The Rise of Digital Payments: A Revolution in Financial Transactions

Digital payments are rapidly transforming the way we conduct financial transactions, replacing traditional cash-based systems with electronic alternatives. This shift is driven by several factors, including the increasing popularity of e-commerce, the widespread adoption of mobile devices, and the growing demand for more convenient and secure payment methods.

The Growth Trajectory of the Digital Payment Market

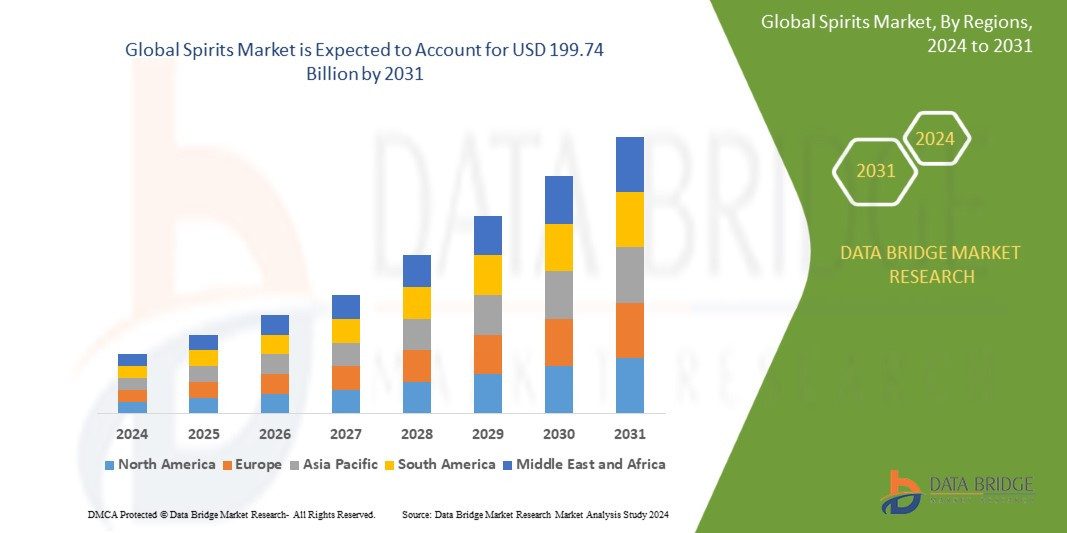

According to InsightAce Analytic, The global digital payment market, valued at $103.41 billion in 2022, is projected to reach a staggering $266.61 billion by 2031, demonstrating an impressive compound annual growth rate (CAGR) of 11.26% during the forecast period of 2023 to 2031.

Key Drivers Shaping the Digital Payment Landscape

The Convenience Factor

Consumers are increasingly opting for digital payment solutions that offer unparalleled convenience and ease of use. These solutions eliminate the need to carry cash or write checks, streamlining the transaction process and allowing for faster payments. This trend is particularly prevalent among millennials, who are more comfortable with digital technology and embrace digital payment methods as a natural extension of their online lives.

E-commerce Fuels the Demand for Digital Payments

The rapid growth of e-commerce has significantly boosted the demand for secure and reliable digital payment systems. Online shoppers require trusted platforms to facilitate online transactions, leading to a surge in the adoption of digital payment gateways and online payment processing services.

Technological Advancements Enhance Security and Accessibility

The development of innovative technologies, such as mobile wallets, contactless payments, and biometrics, has further accelerated the adoption of digital payments. These advancements have improved the security of transactions, expanded accessibility, and enhanced the overall user experience.

Challenges and Obstacles in the Global Digital Payment Market

Cross-Border Payment Standardization Remains a Challenge

Despite the rapid growth of digital payments, the lack of standardized cross-border payment systems presents a significant obstacle to further expansion. The absence of uniform regulations, diverse government restrictions, and varying payment infrastructure across different countries create complexities for seamless cross-border transactions.

Bridging the Digital Divide in Emerging Economies

The expansion of digital payments in emerging economies is often hampered by factors such as limited access to reliable internet connectivity, low smartphone penetration, and a lack of financial literacy. To foster inclusive growth, it is crucial to address these challenges and promote financial inclusion through initiatives that expand digital infrastructure and enhance financial education in these regions.

Regional Trends: Asia-Pacific Leads the Charge

Asia-Pacific Dominates the Digital Payment Market

The Asia-Pacific region is poised to dominate the digital payment market, with mobile payments and digital wallets gaining immense popularity in this region. Factors such as the large populations of India and China, coupled with significant smartphone penetration, create a highly favorable environment for digital payment growth.

North America: A Mature Digital Payment Market

North America has established itself as a mature digital payment market, with a robust technological infrastructure, high internet penetration, and a tech-savvy consumer base. The continued adoption of digital payment solutions by businesses and consumers is driving market growth in this region.

Key Players Shaping the Digital Payment Landscape

The digital payment market is characterized by intense competition, with established financial institutions, technology giants, and fintech startups vying for market share. Leading players in this space include:

- Samsung Pay: Samsung's mobile payment platform offers a seamless and secure payment experience.

- Google Pay: Google's digital payment solution allows for quick and convenient payments using smartphones.

- Alipay: A Chinese mobile payment platform, Alipay has gained immense popularity in China and is expanding its reach globally.

- Apple Pay: Apple's mobile payment service provides a secure and user-friendly way to make payments using Apple devices.

These companies have invested heavily in developing innovative technologies and expanding their global reach, further accelerating the adoption of digital payments worldwide.

The Future of Digital Payments: A Cashless World?

The digital payment market is expected to continue its impressive growth trajectory, driven by factors such as increasing smartphone penetration, the growing popularity of e-commerce, and the rising demand for convenient and secure payment solutions. As technology continues to evolve and digital payment solutions become more sophisticated, the world may be moving towards a more cashless future, where digital transactions become the norm.

Conclusion: Embracing the Digital Transformation

The digital payment landscape is constantly evolving, driven by technological advancements, shifting consumer preferences, and growing demand for seamless and secure payment solutions. Understanding the key drivers, challenges, and regional trends is crucial for businesses to navigate this dynamic market and capitalize on the opportunities it presents. As digital payments continue to transform the financial sector, it is essential for stakeholders to embrace this transformation and adapt to the changing landscape to thrive in this rapidly evolving world.