The strike is costing the company about $1 billion a month, according to S&P Global Ratings.

New CEO Kelly Ortberg had said reaching a deal with machinists was a priority in order to get the company back on track after years of safety and quality problems.

Ortberg's laid out his vision for Boeing's future, which could includes slimming down the company to focus on core businesses. Earlier this month, he announced Boeing will cut 10% of its global workforce of 170,000 people.

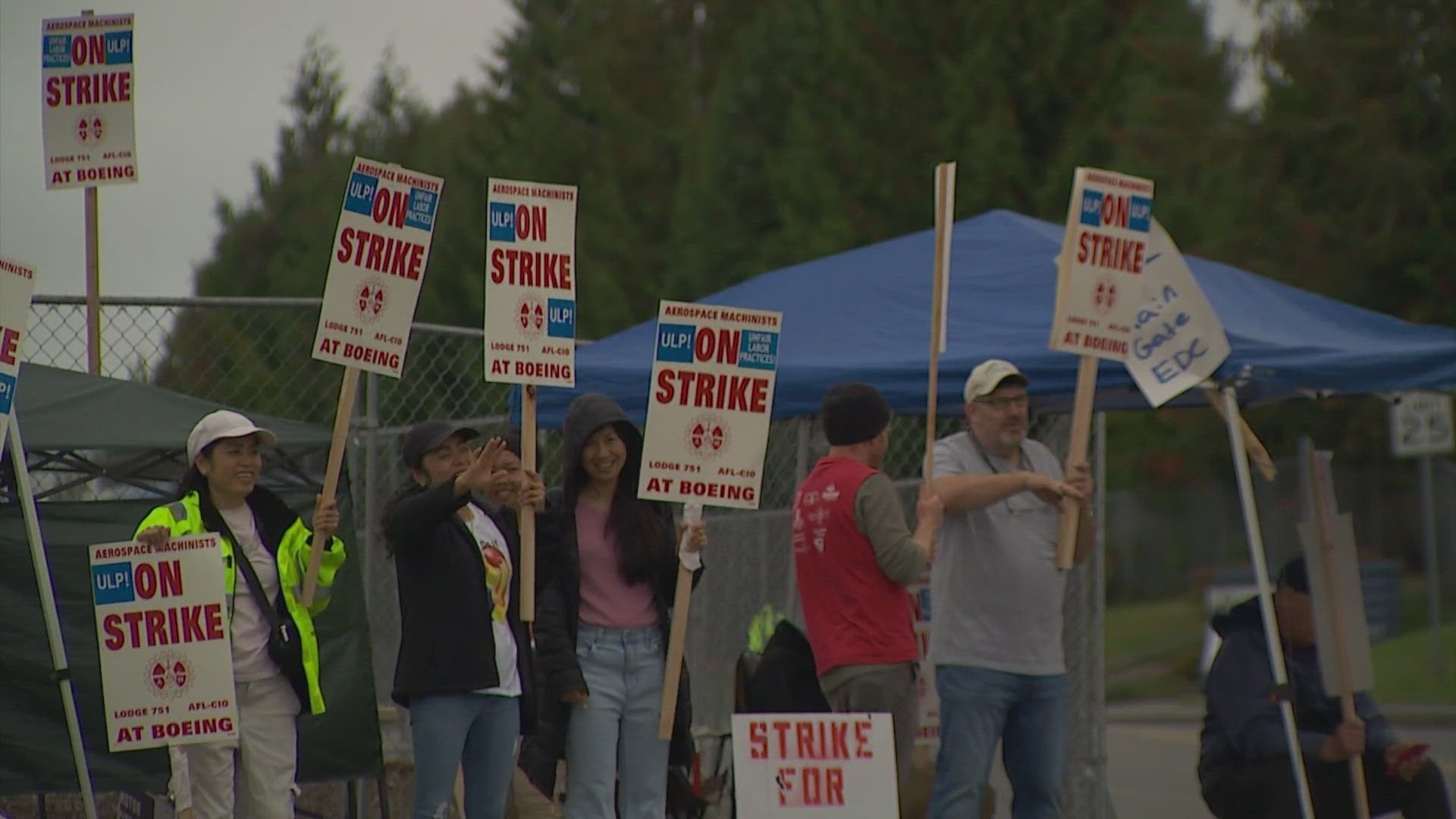

Boeing's more than 32,000 machinists in the Puget Sound area, in Oregon and in other locations walked off the job on Sept. 13 after overwhelmingly voting down a previous tentative agreement that proposed raises of 25%. The International Association of Machinists and Aerospace Workers union had originally sought wage increases of 40%. It is the machinists' first strike since 2008.

The latest proposal, announced last Saturday, included 35% raises over four years, increased 401(k) contributions, a $7,000 bonus and other improvements.

Workers had pushed for higher pay amid a surge in living costs in the Puget Sound area. Some machinists were upset about losing their pension plan in a previous contract that they signed in 2014, but the latest proposal didn't offer a pension.

Boeing agreed in the new contract to build its next aircraft in the Pacific Northwest, which had also been a sticking point with unionized workers after Boeing moved all of its 787 Dreamliner production to a non-union factory in South Carolina.

"We have made tremendous gains in this agreement. However, we have not achieved enough to meet our members' demands," said Jon Holden, president of IAM District 751, at a news conference Wednesday night. He said the union will push to go back to the negotiating table.

Boeing declined to comment on the voting results.

The Latest in a Series of Troubles

The labor strife is the latest in a long list of problems at Boeing, which started the year when a door plug blew out midair from a packed Boeing 737 Max 9, its best-selling plane, reigniting regulator scrutiny of the company.

The strike began as Boeing was working to ramp up production of the 737 and other aircraft.

The extended stoppage is also a challenge for the aerospace supply chain, which is fragile coming out of the pandemic, as the company's web of suppliers had to train new workers quickly.

