Intuit and Adyen Partner to Streamline Small Business Payments

Intuit, the financial technology giant behind popular platforms like TurboTax, Credit Karma, QuickBooks, and Mailchimp, has announced a significant collaboration with Adyen, a leading fintech company specializing in payment processing. This partnership aims to revolutionize the way small and medium-sized businesses (SMBs) manage electronic payments, leveraging the power of integrated financial technology.

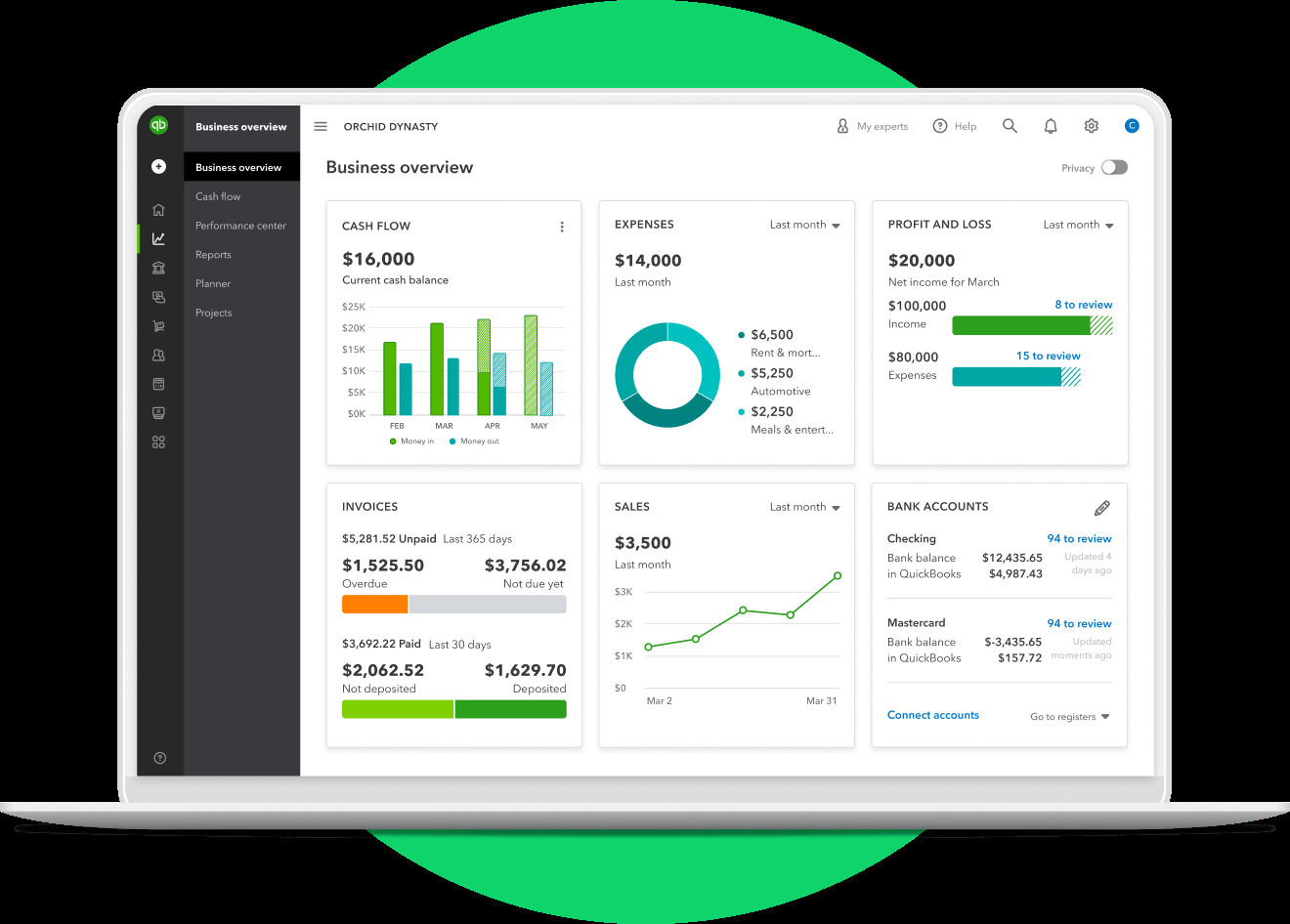

The initial focus of this collaboration is the integration of Adyen's embedded payment services into Intuit's business platform, primarily through QuickBooks Online. QuickBooks Online currently boasts approximately 6.5 million subscribers, enabling approximately 2.9 million invoices to be sent monthly in the UK alone. This substantial user base makes it a prime target for enhancing payment processing capabilities.

