Disposable incomes in Oxford have grown at the same rate as the UK since 1997, new figures reveal. This suggests that the city has mirrored the national economic trajectory during this period. However, while the figures may seem positive, a think tank has raised concerns about regional inequality and called for greater investment in local authorities to address this issue.

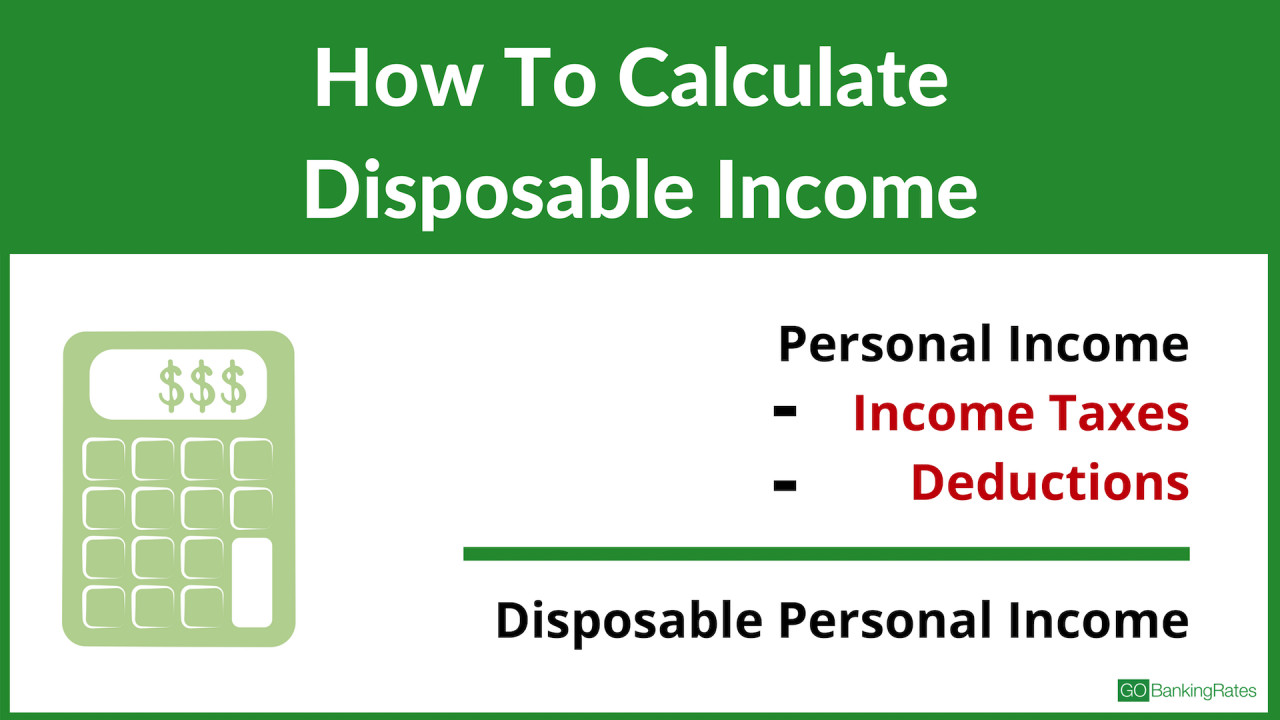

Understanding Disposable Income

Disposable income is a crucial indicator of economic welfare. It refers to the amount of money people have left after paying taxes and social contributions, which they can use for spending or saving. Economists use it to compare the economic well-being of different areas.

Oxford's Economic Performance

The Office for National Statistics (ONS) estimates that Oxford residents had around £22,868 in disposable income as of 2022. Since 1997, this figure has grown by an average of 3 per cent per year, closely aligning with the national growth rate of 3.1 per cent. This suggests that Oxford's economic performance has been in line with the rest of the UK.

Impact of Inflation

However, it's important to consider the impact of inflation. While disposable incomes have grown in Oxford, the ONS suggests that recent price rises might have affected disposable income. Although data on the local impact of inflation isn't available, it's important to acknowledge that inflation erodes the purchasing power of money. In Oxford, disposable incomes grew by 4.9 per cent between 2021 and 2022, which is lower than the CPIH inflation rate of 7.9 per cent. This indicates that the real value of disposable incomes may have decreased during this period.

Concerns About Regional Inequality

Despite the positive trend in Oxford, the New Economics Foundation (NEF) think tank highlights concerns about regional inequality. Benedikt Stranak, a researcher at the NEF, argues that inflation has “made us poorer” and that the current pattern of public investment favors London at the expense of other regions.

“Despite promises of ‘levelling up’, year after year we see the same old pattern – disproportionate public investment in London, and very little in other parts of the country,” said Mr. Stranak. “The damage caused is immense. More people are being forced to rely on foodbanks, and the lack of economic security is fostering a climate where racism and hatred can thrive, as evidenced by recent far-right riots.”

He also points out that simply pursuing more growth isn’t the solution. “In 2022, six out of the 10 local areas with the highest GDHI per capita were in inner London, which also has the highest poverty rate of all UK regions.”

Addressing Regional Inequality

The NEF emphasizes the need for a more balanced approach, advocating for the government to “empower and properly fund local authorities” to tackle the cost-of-living crisis and revitalize local economies. This approach could help bridge the gap in economic well-being between London and other regions.

A Government Response

A Treasury spokesperson responded to the NEF's concerns by stating that the government inherited an economy that has barely grown in recent years, impacting people's living standards. They asserted that the only way to achieve sustainable growth is by “fixing the foundations so we can rebuild this country and deliver a Britain that is better off.”

A Tale of Two Oxfords

While Oxford's disposable income figures may align with national trends, the story is different for other regions within the county. Several areas like West, South, and the Vale lag behind the rest of the country in terms of disposable income. This discrepancy highlights the need for a more nuanced understanding of regional economic performance.

West Oxfordshire

The ONS estimates that West Oxfordshire residents had around £28,583 in disposable income as of 2022. This represents a 2.8 per cent average annual growth since 1997, lagging behind the national average. Furthermore, disposable incomes in West Oxfordshire grew by 6.7 per cent between 2021 and 2022, again lower than the CPIH inflation rate.

South Oxfordshire

South Oxfordshire residents had an average disposable income of £31,132 in 2022. The figures reveal a 2.9 per cent average annual growth since 1997, slightly higher than West Oxfordshire but still below the national rate. Between 2021 and 2022, disposable incomes in South Oxfordshire grew by 6.3 per cent, which is also below the inflation rate.

A Call for Action

The disparities in disposable income across different regions within the county raise critical questions about the effectiveness of economic policies and the need for greater regional investment. While Oxford's disposable income figures might be mirroring national trends, the overall picture points to a need for more targeted interventions to address regional inequalities and ensure a more equitable distribution of economic benefits.

Conclusion: Beyond the Headline

The news about disposable income figures in Oxford might seem positive, but it's crucial to consider the larger context. While Oxford's economic performance might be on par with the national average, other regions within the county are lagging behind. This highlights the pressing need for addressing regional inequalities and ensuring a more balanced approach to economic development. It's not enough to simply focus on growth; it's essential to ensure that those benefits are distributed fairly across all regions.