Ireland's New Pension Scheme: A Step Forward or a Missed Opportunity for Gender Equality?

The Irish government's ambitious new auto-enrolment pension scheme, slated to launch next September, promises to revolutionize the nation's retirement landscape. Projected to enroll 750,000 workers, the "My Future Fund" aims to significantly boost workplace pension coverage. However, a recent report from the National Women’s Council (NWC) casts a shadow on this otherwise positive development, highlighting a potentially detrimental consequence: the widening of the existing gender pension gap.

The Gender Pension Gap: A Persistent Problem

The report, titled “Still Stuck in the Gap – Pensions Auto-enrolment from a Gender and Care Lens,” paints a stark picture of pension inequality in Ireland. Currently, a significant 35% gender pension gap exists, with women receiving considerably less in retirement income than men. This disparity stems from a complex interplay of factors, including lower average earnings for women, more frequent career interruptions for caregiving responsibilities, and historical discrimination like the marriage bar.

Unpaid Care Work: A Significant Factor

The report underscores the critical role of unpaid care work in perpetuating the gender pension gap. Women disproportionately shoulder the burden of caring for children and elderly family members, often leading to reduced participation in the formal workforce and lower pension contributions. The auto-enrolment scheme, by primarily focusing on paid employment, fails to adequately address this crucial aspect. The scheme's design, therefore, risks exacerbating existing inequalities rather than bridging them.

Auto-Enrolment: A Double-Edged Sword?

While the NWC acknowledges the scheme's potential to increase overall pension coverage—a commendable goal—it argues that its design may inadvertently deepen the gender divide. The scheme’s structure, which closely ties pension entitlements to paid employment, further marginalizes women who often work part-time or take career breaks due to caregiving. This connection, according to the report, could "exacerbate the gender pension gap."

