Shifting winds have hit the automotive market. After years of unit growth for battery-powered electric vehicles (EVs), the sector has begun to stagnate. New unit sales for EVs were growing 51% year over year less than a year ago. In the first quarter of 2024, that growth rate collapsed to zero, meaning the number of EVs sold in the United States was the same as a year ago.

What is replacing this growth? Plug-in hybrids. The versatile technology that brings battery charging and gasoline-powered engines to the same vehicle is growing north of 50% year over year, making up the majority of growth for the automotive market in 2024. This has inspired Ford (NYSE: F) to scrap plans for an all-electric SUV, replacing the upcoming model with a plug-in hybrid.

Does this spell trouble for full EV upstarts such as Rivian Automotive (NASDAQ: RIVN), a company betting on all-electric pick-up trucks and SUVs? Let's investigate further and find out.

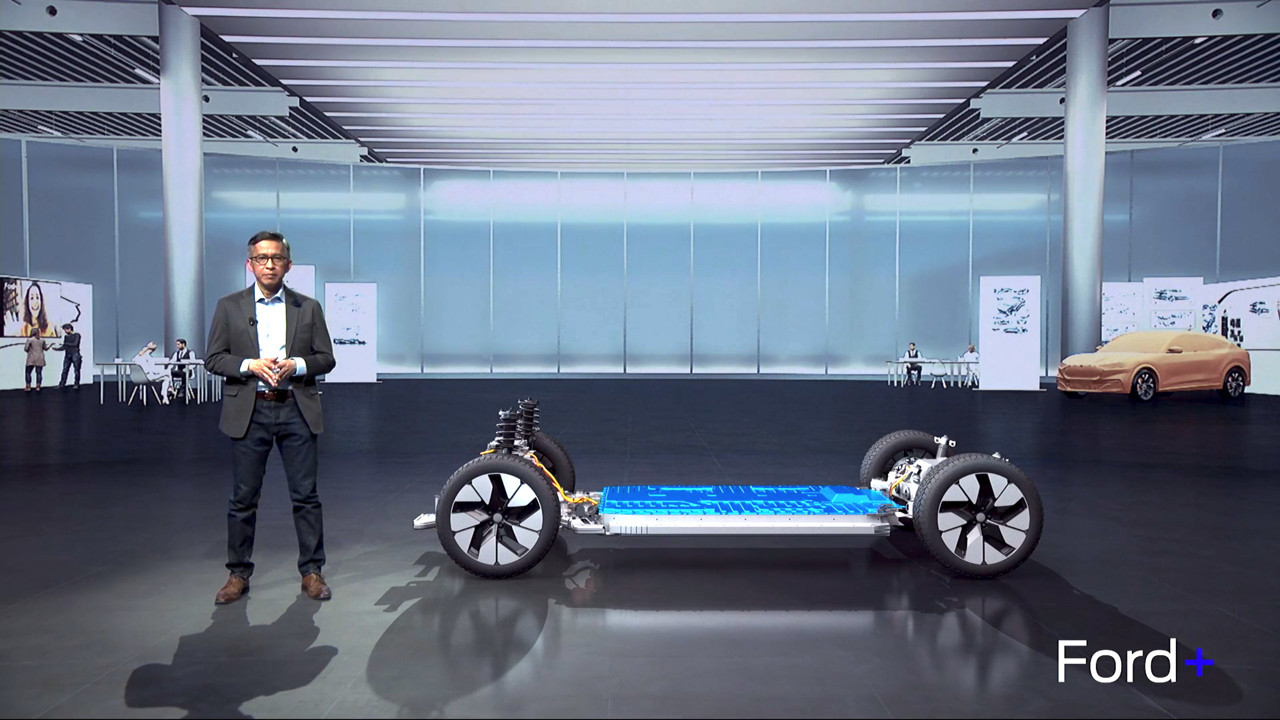

A few years ago, Ford began investing heavily in battery power and EV technologies. It came out with the Mustang Mach-E and F-150 Lightning. In 2021, it announced an $11.4 billion investment into new American factories set to pump out batteries and electric cars. Now, it has announced a pivot to this strategy.

Instead of a fully electric vehicle, Ford's upcoming SUV models will be plug-in hybrids. This doesn't mean Ford's $11.4 billion investment will go completely to waste, as these vehicles still require sizable lithium-ion batteries. They just don't need nearly the amount of raw materials for the batteries, which saves on costs. People are saying they want the flexibility of a plug-in hybrid as well. While full EVs are not growing in the United States, plug-in hybrid sales jumped 59% year over year in Q1 2024.

For right now at least, people want the flexibility of a plug-in hybrid over the fully electric vehicles produced by the likes of Rivian or Tesla. But what does it mean for these businesses?

On the one hand, investors could argue that Rivian is on the right side of history. The company produces all-electric SUVs and pick-up trucks. People are now saying they want more environmentally friendly cars to drive, and that eventually traditional full internal combustion vehicles will go extinct.

