Intel's Foundry Spin-Off and Amazon Deal Fuel Stock Surge

Wall Street is bracing for tomorrow's Fed Decision, where the central bank is widely expected to cut interest rates. Fed Chair Jerome Powell and company kick off their two-day policy meeting this morning. The September meeting comes amid the release of more key economic data, including August retail sales out this morning.

On the tech front, both Microsoft (MSFT) and Intel (INTC) shares are higher. Microsoft is rising after the company raised its dividend, while Intel is jumping after it announced plans to make its foundry business a subsidiary. This comes after a strong day yesterday for the stock following the Biden Administration's decision to award Intel with up to $3 billion in funding through the CHIPS and Science Act.

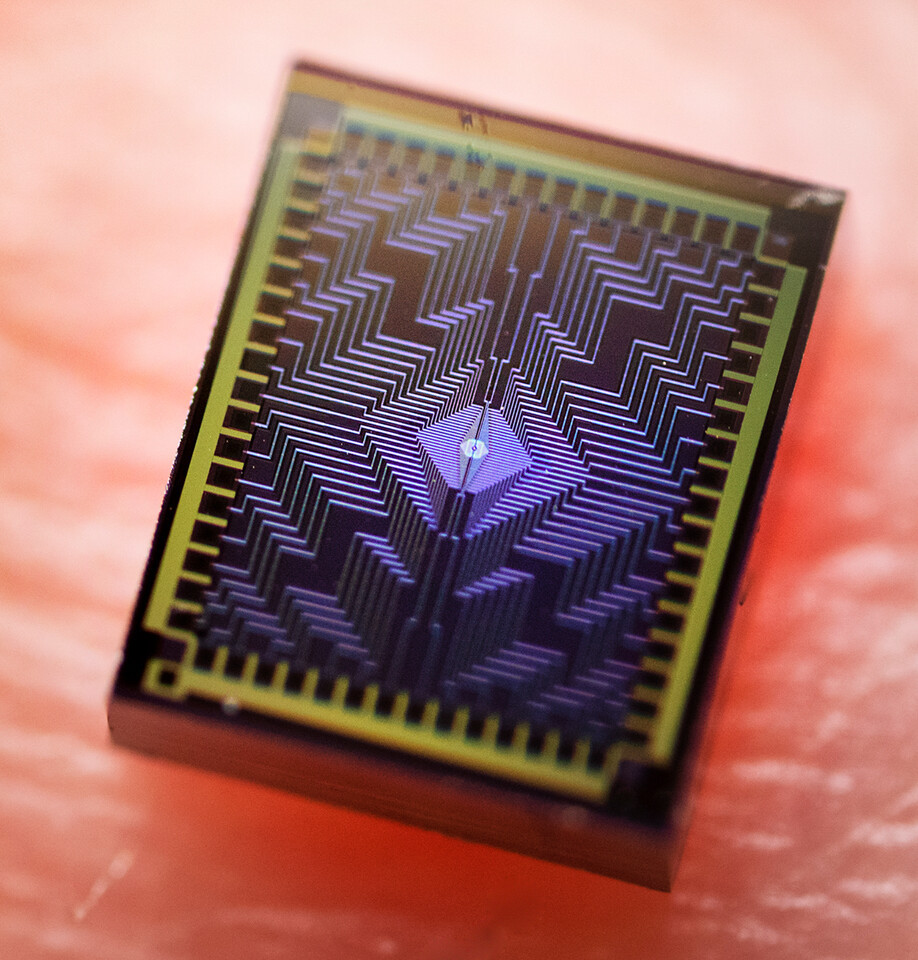

Intel's Bold Strategy

Intel's decision to spin off its foundry business into a separate subsidiary has been met with enthusiasm by investors. The move is seen as a strategic step to capitalize on the growing demand for U.S.-made chips, particularly in the wake of the CHIPS Act. The Act aims to boost domestic semiconductor production and reduce reliance on foreign suppliers. Intel's foundry business, which manufactures chips for other companies, is expected to benefit from this increased demand.

The Amazon Partnership

In addition to the foundry spin-off, Intel announced a deal to make chips for Amazon's (AMZN) Amazon Web Services (AWS). This partnership is a significant win for Intel, as it secures a major customer in the fast-growing cloud computing market. Amazon shares also rose on the news, reflecting the positive impact of the deal on the company's cloud computing business.

The Broader Market Context

Intel's stock surge comes amid a broader trend of optimism in the tech sector. The Nasdaq 100 index added 0.6% to 19,534, with other top tech risers including CrowdStrike Holdings Inc (NASDAQ:CRWD), Cisco Systems Inc (NASDAQ:CSCO, ETR:CIS), Meta Platforms Inc (NASDAQ:META, ETR:FB2A, SWX:FB), and Cadence.

The Fed's Impact on the Market

The stock market's performance is also being influenced by the upcoming Federal Reserve meeting. The central bank is expected to cut interest rates, which could provide a boost to corporate earnings and investor confidence. However, the magnitude of the rate cut remains uncertain, and some analysts believe that the market may experience further volatility in the near term.

A Look at the Data

The August retail sales report, released earlier today, showed a 0.1% increase, surpassing expectations for a 0.2% decline. This positive data suggests that U.S. consumer spending remains resilient despite rising interest rates and inflation.

Market Outlook

Overall, the market outlook remains cautiously optimistic. While Intel's stock surge is a positive sign, investors are awaiting the Fed's decision on interest rates and the continued release of economic data to gauge the direction of the market in the coming weeks.

The Future of Intel and the Semiconductor Industry

Intel's decision to spin off its foundry business and partner with Amazon could have a significant impact on the future of the semiconductor industry. By focusing on its foundry business, Intel is positioning itself to become a leading player in the manufacturing of chips for other companies. This could lead to increased competition in the semiconductor market, which could benefit consumers through lower prices and better products.

The partnership with Amazon is also a key development for Intel. By supplying chips for AWS, Intel gains access to a vast and growing market for cloud computing services. This could help Intel to expand its business and generate new revenue streams.

Conclusion: A Bold Move With Potential

Intel's strategic moves have been met with positive reactions from investors. The company's focus on its foundry business and the partnership with Amazon are likely to drive growth in the years to come. While the market outlook remains uncertain, Intel is well-positioned to capitalize on the growing demand for semiconductors and the evolution of the cloud computing landscape.