Low Participation Rates: Exacerbating Existing Inequalities

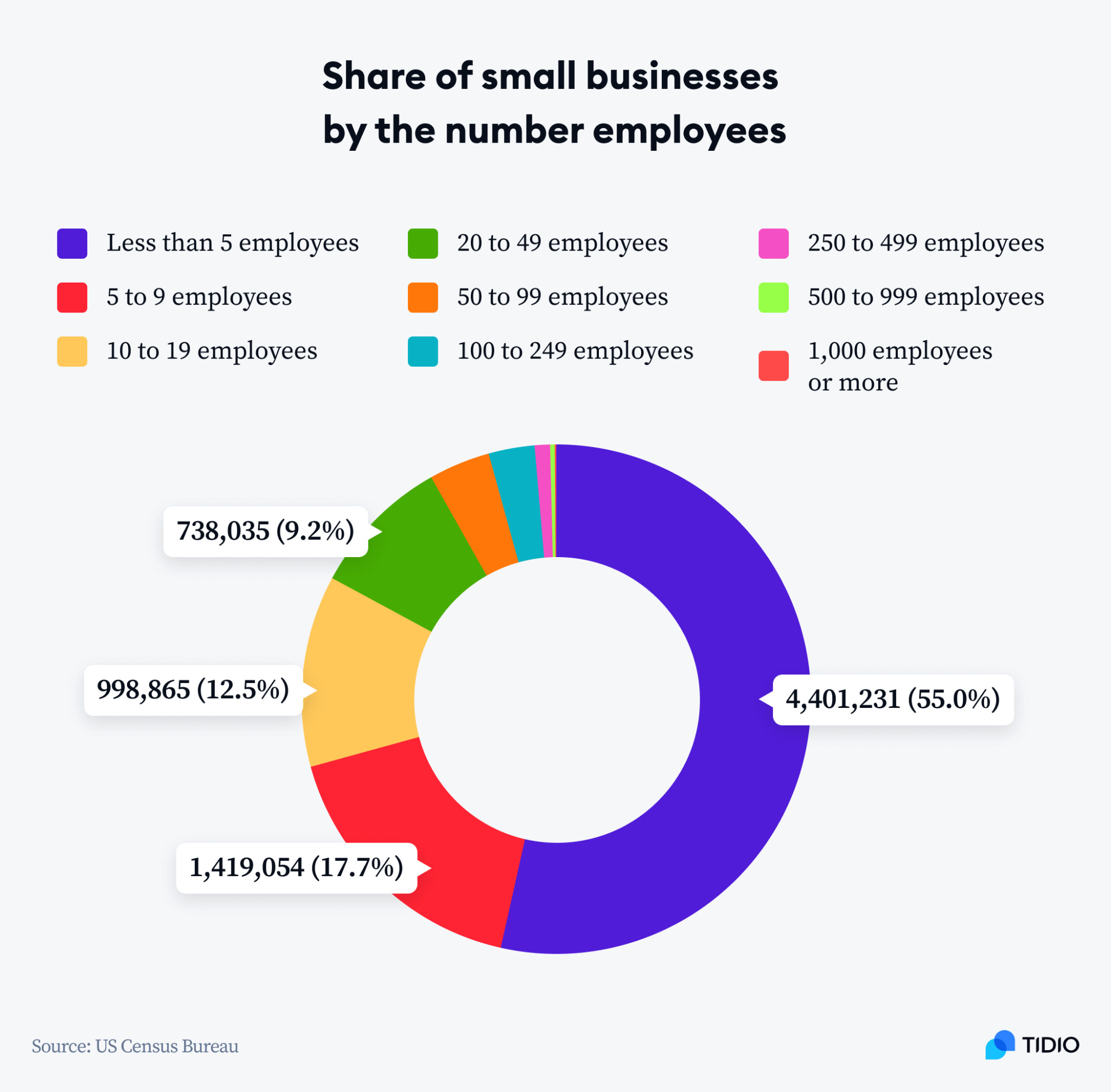

The report points out that less than half of workers in Ireland currently have an occupational pension, a low rate that highlights the existing need for reform. While the auto-enrollment scheme aims to address this, the NWC expresses concern that it might not impact all demographics equally, failing to improve the pension prospects of low-paid, part-time workers, or those outside of paid employment. The failure to address such inequalities, the report claims, could lead to a widening rather than closing of the gender pension gap.

Proposed Solutions: A Call for Systemic Change

The NWC advocates for a more comprehensive approach that goes beyond auto-enrolment. They propose strengthening the state pension, increasing its value, and ultimately developing a universal pension system. This system would not be means-tested and would provide an adequate income for all retirees, regardless of their employment history or gender. This proposal aims to tackle the systemic inequalities that underpin the gender pension gap and ensure a more equitable retirement for all.

Reforming Tax Reliefs and Prioritizing State Pension

To fund such a universal pension system, the NWC suggests reforming pension tax reliefs, which currently disproportionately benefit higher earners. The current system needs significant reform so as to ensure a more adequate pension for all Irish citizens, as opposed to focusing on private occupational coverage which only serves to disproportionately reward higher earners and ignores the systemic factors behind the gender pension gap. They propose that the full rate of the contributory state pension should be set at 35pc of average yearly earnings, a significant increase that would go a long way in securing financial stability for a significant segment of the Irish population.

Economic Model Re-evaluation

The report's recommendations extend beyond financial mechanisms, calling for a broader cultural shift that values both paid and unpaid care work. This includes better employee rights for flexibility, improved parental leave policies, and a universal childcare scheme. Such measures aim to reduce the gendered division of care responsibilities and enable women to better balance work and family life, ultimately increasing their economic participation and retirement income.

The Road Ahead: A Call for Action

The NWC's report serves as a critical analysis of Ireland’s new pension auto-enrolment scheme, highlighting its potential shortcomings in addressing the persistent gender pension gap. The report also advocates for a deeper systemic change that prioritizes gender equality and recognizes the value of unpaid care work in shaping retirement outcomes for women. By emphasizing a strong and comprehensive state pension system, the NWC hopes to secure a financially secure and more equitable retirement for all Irish citizens, regardless of gender or other social factors. The recommendations put forward by the NWC represent a call for a more equitable and just retirement system in Ireland, acknowledging that a fair retirement is not just about having a pension, but about ensuring financial stability and security for all its citizens.