Spirit AeroSystems last week said it would temporarily furlough about 700 workers and that layoffs or other furloughs are possible if Boeing machinists' strike continues.

Boeing's Defense Sector Bleeding Cash

The troubled aviation firm reported nearly $6.2 billion in net losses in its quarterly earnings call with investors. That included a $2.4 billion loss for its Defense, Space and Security sector, whose former head, Ted Colbert, was fired Sept. 20.

Boeing defense reported $2 billion in charges on major programs, including the KC-46A Pegasus tanker, as the company reeled from the effects of the nearly six-week International Association of Machinists strike.

Members of the union are voting Wednesday on a proposed contract for about 33,000 machinists that would include a cumulative 35% raise, which could end the strike.

The KC-46′s roughly $661 million charge stems partly from the work stoppage that began Sept. 13, the company said, which hit work on the 767 airliner that form the foundation of the refueling aircraft.

The strike also led the company to decide to wrap up most of its 767 production, and beginning in 2027, only produce 767-2C aircraft to support the KC-46 program, Boeing said. This decision to cease production of most 767s also contributed to the program’s charges.

Boeing also racked up a roughly $908 million charge on the Air Force’s T-7 Red Hawk trainer, which was driven by expected higher costs on production contracts beginning in 2026. The Commercial Crew space capsule program had a $250 million charge, and the Navy’s MQ-25 Stingray program had a $217 million charge, its first of the year.

When combined with $250 million in previous charges on the VC-25B Air Force One program, Boeing defense’s five major fixed price development programs have incurred $3.3 billion in losses so far this year.

Under a fixed-price contract, the government agrees to pay a company a certain amount of money to produce an aircraft or other system. If the company gets the job done cheaper than expected, it can pocket the remaining payments as profit.

But if the fixed-price program experiences delays or cost overruns, the company is on the hook for losses — which can sometimes run into the billions of dollars, as in the case of the KC-46.

Boeing’s fixed-price losses expanded in magnitude as the company closed the books on the third quarter, chief financial officer Brian West said, as higher estimated production costs on the T-7 in 2026 and beyond came into focus.