Addressing the Challenges of Late Payments

Late payments represent a significant hurdle for many SMBs. In the UK, late payments cost small businesses an average of £22,000 annually, according to the Federation of Small Businesses and the UK Government. This financial strain contributes to a staggering 50,000 business closures each year. The Office of the Small Business Commissioner estimates that timely payments could inject an additional £2.5 billion annually into the UK economy. The partnership between Intuit and Adyen directly tackles this critical issue by offering quicker payment solutions.

Faster Payments and Enhanced Options

By integrating Adyen's payment platform, Intuit QuickBooks customers will gain access to a broader array of payment options and significantly faster payment processing. Adyen's UK banking license and direct connection to the Faster Payments Service (FPS) ensure rapid funds transfer, resolving cash flow problems that hamper the success of many small businesses. This integration is more than just a technological upgrade—it's a lifeline for SMBs struggling with financial constraints. The added convenience and speed translate to improved operational efficiency and business growth.

A Synergistic Partnership for Growth

Intuit QuickBooks, a core component of Intuit's business platform, empowers sole traders and SMBs to manage their finances, receive payments, and control cash flow efficiently. The collaboration with Adyen perfectly aligns with Intuit's broader strategy of integrating best-in-class tools to improve the user experience across its platform. Globally, Intuit products support 100 million customers, offering a comprehensive suite of tools designed to increase customer acquisition, revenue generation, and efficiency, all while providing AI-powered insights that foster growth.

Intuit QuickBooks UK already supports a variety of payment platforms to minimize payment friction for its customers. The addition of Adyen's payment capabilities, facilitated by locally approved Adyen entities, sets the stage for future integration of a wider range of embedded financial products within the Intuit software ecosystem.

A Seamless Integration for Enhanced User Experience

The initial integration with Adyen will offer several key benefits: faster settlement times, comprehensive risk management tools, and an enhanced overall payment experience. Nick Williams, Product Director at Intuit QuickBooks, highlights the company's excitement about this partnership, stating, “We are thrilled to team up with Adyen so businesses can benefit from end-to-end financial management on our platform. Adyen’s payment platform is designed to provide a seamless payments experience for merchants and their customers, and we are pleased to bring this capability to our users, improving the convenience of money movement on QuickBooks Online.” Intuit's rigorous selection process underscores their commitment to partnering with industry leaders. The thorough process involved ensuring Adyen offered a robust platform capable of handling the complexities of small business financial management.

Hemmo Bosscher, SVP Platforms & Financial Services at Adyen, shares an equally enthusiastic outlook. He emphasizes the synergistic nature of the partnership: “This collaboration combines Intuit’s top-tier financial tools with Adyen’s cutting-edge embedded financial technology, empowering SMBs across a range of industries with optimized payment experiences, simplified everyday operations, and new growth opportunities.” The collaborative effort aims to provide small businesses with the essential tools for thriving in a rapidly evolving digital landscape.

The Future is Now: Embracing Embedded Finance

The Intuit-Adyen partnership represents more than just an upgrade to payment processing; it signifies a broader trend in the adoption of embedded finance. By integrating financial services directly into their existing software platform, Intuit is providing a seamless and convenient experience for their customers, simplifying complex financial tasks and streamlining business operations. This innovative approach sets a new standard for financial technology integration, potentially reshaping the landscape of small business financial management. The combined power of Intuit's established platform and Adyen's innovative payment solutions positions the partnership for significant success in the SMB market and beyond. This forward-thinking collaboration is poised to set a new precedent for seamless financial integration, empowering businesses to focus on growth and innovation.