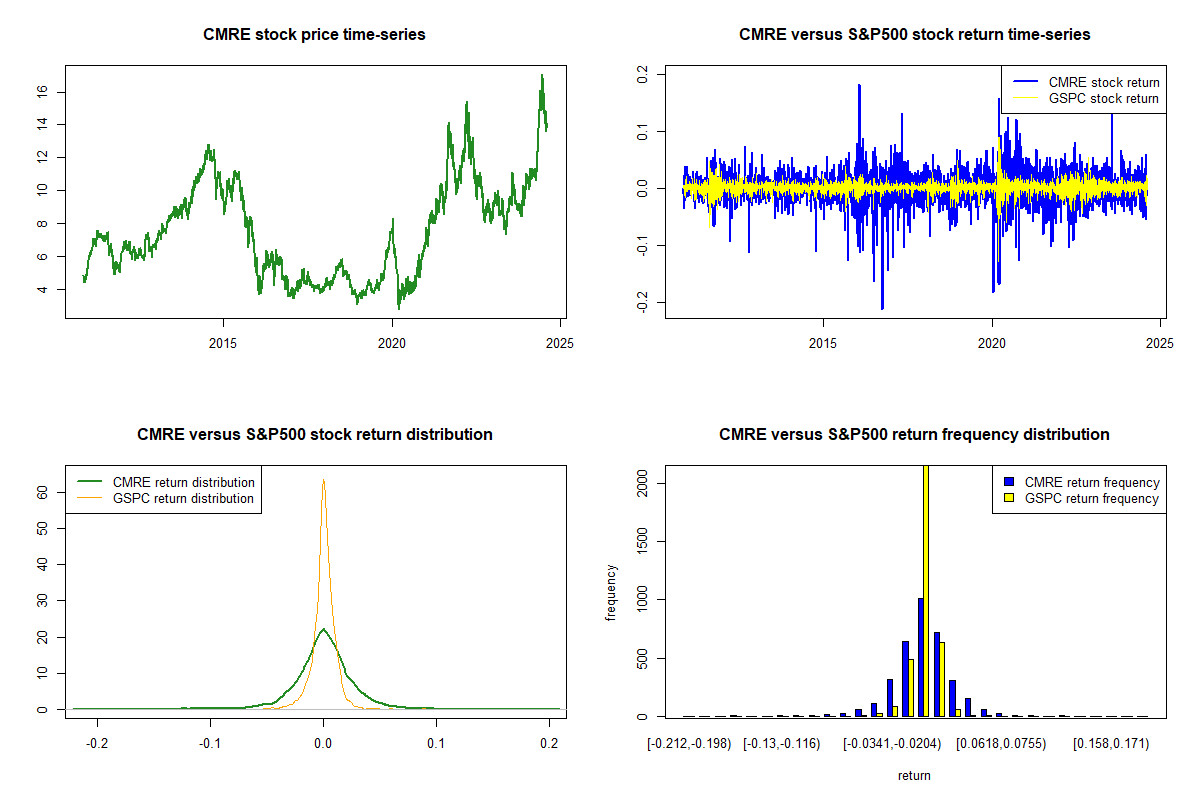

Costamare (CMRE) closed the latest trading day at $13.53, indicating a +1.65% change from the previous session's end. This move outpaced the S&P 500's daily gain of 0.75%. Elsewhere, the Dow gained 0.58%, while the tech-heavy Nasdaq added 1%.

Recent Performance and Analyst Estimates

The investment community will be paying close attention to the earnings performance of Costamare in its upcoming release. It is anticipated that the company will report an EPS of $0.79, marking a 71.74% rise compared to the same quarter of the previous year. Alongside, our most recent consensus estimate is anticipating revenue of $424.93 million, indicating a 6.13% upward movement from the same quarter last year.

Regarding the entire year, the Zacks Consensus Estimates forecast earnings of $3.05 per share and revenue of $1.85 billion, indicating changes of +47.34% and +22.32%, respectively, compared to the previous year.

Understanding Analyst Estimates

It is also important to note the recent changes to analyst estimates for Costamare. These recent revisions tend to reflect the evolving nature of short-term business trends. With this in mind, we can consider positive estimate revisions a sign of optimism about the company's business outlook.

Research indicates that these estimate revisions are directly correlated with near-term share price momentum. To utilize this, we have created the Zacks Rank, a proprietary model that integrates these estimate changes and provides a functional rating system.

Zacks Rank and Valuation

The Zacks Rank system, ranging from #1 (Strong Buy) to #5 (Strong Sell), possesses a remarkable history of outdoing, externally audited, with #1 stocks returning an average annual gain of +25% since 1988. Within the past 30 days, our consensus EPS projection remained stagnant. Costamare is currently sporting a Zacks Rank of #3 (Hold).

Digging into valuation, Costamare currently has a Forward P/E ratio of 4.37. This indicates a discount in contrast to its industry's Forward P/E of 6.76.

Industry Outlook and Performance

The Transportation - Shipping industry is part of the Transportation sector. Currently, this industry holds a Zacks Industry Rank of 136, positioning it in the bottom 47% of all 250+ industries.

The Zacks Industry Rank assesses the strength of our separate industry groups by calculating the average Zacks Rank of the individual stocks contained within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Conclusion: A Time to Watch and Wait?

Costamare's recent stock performance and positive earnings expectations present a compelling case for investors to consider. However, its lagging performance compared to the sector and the industry's ranking in the bottom half of all industries suggest that investors should proceed with caution.

The company's Zacks Rank of #3 (Hold) further indicates that while there is potential for growth, there are also factors that might hinder it. Investors may want to watch Costamare's performance over the next few months, particularly after its upcoming earnings release, to better gauge its true potential and decide if it's the right investment for their portfolios.

Make sure to utilize Zacks.com to follow all of these stock-moving metrics, and more, in the coming trading sessions.