Global Central Banks Lower Rates Amidst Geopolitical Uncertainty

The global monetary easing cycle continued its course in October, with central banks across developed and emerging economies taking steps to lower interest rates. This trend was largely driven by the upcoming U.S. election, a major geopolitical event that has cast a shadow of uncertainty over the global economy.

The decision to ease monetary policy reflects a cautious approach by central bankers, who are grappling with a complex interplay of factors, including inflation, economic growth, and geopolitical risks.

A Closer Look at the Key Rate Cuts

Three of the four central banks overseeing the 10 most heavily traded currencies that held meetings in October reduced their benchmark interest rates. The Bank of Canada and the Reserve Bank of New Zealand each lowered rates by 50 basis points, while the European Central Bank delivered a 25 basis points cut. The Bank of Japan, on the other hand, maintained its rates unchanged.

The Bank of Canada’s Decision: A Closer Look

The Bank of Canada's decision to cut rates by 50 basis points was not without its internal debate. Some officials expressed concerns that such a significant reduction could be misinterpreted as a sign of weakness in the economy. These concerns, however, were outweighed by the perceived need to stimulate growth and address the uncertainties surrounding the U.S. election.

The US Dollar Surges Amidst Global Uncertainty

The U.S. Dollar has shown remarkable strength in recent weeks, surging more than 4% against the Swiss Franc. This move has propelled the USD/CHF exchange rate towards major resistance levels, prompting speculation about a potential inflection point. The strong dollar is a reflection of the global economic and geopolitical landscape, with investors seeking safe haven assets amid uncertainty.

The Chinese Economy: A Tale of Two Trends

The Chinese economy is currently grappling with mild deflation. However, there is a glimmer of hope as inflation is expected to pick up in the coming months. This optimism is contingent upon the government's ability to boost nominal demand through a combination of fiscal and monetary policy support. The Chinese government has signaled its commitment to supporting economic growth, but the effectiveness of these measures remains to be seen.

The U.S. Election: A Key Catalyst for Global Markets

The upcoming U.S. election is a major event that is casting a long shadow over global markets. The outcome of the election could have significant implications for the direction of the global economy, particularly in terms of trade policy and global cooperation. As the election draws near, investors are closely monitoring the developments in the race, seeking to anticipate the impact on their portfolios.

Markets Respond to Past U.S. Elections

Looking back at the six previous U.S. elections, markets have exhibited a range of reactions in the lead-up to Election Day. In some cases, markets have remained relatively calm, while in others they have experienced volatility. The overall response is influenced by a complex interplay of factors, including the candidates' economic policies, the political climate, and the broader global economic environment.

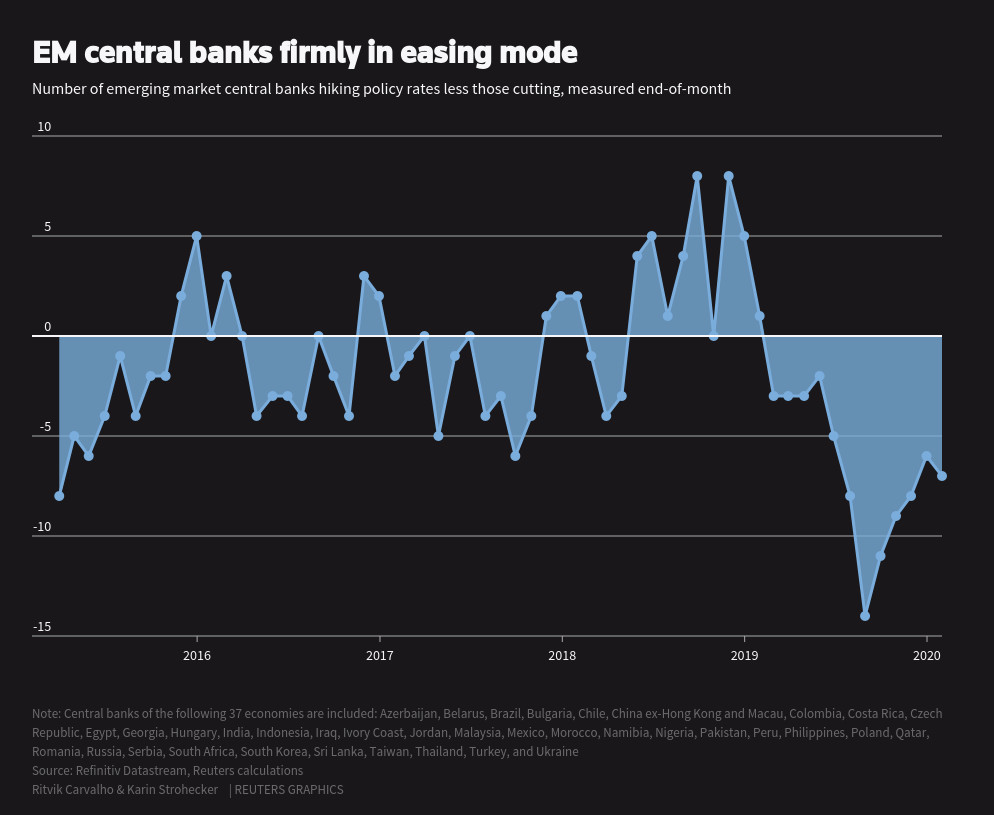

The Easing Cycle: A Shift in the Winds?

The global monetary easing cycle, while evident in recent months, may be nearing its end. The U.S. Federal Reserve, along with central banks in Australia, Switzerland, Norway, and the UK, have not yet joined the easing trend. The Fed's stance, in particular, is closely watched by investors as it is a key driver of global financial markets. The Fed's recent statements suggest that it is closely monitoring the economic outlook and is prepared to act if necessary. However, the Fed is also mindful of the potential for inflation to return, a factor that could weigh against further easing.

Navigating the Uncharted Waters

The global economic landscape is currently characterized by a confluence of factors, including geopolitical risks, inflation, and the potential for a slowdown in growth. Central banks are navigating this complex terrain with a cautious approach, seeking to balance the need for economic stimulus with the risks of inflation and financial instability. The coming months will likely see continued volatility in global markets as investors grapple with these uncertainties.

A Time for Vigilance

In this era of uncertainty, it is more important than ever for investors to stay informed and vigilant. Keep an eye on central bank pronouncements, geopolitical developments, and economic data releases. By carefully monitoring these key indicators, investors can make informed decisions and navigate the challenging waters of the global financial markets.