Industrial Valves Market on the Rise: Projected to Reach USD 123.05 Billion by 2034

The global industrial valve market is poised for substantial growth, driven by the expanding industrial sectors like oil and gas, water treatment, and manufacturing. The increasing demand for industrial valves is inextricably linked to ongoing process optimization initiatives, automation trends, and the integration of smart technologies in industrial operations.

The market is expected to reach a valuation of USD 123.05 billion by 2034, exhibiting a steady compound annual growth rate (CAGR) of 4.2%. This growth trajectory is fueled by the rising demand across various industrial sectors, including oil & gas, chemicals, water & wastewater treatment, and power generation.

Role of Industrial Valves

Industrial valves are essential components in regulating, controlling, and directing the flow of liquids, gases, and slurries within pipelines. Their key applications include pressure control, system protection, and flow management, making them indispensable across diverse industries.

Technological Advancements Drive Growth

Technological advancements, such as the integration of IoT (Internet of Things) and automation in industrial valves, have significantly boosted market demand. The integration of AI and IoT enables real-time monitoring and predictive maintenance, improving operational efficiency and reducing costs. This has led to the emergence of 'smart valve' solutions that are transforming the industry.

Sustainability and Energy Efficiency as Key Drivers

As the world shifts its focus towards sustainability and energy efficiency, the industrial valve market is also benefiting from the increasing demand for renewable energy systems and environmental protection solutions. This trend has spurred innovation in eco-friendly industrial valve solutions, utilizing materials that are both durable and environmentally responsible.

Key Drivers and Opportunities

Rising Energy Demand

One of the primary drivers of the industrial valve market is the rising energy demand, leading to an increased focus on efficient oil & gas extraction and processing activities. This trend is particularly pronounced in developing economies, where industrialization is driving an increased need for energy resources.

Expanding Infrastructure Projects

Expanding infrastructure projects, especially in developing economies, are significantly contributing to the higher demand for valves in various sectors like water treatment, chemical processing, and power generation. These projects necessitate robust valve systems to ensure efficient and reliable operation, driving market growth.

Automation and Digital Transformation

Automation and digital transformation are opening new avenues for smart valve solutions. The integration of advanced technologies like AI and IoT enables real-time monitoring and predictive maintenance, leading to improved operational efficiency and cost reductions. This shift towards smart valves is a major growth driver for the market.

Government Regulations and Environmental Safety

Increased government regulations focused on environmental safety have further propelled innovation in eco-friendly industrial valve solutions. This has driven manufacturers to develop valves that minimize environmental impact and comply with stringent regulations, creating opportunities for sustainable valve solutions.

Key Takeaways from the Market Study

- The industrial valve market is projected to grow from USD 81.55 billion in 2024 to USD 123.05 billion in 2034, with a CAGR of 4.2%.

- Oil & gas remains the largest application segment, fueled by the ongoing demand for energy and fuel.

- Technological advancements, including IoT integration, are creating significant growth opportunities.

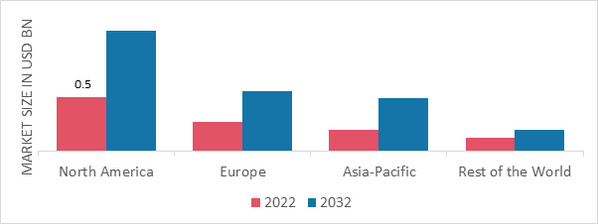

- Asia Pacific is expected to witness the highest growth rate, driven by rapid industrialization and infrastructure development.

Component Insights

Types of Industrial Valves

Industrial valves come in various types, each serving specific applications. Some of the most common types include:

- Ball Valves: These valves are gaining popularity for their durability and ability to maintain and regulate high pressure. They are frequently used in applications where reliable flow control is critical.

- Gate Valves: These valves are primarily used for on/off operations, providing a full open or closed flow path. They are commonly used in water distribution systems and other applications where a simple on/off function is needed.

- Globe Valves: These valves are commonly used for regulating flow. They offer a higher degree of control compared to gate valves, making them suitable for applications where precise flow adjustments are essential.

- Butterfly Valves: These valves are characterized by a disc-shaped element that rotates to control flow. They are known for their compact design and ease of operation, often used in applications where space is limited.

Valve Materials

Key materials used in valve manufacturing include steel, cast iron, and alloys. The choice of material depends on application requirements, such as temperature resistance and corrosion protection.

- Steel: Steel is widely used in valve manufacturing due to its strength and durability. It is suitable for high-pressure and high-temperature applications.

- Cast Iron: Cast iron offers good resistance to corrosion, making it suitable for applications involving water and wastewater treatment.

- Alloys: Alloys, such as stainless steel, are used when specific properties like corrosion resistance, heat resistance, or strength are required.

Leading Players in the Industrial Valve Market

Emerson Electric Co.

Emerson Electric Co. is currently recognized as the biggest vendor in the global industrial valve market. The company offers a diverse portfolio of valve solutions catering to multiple industries, including oil & gas, chemical processing, and power generation. Emerson's focus on innovation and smart technology integration has cemented its position as a market leader.

Other Key Players

Other major players in the industrial valve market include:

- Schlumberger Limited

- Flowserve Corporation

- Curtiss-Wright Corporation

- Weir Group

These companies collectively hold a significant share of the global industrial valve market. Their commitment to product innovation, customer-centric solutions, and strategic mergers and acquisitions has solidified their market positioning.

Growth Drivers:

- Growing demand for energy, especially in the oil & gas sector.

- Rising investment in water & wastewater management systems.

- Technological advancements in valve manufacturing, including automation and IoT integration.

- Expanding industrial infrastructure projects in emerging economies.

Key Segments

The industrial valve market is segmented based on various parameters, including:

- By Valve Type: Gate, Parallel, Wedge, Globe, Tee, Angle, Wye, Ball, Trunnion, Floating, Threaded Series, Butterfly, High Performance, Lined, Plug, Lined, Lubricated, Non-Lubricated, Check, Dual Plate, Piston Lift, Spring Loaded Disk, Swing Check, Tilting Check, Y Pattern, T Pattern, Safety Relief, Spring Loaded, Pilot Operated, Other Customized

- By Valve Material: Cast Steel, Carbon Steel, Stainless Steel, Bronze, Others

- By Function: Manual, Automatic

- By End-use Industry: Oil & Gas, Chemical, Water & Wastewater Treatment, Power Plants, Paper & Pulp, Others

- By Region: North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa

The Future of the Industrial Valve Market

The industrial valve market is expected to continue its growth trajectory in the coming years, driven by factors such as increasing energy demand, infrastructure development, and technological advancements. The integration of smart technologies and the focus on sustainability are creating new opportunities for manufacturers, who are developing innovative and efficient valve solutions to meet the evolving needs of the industry.

A Look Ahead

The future of the industrial valve market is bright, with continued growth driven by global demand for energy, infrastructure expansion, and the adoption of smart technologies. The industry is poised to play a vital role in supporting the world's growing energy needs while fostering sustainable and efficient industrial practices. As the demand for energy and infrastructure development continues to rise, so too will the need for reliable and innovative industrial valve solutions. The market is expected to see significant advancements in material science, automation, and digital technology, shaping a future where valves are more efficient, reliable, and environmentally friendly than ever before.