The Fed's Decision: A Gamble with High Stakes

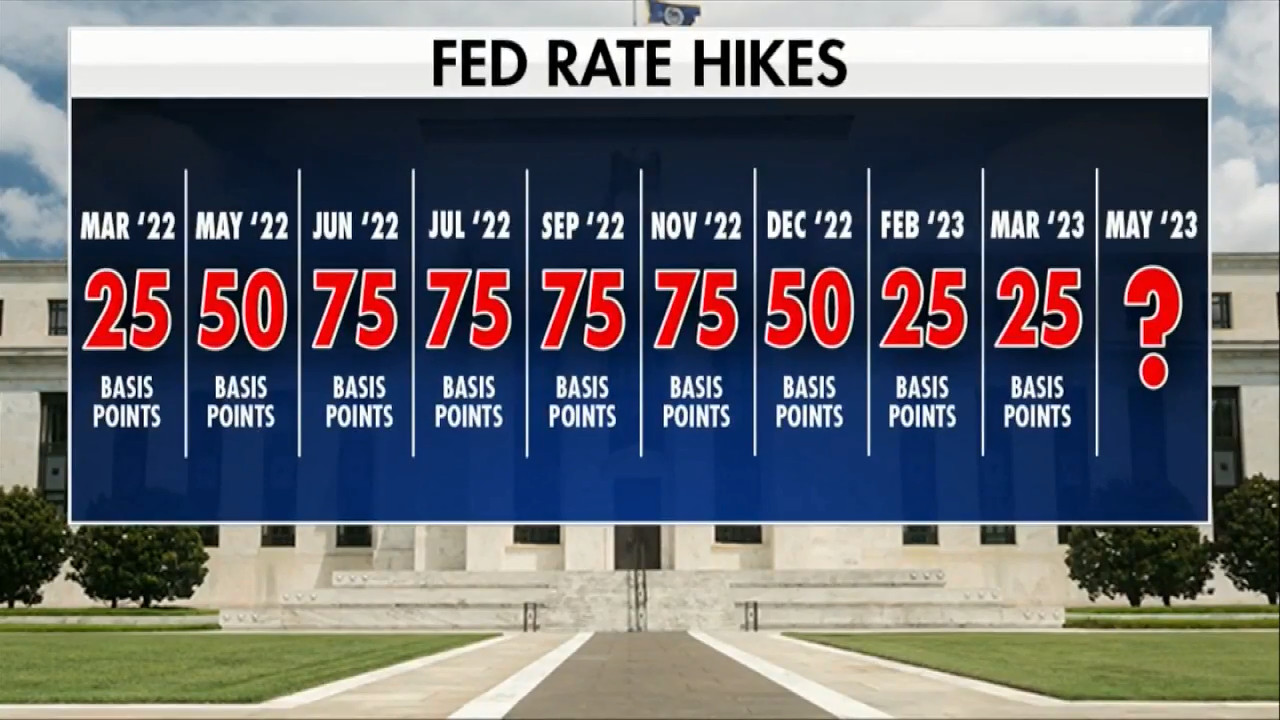

The Federal Reserve's decision on the interest rate hike is a topic that has the market buzzing. Will it be a 50 basis point increase or a more modest 25? The answer is a gamble with high stakes for investors. The market is holding its breath, waiting for the outcome, much like a parent waiting to find out if their unborn child is a boy or a girl.

Whispers on the Wall: 50 is the Buzz

The consensus among many experts is that a 50 basis point increase is the most likely outcome. This sentiment is echoed by analysts, traders, and even the whispers on the wall. One prominent analyst, who predicts a 50 basis point hike, believes the odds were 80% in favor of 50 and only 20% for a 25 basis point increase. The market has been so clearly leaning towards a 50 basis point hike, that a decision for 25 would be considered tone-deaf by many. This would mean a huge risk for the Fed, as it would risk eroding their credibility and undermining the public's trust.

A Strong Rally Could Lead to a Pullback: The Uncertainty Lurks

Even though the market is overwhelmingly leaning towards a 50 basis point increase, there is a lingering question about what might happen after the decision. Some are concerned that a strong rally following the announcement could be followed by a pullback, starting soon after options expire. The market's reaction to the Fed's decision is unpredictable, and it's a factor that could significantly impact the market's trajectory in the coming weeks.

The Dynamics of the Market: A Complex Interplay

The decision on the interest rate hike is not a simple choice. It's a complex interplay of many moving parts, including economic indicators, inflation trends, and geopolitical events. Experienced analysts, including those on Wall Street, have been closely monitoring these factors, hoping to predict the Fed's next move. There's an old adage that says a lot of “pro” money is intertwined in this process. This means that the structure of the market, based on speculation and insider information, will play a role in determining the outcome.

The Past and Current Truth: Dudley's Insights

Past pronouncements from former Fed officials, such as William Dudley, offer valuable insights into the current situation. Dudley's 2020 comments on the Fed's actions and their potential impact on the market provide a framework for understanding the challenges that the Fed currently faces. Dudley's comments are a reminder that the Fed is operating within a complex system and that their decisions have far-reaching consequences.

The Bottom Line: A Gamble with High Stakes

The decision on the interest rate hike is a significant event that will shape the market's direction for the coming months. It's a gamble with high stakes, and the market is holding its breath waiting for the outcome. The Fed is navigating a complex and volatile landscape, and the outcome of their decision will have a significant impact on investors and the global economy.

The stakes are high, and the market is anticipating a significant move. However, as with all things in the financial markets, there is always uncertainty. The future is never guaranteed, and there is a possibility that the Fed could surprise the market with a different decision. The market is always evolving, and the Fed is constantly assessing the economic landscape and adjusting its policies accordingly. For investors, the key is to stay informed and to understand the risks involved.

A Word of Caution: Not Investment Advice

It's important to note that this article is not intended as investment advice. The markets are complex and unpredictable, and investment decisions should always be made with careful consideration and professional guidance. The information provided in this article should not be interpreted as a recommendation to buy or sell any particular security. Investors should always conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.