“While acknowledging these are disappointing results, these are complicated development programs, and we remain focused on retiring risk each quarter and ultimately delivering these mission-critical capabilities to our customers,” West said.

Chief executive Kelly Ortberg said Boeing has no choice but to “work our way through some of those tough contracts,” and that “there’s no magic bullet to that.”

The company needs to keep a closer eye on such “problematic” contracts, he said, and work with customers such as the military to reduce the risk on those programs before their costs start to run over expectations.

“We’ve gone from today’s problem, to today’s problem, to today’s problem, and that’s because we’re not looking around the corner enough on these programs,” Ortberg said. “Some of that means that you’ve got to be better at working with your customer to define success on these programs. … We know how to run these programs. We just have lost a little bit of discipline.”

But cutting losses and exiting those troubled programs isn’t an option for Boeing, Ortberg said, since the company has made long-term commitments to customers such as the Air Force.

“We do have to get in a position where we’ve got a portfolio much more balanced with less-risky programs and more profitable programs,” Ortberg said. “But I don’t think a wholesale walk-away is in the cards.”

With current global turmoil and rising defense spending, demand for Boeing’s defense products remains strong, West said, and the company expects it will be able to improve financial performance in the medium to long term.

Until then, however, more financial pain remains on the horizon. Boeing expects its overall performance next year to be much better than in 2024 — but still expects to be in the red for all of 2025. The company has so far lost $8 billion in 2024.

Ortberg is still traveling to Boeing facilities and having in-person conversations with rank-and-file employees, and said he believes the company has “fantastic people” on its staff.

“We just got to get everybody in the right position, running the right plays,” Ortberg said, adding that he and top Boeing leaders have “talked explicitly about what we’re going to do to change the culture, but it’s going to take time. This isn’t something that there’s just a light switch that flips. It’s a never-ending process.”

Ortberg declined to comment on who might be the next head of Boeing defense, but said he would look outside the company if Boeing can’t find the right internal candidate.

Boeing Faces a Bleak Future

Boeing had a day to forget Wednesday.

It began with the company releasing its third-quarter earnings report, where it posted a huge loss of $6.1 billion, largely blamed on the ongoing strike by workers at its key Seattle plant.

However, these poor results largely aligned with Wall Street's predictions, and Boeing's stock price dipped only marginally in pre-market trading.

CEO Kelly Ortberg vowed to “return Boeing to its former legacy” and said the company would focus on changing its culture. He was interviewed on CNBC and appeared downbeat as he reiterated his commitment to transformation.

At the same time, some 33,000 union members in the Pacific Northwest were waiting to vote on Boeing's third contract offer.

Wall Street analysts were hopeful that the 35% pay rise and increased 401(k) contributions would be approved — given that the acting Labor Secretary had flown to Seattle to help mediate talks.

But the contract offer was again rejected, albeit by 64% of voters, rather than the more than 95% who had turned down the first offer. Boeing stock subsequently dipped 3%.

Over the four years of the deal, the pay rise would be close to the 40% that the union demanded. However, restoring the traditional defined-benefit pension plan — replaced with a 401(k) in 2014 negotiations — has been a key issue for many on the picket lines.

Boeing has appeared inflexible on this issue, with its chief negotiator telling The Seattle Times there is “no scenario” where the traditional pension plan would be restored.

Bank of America analysts estimated that restoring this pension plan would cost up to $400 million annually. At the same time, Anderson Economic Group predicted Boeing has lost over $5 billion due to the strike.

The planemaker has announced plans to lay off 10% of its workforce, plus further delays to its long-awaited 777X program.

Yet Wall Street is optimistic that Ortberg can return the planemaker to a stronger position.

“Despite all the drama associated with Boeing, we continue to believe that the company deserves a premium earnings multiple because of the expected ramp-up in production and its strong aircraft backlog,” analysts from William Blair said in a Wednesday report.

