Hundreds of thousands of people receiving Personal Independence Payments (PIP) may be due arrears going back as far as April 2016, following a change to the assessment rules for the Daily Living component, specifically on the definition of ‘social support’. New figures published by the Department for Work and Pensions (DWP) show that 325,867 reviews have still to be conducted for claimants who may have been affected and been underpaid the disability benefit.

In July 2019, the Supreme Court handed down a judgment following an Upper Tribunal (UT) decision which changed the way the DWP considers the definition of ‘social support’ for Daily Living activity number nine. The ‘MM’ judgment concerns the definition of ‘social support’ when engaging with other people face to face and when ‘prompting’ should be considered ‘social support’ in the PIP assessment, and how far in advance social support can be provided.

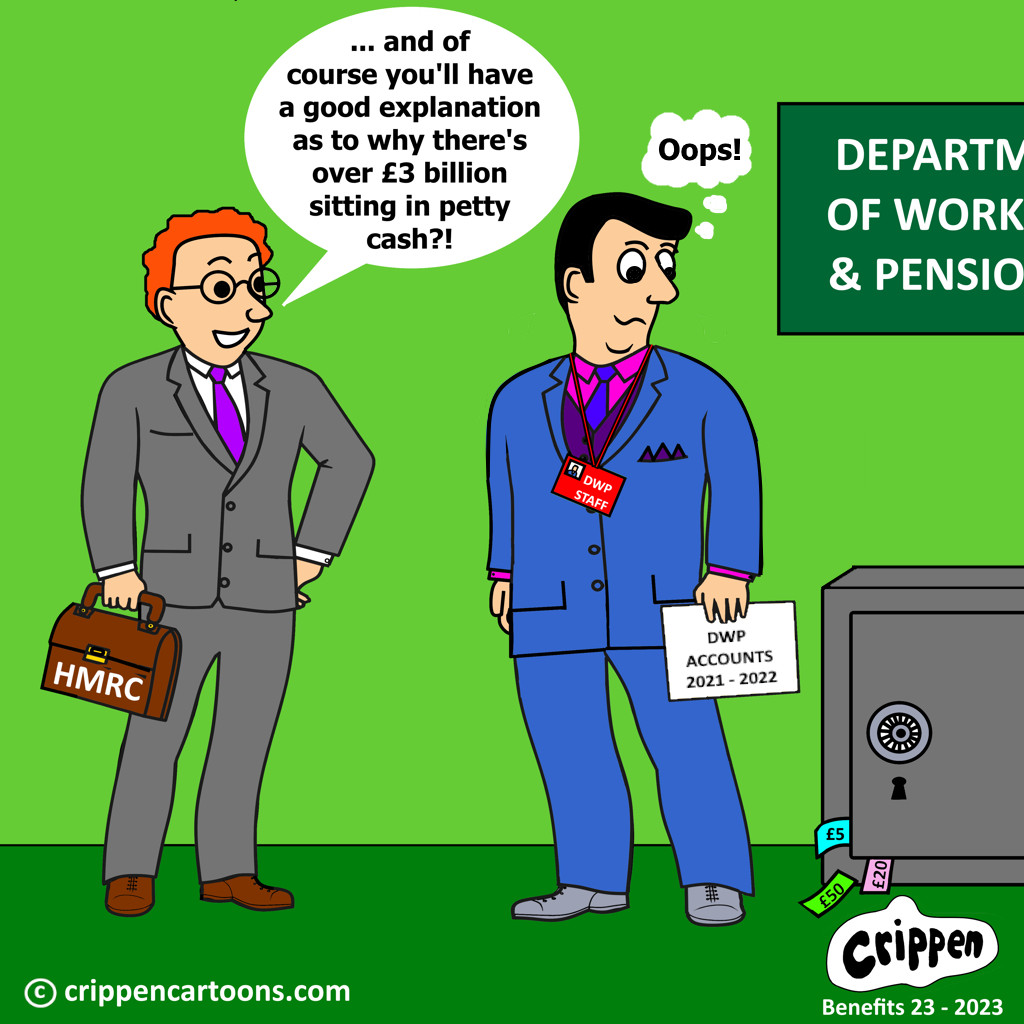

The DWP estimates that it will review 632,286 PIP cases during the course of the corrections exercise this year and by March 31 had already looked at 219,080 awards, paying out a total of £142 million in arrears payments.

Who is eligible for a review?

How much could people receive?

How have people been notified?

The independent Benefits and Work website reports that several members of its online community have been contacted by the DWP - by phone and through the post - informing them they are due an arrears payment.

Real-life examples of PIP backpayments

And one member who previously shared how they had received £5,000 in early March after having their case reviewed and award increased to the enhanced rate, added that they have received a further £5,500 from HM Revenue and Customs (HMRC).

The member previously explained to Benefits and Work how they received a call from a DWP decision maker who “ran through a few questions” with them, asking what plans they made when they were going out and who they used as their support when they did. They added: “She told me there and then that she was going to back date my claim to 2016 and increase it from standard to enhanced. I have just had just under £5,000 paid into my account today.”

The member then posted an update saying that once the money was paid by DWP they called HMRC to let them know about the historical error as they had been working and claiming Tax Credits during that time period.

As a result of the phone call, the member found out they should have been entitled to additional Working Tax Credit and has now received a lump sum payment of £5,500 in arrears.

The member posted on the Benefits and Work forum: “I have just received an additional £5.5k from them (HMRC) meaning in total I've had a back payment of £10.5k.This has changed my life in a way I can't even articulate, I've been able to buy a car for my family, pay off debt and can afford to live day to day without any fear of running out of money.”

The member added: “Thank you to this group and everyone in it, you'll never know how much you've helped flip my whole life around.”

You can read more member comments about PIP back payments on the Benefits and Work website here.

Who might be affected?

The MM judgment can only affect a claimant’s assessment for the Daily Living part of the PIP assessment. The DWP is reviewing cases where additional points for Activity 9 (‘prompting’ or ‘social support’) may make a material difference to the amount of PIP claimants’ are entitled to.

People who may have missed out on the Daily Living component element of PIP, or were awarded the standard rate and may be entitled to the enhanced rate, include:

- People who have regular meetings with a mental health professional, without which they would not be able to manage face to face encounters.

- People who need the input of particular friends or relatives with experience of supporting them in social situations - rather than just any well-meaning friend or relative - to help them manage face to face encounters.

Who will not be reviewed?

The DWP is not reviewing claims if:

- The enhanced rate of the daily living part of PIP has been awarded continuously since April 6, 2016.

- A Tribunal made a decision on a claim since April 6, 2016.

- A decision not to award PIP was made before April 6, 2016.

What happens if you disagree with the review?

Claimants who wish to dispute a decision on the review of their PIP claim under the MM judgment can ask DWP to reconsider the decision - this is called a Mandatory Reconsideration (MR) and must be completed before an appeal is made and lodged with His Majesty’s Courts and Tribunals Service (HMCTS).

Full details about challenging your PIP (and other benefit) decisions can be found on GOV.UK here.

What if you think you've been underpaid?

If you believe you may have been affected by this change to the assessment rules, you should contact the DWP to request a review of your claim.