Real estate is often cited as one of the best investments you can make, because, within reason, many properties tend to appreciate in value, making it possible to withdraw equity that can be used for further investment.

Though truly getting good at real estate investing can take time and education, investors explain some ways you can learn to pick the next hot housing market to invest in.

In real estate, it’s important to learn the fundamentals of supply and demand as they affect future real estate values, according to Mike Hardy, a real estate investor and managing partner for the Pacific Southwest with Churchill Mortgage.

You want to ask such questions as:

Market Fundamentals

Supply and Demand

- What does the current and the future supply look like?

- What does the current and the future demand look like?

- What are the related affordability issues that you may deal with?

- And, what does the current credit environment and future credit environment look like?

“So, when I step back and zoom out to look at housing, I want to understand what’s the current inventory level and [how that meets] the current and the future demographics,” said Hardy.

For example, currently, “We’re still many years behind a new build run rate to be able to meet the current demographics,” he continued. “And there’s a wave of new buyers coming in and pent-up demand from buyers that haven’t been able to enter the marketplace over the last couple of years. It’s almost like the tide coming in.”

The existing inventory of homes and the rate of new builds is not positioned to meet that demand, he explained, which keeps prices higher.

Psychological Factors

People’s attitudes toward the market also influence it, because these attitudes affect when and how people buy properties.

“Housing has been out of favor psychologically for a while, mainly because of the higher interest rates, but when interest rates move from the sevens to the sixes, and even fours and fives, now all of a sudden there’s this internal thing that says the time is right because there’s a five in the interest rate instead of a six,” Hardy explained.

He finds it amazing how quickly the market can swing just because people see the time as better.

“All of a sudden another wave of buyers come off the fence simply because of that psychological aspect, even though the affordability difference was really negligible between the two,” he added.

The 8-12 Year Reset Cycle

Another way to find a hot market may have less to do with where you look and more at when, according to Andy Heller, a real estate investor and owner of Regular Riches, a real estate education company.

He said he’s noticed a housing market “reset” pattern that occurs in real estate every eight to 12 years. He cites a specific reset that happened in the early 1990s after the savings and loan crash of the late ’80s, then one that followed the dot.com bust of the late ’90s, and again after the housing crash and Great Recession of 2008.

He said that COVID-19 stimulus money that was pumped into the economy has delayed the next reset, but he believes it is coming.

Key Indicators of a Market Reset

One of the signs that any market is about to reset is related to the percentage of mortgage delinquencies.

“When more people get behind in their mortgages today, it means tomorrow in the future we’re going to see typically a rise in foreclosures and eventually, and that’s bank owned property,” said Heller.

When there’s an uptick in foreclosures, he pointed out that this is typically followed shortly thereafter by a drop in values. Using data from Auction.com, he shared that compared to Q1 of 2024, 30- to 60-day mortgage delinquencies are up 27% and 60- to 90-day delinquencies are up 33%.

“This is the highest since the second quarter of 2020,” he continued. “This is what I would call a lead-in indicator now, but it operates on a delay because somebody [falling] behind today is probably anywhere from six to 18 months from actually losing those homes.”

Another key sign that a market is about to have a greater number of cheaper homes available, Heller said, is when real estate values rise above this threshold where two income earners can afford a home.

“Eventually, when that happens, that’s also a sign that a correction is coming,” he added.

When property values remain out of reach for those families for too long, he said “it’s not sustainable.”

You can also extrapolate these signs to a more micro level. One city or even neighborhood may be heading toward a decline in prices and an increase in supply, but you’ll need to keep close track of data.

Making the Investment Decision

Ultimately, Heller recommended investors practice patience.

“Long-term investors like me wait for these resets. It’s a double-edged sword, too, because I don’t ever like to see bad things happen to people, like losing jobs and homes,” said Heller.

However, he acknowledged that is typically when the housing market is going to move more in an investor’s favor.

Even if the signs seem right, Heller urged, “Don’t force yourself to buy a property if the numbers don’t work.”