Boeing's production has been limited as it faces supply-chain constraints and renewed scrutiny from regulators in the wake of January's Alaska Airlines blowout. But with a backlog of 5,400 planes worth more than $500 billion, it is clear airlines still want its planes.

“If Boeing and Airbus improve deliveries, backlogs will be reduced and increase customer confidence,” Peter McNally, global head of sector analysts at business research firm Third Bridge, told Business Insider in an email.

He added that a serious challenge from China's Comac, which has been widely touted as a potential disruptor of the Boeing-Airbus duopoly, has so far failed to materialize.

“Honestly, our experts hear a lot less about Comac today than they did a few years ago, and these people have pointed to recent orders to Boeing and Airbus from Chinese customers as evidence,” McNally said.

In a note, Morningstar's Nicolas Owens called on Boeing to lay out a “clear and bold product strategy and begin designing aircraft to meet that strategy in the next few years.”

Otherwise, he added, it could further lose ground to Airbus in the narrowbody market, where the A320 outsells the 737 Max.

Since taking charge in August, Ortberg has had to contend with many problems, and Wednesday's union vote was certainly a further blow.

Yet, with a four-point plan to improve trust and build a new future, a path out of the crisis appears more visible than before.

Another Blow to Boeing's Reputation

The strike by 33,000 workers at Boeing will continue after rank-and-file union members rejected an offer from the company in a vote on Wednesday and decided to remain on the picket lines instead.

The membership of the International Association of Machinists voted 64% against the deal, the union announced late Wednesday. While that was less than the 95% who rejected an earlier offer, it left the vote far short of the simple majority needed to end the strike.

“Our members deserve more,” said Jon Holden, the president of the largest IAM local at Boeing and its chief negotiator. “They’ve spoken loudly, and we’re going to go back to the table to try to achieve those things.”

Boeing said late Wednesday that it did not have a comment on the vote results.

The offer would have raised wages for IAM members at Boeing by 35 percentage points over the four-year life of the contract, with an immediate 12% raise. It would also have paid them a $7,000 signing bonus, increased contributions to union members’ retirement accounts and provided some job security, with the promise that the company’s next commercial jet would be built at a unionized factory rather than a new, non-union plant.

But the ratification is not certain. Union leadership stopped short of endorsing the offer, saying only that it “includes several key improvements” and that “it warrants presenting to the members and is worthy of your consideration.”

The previous tentative agreement that had been recommended by union leadership was almost unanimously rejected by rank-and-file members, sparking the start of the start of the strike on September 13.

Among the major issues for many members was the loss of a traditional pension plan. Membership narrowly gave up the pension in 2014 after the company threatened to build the 737 Max and 777X at non-union facilities. The loss of the pensions, at a time when Boeing was doing well financially, sparked deep resentment that continues to this day.

While the proposed contract achieved many of the union’s bargaining goals, and did provide for improved retirement benefits, it did not restore the traditional pension plan. Holden said Wednesday that issue is a “big sticking point for many of our members.”

“This membership has gone through a lot,” he said. “There are some deep wounds that were (created) out of some take aways and concessions, threats of job loss. Our members haven’t forgotten that.”

The rejected agreement would have raised Boeing’s labor costs by more than $1 billion annually, according to an analysis from Seth Seifman, an aerospace analyst at JPMorgan Chase.

Boeing has already announced plans to cut its global workforce of 171,000 employees by about 10%, or 17,000 jobs. The cost savings from those cuts could more than offset the increased cost of the wage package, Seifman said.

But Boeing desperately needed to reach a deal to end the strike. According to an estimate from Standard & Poor’s, the strike is costing the company $1 billion a month on top of its ongoing losses.

Earlier Wednesday, Boeing reported its third-quarter net loss surged to $6.2 billion from $1.6 billion a year earlier. And that period included only a limited impact on results from the strike, as the work stoppage did not start to affect aircraft deliveries, and thus company revenue, until the final days of the three-month period.

Boeing’s new CEO, Kelly Ortberg, said Wednesday that the company is at a crossroads and needs a fundamental change in its culture to stabilize its business. He has said he wants to reset the relationship between management and the union.