The problem is, Rivian has limited itself to not selling plug-in hybrids, which is where all the growth is today. You can see it in its delivery and production figures. Rivian's production has not grown over the last few quarters and seems stuck at around 60,000 vehicles a year. Deliveries have climbed slightly, but that is due to Rivian selling through some inventory that built up in late 2023. The trailing rate of deliveries has only just caught up to the trailing rate of production.

This growth slowdown coincides perfectly with the uptick in plug-in hybrid sales. The problem is that -- especially with larger vehicles like SUVs and pick-up trucks -- you need extra-large batteries. Larger batteries mean higher input costs, which consumers are not willing to pay up for. Even though the average Rivian pick-up truck starts at $75,000, the company has a shocking negative 41% gross margin.

An automotive market trending to plug-in hybrids is a disastrous development for Rivian. The company needs customers willing to pay up for premium EVs, and to reach a larger production scale to bring its gross margins from negative to positive. This is what happened to Tesla when it ramped up Model 3 production, for reference.

Bringing a completely new car model to market costs billions of dollars. From design to supply chain procurement to capital investments in the manufacturing plants, there is no way to shortcut the automotive production process. Rivian is burning $5 billion a year and has less than $8 billion in cash on the balance sheet. It likely does not have the time or the money to invest in a plug-in hybrid unless it can secure billions more in financing from outside investors.

Up until late last year, Rivian's gross margin was moving in the right direction. It still had a long ways to go, but you had a line of sight to improvement and eventual profits as the company scaled up production. Now, gross margins have stagnated at well in the negative territory, along with production and deliveries to customers. This coincided with the growth in demand for plug-in hybrids in the United States.

If the growth in plug-in hybrids continues, Rivian's business will continue to struggle. From my seat, this means investors should avoid buying this risky and unprofitable stock at the moment.

Ford's Shift to Smaller, More Affordable EVs

Ford, however, is taking a different approach. The company is shifting its focus to smaller, more affordable EVs, recognizing that the market demand for larger, luxury EVs is not as robust as initially anticipated. This change in strategy has been prompted by several factors, including the slowing growth of the EV market, the rising cost of batteries, and the emergence of formidable competitors, particularly from China.

Ford's new strategy is centered around its belief that the highest adoption rates for EVs will be in the affordable segment on the lower size-end of the range. To capitalize on this, Ford plans to roll out a series of smaller, more affordable EVs, starting with a commercial van in 2026, followed by a midsized pickup in 2027, and then its next-generation "T3" electric full-size pickup truck in late 2027.

This new direction signals a significant departure from Ford's previous plans, which included a larger, three-row electric SUV that has now been canceled. The company is also shifting its focus to battery production in the U.S. to qualify for tax incentives and credits, further streamlining its EV operations.

Why Smaller, Cheaper EVs Make Sense

Ford believes that smaller, more affordable EVs are a more capital-efficient, profitable approach to the electric vehicle market. This strategy is grounded in the unique cost dynamics of EVs compared to traditional internal combustion engine (ICE) vehicles. Unlike ICE vehicles, where larger vehicles typically command higher profit margins, EVs face a different equation. The weight and cost of battery packs needed for larger vehicles, particularly for SUVs and trucks, significantly impact their overall cost and range.

This limitation poses a challenge for both consumers and automakers. Consumers are hesitant to pay a premium for larger EVs, while automakers face difficulty achieving profitability on these vehicles. By focusing on smaller, more affordable EVs, Ford aims to address these challenges and create a more sustainable and profitable EV business.

A Challenge to Rivian's Strategy

Ford's shift to smaller, more affordable EVs could pose a significant challenge to Rivian's current strategy. Rivian has heavily invested in larger, premium EVs, and its dependence on this segment could leave it vulnerable as the market evolves. With the growth of plug-in hybrids, Rivian faces mounting pressure to adapt its product portfolio to meet evolving consumer preferences. The company's reliance on larger, more expensive EVs, coupled with its limited product offering, could put its future at risk in a market increasingly seeking affordability and flexibility.

Implications for the Broader EV Landscape

Ford's decision to pivot towards smaller, more affordable EVs is a significant indicator of the evolving dynamics within the EV market. It underscores the growing importance of affordability and efficiency in driving widespread EV adoption. As the market continues to mature, automakers are likely to prioritize these factors in their product strategies, seeking to capture a larger share of the growing but competitive EV market. This shift could also fuel a greater focus on hybrid technologies, creating a more nuanced and diverse EV landscape.

The Road Ahead

As the auto industry navigates the transition to a more electric future, Ford's new strategy highlights the need for adaptability and a keen understanding of market dynamics. The company's decision to prioritize smaller, more affordable EVs, combined with its focus on plug-in hybrids, underscores the need for a multi-faceted approach to electrification. The success of Ford's new strategy will depend on its ability to effectively balance affordability, efficiency, and innovation, ultimately shaping the future of the EV market in the years to come.