Instead, get your finances and sources lined up to identify an acquisition strategy to figure out how to acquire properties you wish to buy, and then figure out your plan for them. Will you flip them? Wholesale them? Lease them?

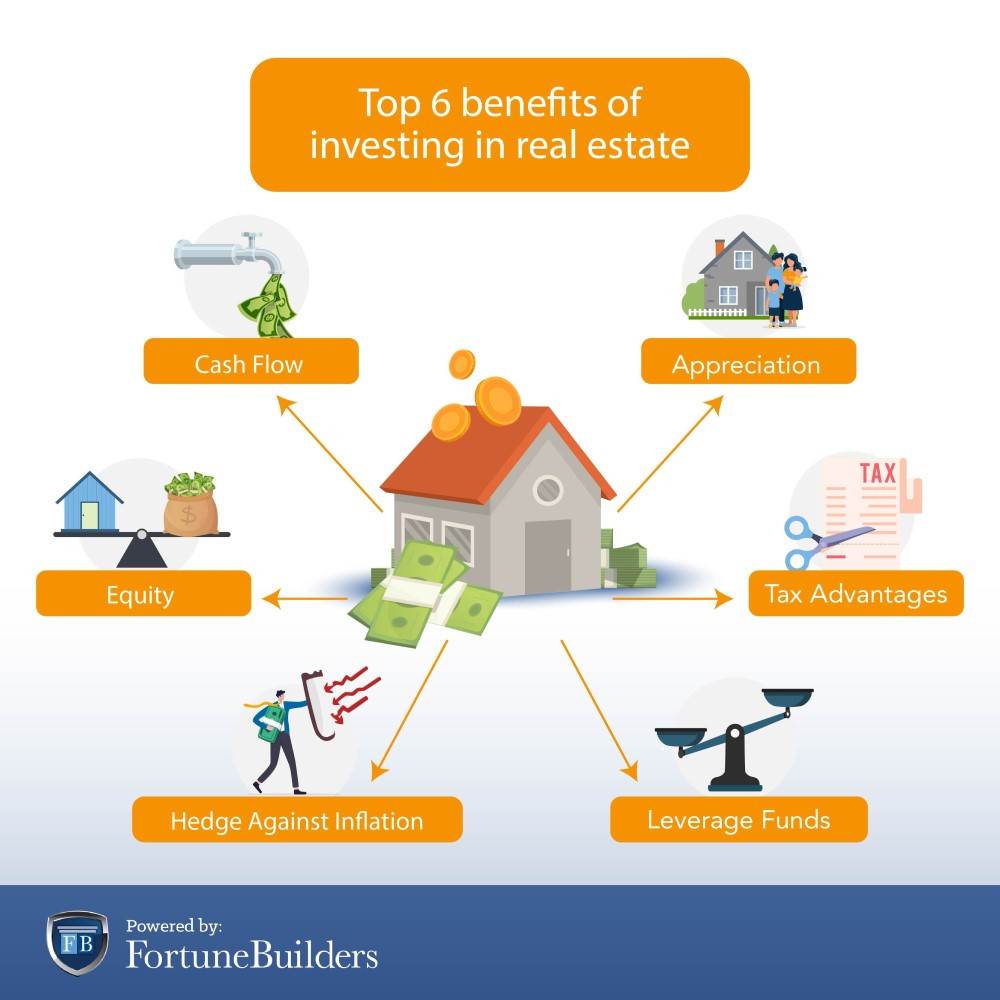

Hardy also recommended that if you’re purchasing a real estate investment property for the first time, you make sure it’s worth it — meaning, will it be cashflow positive or bring about other benefits, such as depreciation and other tax write-offs?

“I always assess three different things: What is the cash-on-cash return? What does the cashflow look like relative to the down payment that I’m going to put on the property? What is the expected appreciation value for that particular area?” said Hardy. “And then extrapolate that out over a relevant timeframe, let’s just say 10 years.”

While finding affordable real estate can seem challenging, if you pay attention to the signs of any market and get your finances in order, you might be able to jump in more quickly than you thought.