The MPC was split by five votes to four, with Governor Bailey casting the deciding vote for the first reduction in borrowing costs since March 2020. This division highlights the uncertainty surrounding the future trajectory of inflation and the potential impact of economic growth.

Politically, the rate cut has been met with mixed reactions. Chancellor Rachel Reeves welcomed the move but cautioned that millions of families are still facing higher mortgage rates. Meanwhile, the Conservative leader and shadow chancellor, Rishi Sunak and Jeremy Hunt, respectively, seized on the cut as evidence of their economic progress while in government.

Looking Ahead: Uncertainty and Potential Challenges

Despite the rate cut, the Bank of England remains cautious about the future. The MPC has warned that headline inflation is on track to rise to about 2.75% within months, overshooting its target. While the Bank forecasts inflation to fall back to 1.7% in two years' time and 1.5% in 2027, the potential paths for inflation remain uncertain.

The MPC acknowledges that the economy is facing several challenges, including the impact of high borrowing costs on economic activity and the jobs market, as well as persistent price rises in the service sector. The Bank also anticipates that unemployment will rise next year.

Despite the rate cut, the Bank's stance remains restrictive, aiming to keep inflation under control and ensure sustainable economic growth. The future trajectory of interest rates will depend on a complex interplay of factors, including inflation, economic growth, and the labor market. It's a balancing act that will require careful monitoring and strategic adjustments by the Bank of England.

The Long-Term Impact

The Bank of England's decision to cut interest rates is a significant development in the UK's economic landscape. While it may bring some short-term relief to borrowers, the long-term implications remain uncertain. The future path of inflation, economic growth, and the labor market will all play a crucial role in shaping the economic outlook. The Bank of England will continue to carefully monitor these factors and adjust its monetary policy accordingly to ensure stability and prosperity for the UK economy.