Copper Stocks: Navigating the Pullback and Finding Opportunity

Copper stocks have faced pressure in recent months, driven by a 16% decline in copper prices from their record highs in May. Despite this correction, analysts at RBC Capital Markets believe copper may be finding a floor near current levels, hovering around $4.00 per pound. While global economic concerns, particularly in China, have weighed on prices, the tight supply constraints remain a significant factor. Any improvement in demand, especially from China, could potentially drive prices higher again.

Copper Market Signals: A Mixed Outlook

RBC highlights the mixed signals within the copper market. On the positive side, the China import premium has risen to $60 per ton from a negative $14 in mid-June, and Shanghai copper inventories have decreased by 15% over the last month. Conversely, London Metal Exchange (LME) inventories have surged by 40% during the same period, reflecting ongoing economic uncertainty.

Analysts cautiously anticipate a stronger performance in the second half of 2024 for copper producers. Many companies are relying on improved operational performance to meet their annual guidance. According to industry updates, approximately 45% of the annual production target has been achieved, with a significant ramp-up expected in the coming months. However, costs are currently tracking about 4% above the midpoint of guidance.

Copper Producers: Key Players and Strategies

Several copper producers faced challenges during the second quarter but remain optimistic about a stronger performance in the latter half of 2024. Producers like Capstone, Teck (TECK), Ivanhoe, Hudbay (HBM), and Lundin are focused on ramping up key projects and improving operations. RBC highlights that costs have generally remained under control in the first half, with expectations of further improvements at Teck due to higher QB2 volumes and at Capstone with the successful ramp-up of its Mantoverde Development Project.

Freeport (FCX) and First Quantum are also well-positioned to meet their full-year guidance if operations remain steady in the coming months, according to RBC.

The Long-Term Copper Outlook: A Different Story

Despite the recent pullback in the copper price, the long-term picture remains different. There is a potential supply deficit on the horizon, which may present an opportunity for investors.

Copper, often referred to as "Dr Copper," is a leading indicator for the global economy due to its widespread use in various industries. The copper price peaked in May and has fallen by as much as 22% since then. This suggests that copper supply might be exceeding demand in the short term, which could be a warning sign for the global economy. However, the long-term outlook points to a potential supply deficit.