“First and foremost on everybody’s mind today is ending the IAM strike,” Ortberg told investors in a call after the earnings report. “We have been feverishly working to find a solution that works for the company and meets employees’ needs.”

The strike is only one of the problems dogging the company over the last six years, during which it has run up core operating losses of nearly $40 billion and seen its long-term debt climb to $53 billion. It is at risk of having its credit rating downgraded to junk bond status for the first time in its history.

Boeing’s problems started with two fatal crashes of the Max in late 2018 and early 2019, which led to a 20-month grounding of the company’s best-selling jet. It was then hit by canceled orders for new planes in 2020 when the pandemic caused a sharp plunge in demand for travel and massive losses at the world’s airlines.

In January this year, a door plug blew off an Alaska Airlines’ 737 Max jet shortly after takeoff. Although no one was seriously injured, the incident sparked numerous federal investigations and questions about the quality and safety of Boeing jets. One federal probe found that the plane had left a Boeing factory without the four bolts needed to hold the door plug in place.

The Federal Aviation Administration ramped up its oversight of the company, a step that will slow Boeing’s ability to increase production of the Max to the levels that it would need to return to profitability.

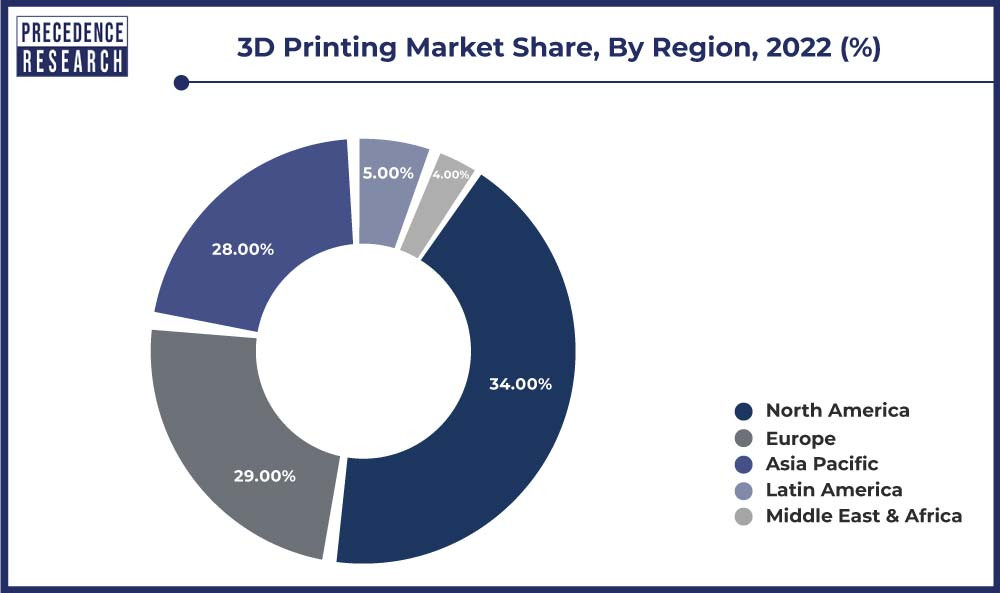

Despite recent issues, Boeing remains a key component in the US economy. It is America’s largest exporter, with an estimated annual contribution of $79 billion to the economy, supporting 1.6 million jobs directly and indirectly at 10,000 suppliers spread among all 50 states. Some of those suppliers have already been laying off workers due to the strike.

Fortunately for Boeing, it is not likely it will be forced out of business by its current financial crisis. Boeing’s place as part of a duopoly, along with European rival Airbus, essentially ensures its survival.

Boeing and Airbus are the only companies that make the full-size jets the global airline industry needs, and both companies have massive backlogs in orders. Any airline that canceled its Boeing orders and shifted to Airbus would need to wait at least four or five years to receive any aircraft from the European giant.

This story has been updated with additional reporting and context.