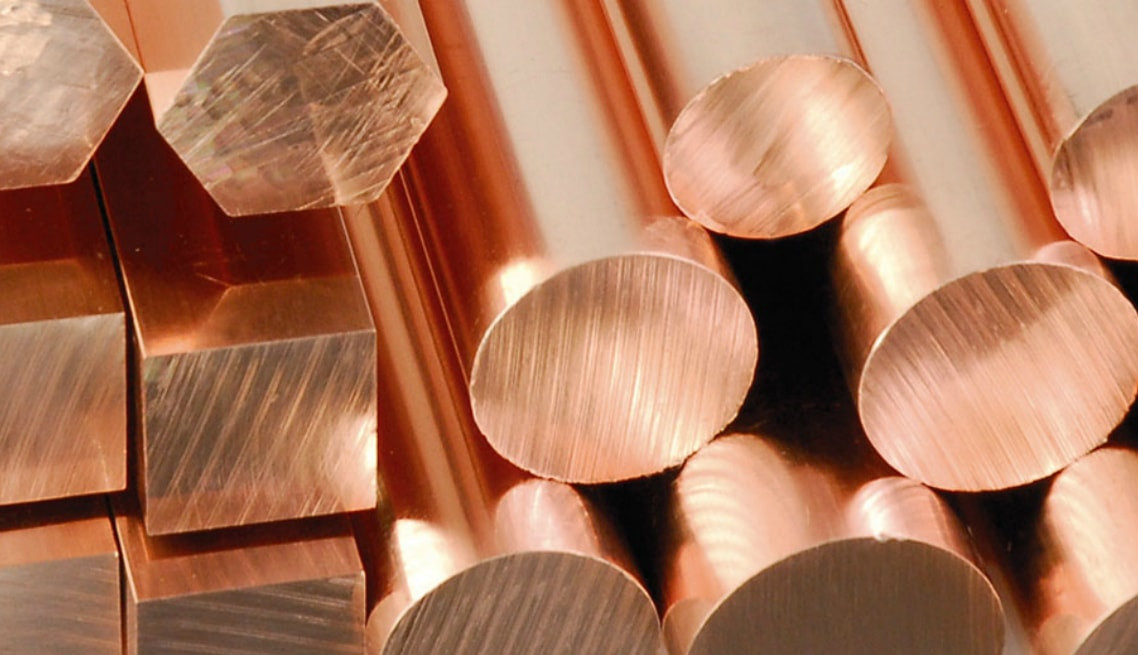

Copper's Vital Role in a Growing Economy

Copper is the third most used industrial metal globally, behind iron and aluminium. About 75% of its usage goes towards electrical wires, telecommunication cables, and electronics. For over a century, copper has been a crucial resource for various industries, and its applications continue to expand. The rising global prosperity and the growth of new industries like renewable energy, automation, and the electrification of the economy are driving copper demand.

Challenges to Copper Supply: A Tightening Market

Copper consumption has increased steadily since before 1900. While China consumes about 55% of the world’s copper, and the rest of Asia consumes around 15%, recent years have seen a slowdown in China’s infrastructure development. However, demand from the manufacturing sector has continued to increase. Global copper demand is currently about 28 million tonnes a year and is increasing at around 2% a year. This demand is met through a combination of newly mined and refined copper, as well as recycled copper. Current reserves are estimated at around 870 million tonnes, which should be enough to satisfy demand for over 20 years. However, the reality is a bit more complex.

The cost of copper production varies depending on factors such as the grade of the ore and the ease of access. Some reserves are only viable at higher copper prices. Recycling also operates similarly, with higher prices making it more profitable to process recycled copper.

Most of the copper mines under development are actually existing mines being redeveloped. S&P Global’s annual analysis of copper discoveries highlights the lack of new discoveries in the last 15 years. Large copper producers are opting to redevelop existing mines rather than exploring and developing new reserves. This is due to several factors:

- Environmental regulations: New mining projects face stringent environmental regulations, increasing development costs and timeframes.

- Community resistance: Local communities often oppose new mining projects due to concerns about environmental impact and social disruptions.

- High upfront costs: Exploration and development of new mines require significant upfront capital investments, making producers hesitant.

These factors contribute to a reluctance to invest in new sites, even when it means lower margins.

Investing in Copper Stocks: Different Approaches

There are several ways to invest in copper, ranging from ETFs to individual copper producers. The largest copper ETF is the Global X Copper Miners ETF, which holds 40 shares and caps the weight of each at 4.7%. The United States Copper Index Fund is an ETN that tracks the copper price through the futures market.

For investors seeking a more direct exposure to copper producers, both large diversified miners and smaller companies offer opportunities. Large diversified miners like BHP Group and Rio Tinto offer exposure to copper alongside other commodities, providing diversification benefits. However, these companies are often not heavily focused on copper production, and their stock prices are impacted by the performance of other commodities as well.

Smaller copper producers offer the potential for higher returns but also come with increased risk. One compelling argument for investing in small-cap copper producers is their potential to be acquired by larger mining companies. Since large mining houses are reluctant to invest in new exploration, acquiring proven assets from smaller companies becomes a viable option.

Key Considerations for Investing in Small-Cap Copper Producers

When considering investing in small-cap copper producers, it's important to consider the following:

- Location: Understand where the company’s assets are located and the potential risks associated with those countries. Political instability, regulatory changes, and infrastructure challenges can all affect the company’s operations and profitability.

- Financial strength: Assess the company’s financial health, including its debt levels, cash flow, and profitability. Small companies with high debt or limited cash flow may be more vulnerable to market downturns.

- Management team: Evaluate the experience and track record of the management team. Strong leadership is essential for navigating industry challenges and driving long-term success.

The Future of Copper: A Complex Landscape

The copper market is influenced by a complex interplay of factors. The recent pullback in prices highlights the volatility of the market. However, the long-term outlook for copper demand remains positive, driven by the growth of the global economy, the transition to renewable energy, and the electrification of various sectors. Investors seeking exposure to copper should carefully consider the risks and opportunities associated with different investment approaches.

Stay Informed and Seek Professional Advice

The copper market is constantly evolving. Stay informed by following industry news, research reports, and expert commentary. It's also important to consult with a qualified financial advisor who can provide personalized advice tailored to your investment goals and risk tolerance.

Remember, investing involves risks, and past performance is not indicative of future results. Always conduct thorough due diligence before making any investment decisions.