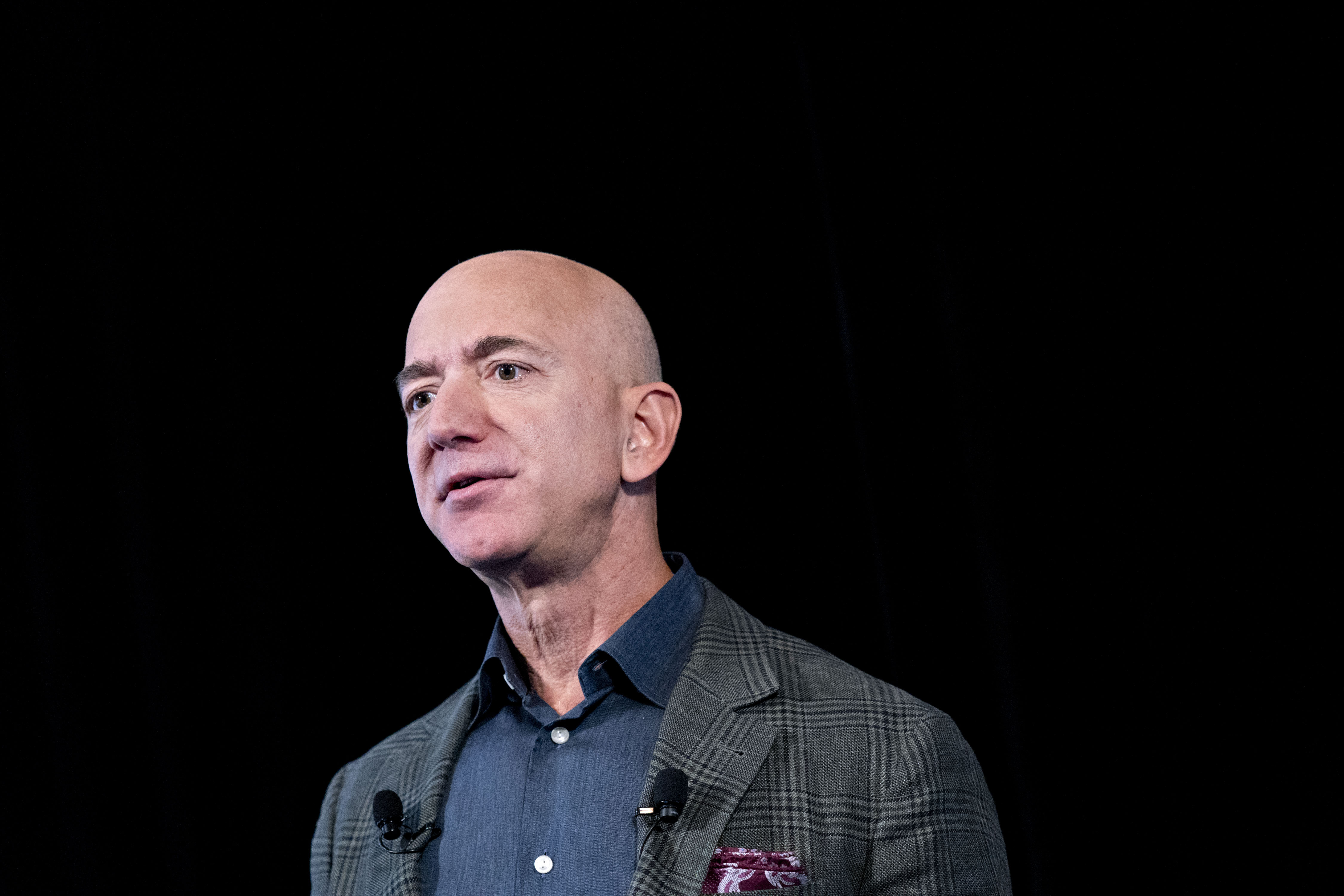

Bezos' Automated Stock Sales: A Window into Amazon's Future?

The recent automated stock sales by Amazon founder Jeff Bezos have sparked significant interest and speculation within the financial community. Bezos's actions, executed through a 10b5-1 plan filed with the U.S. Securities and Exchange Commission (SEC), have revealed a clear pattern that suggests his personal valuation of Amazon.

The Pattern: A $200 Threshold

Throughout 2023, Bezos has consistently sold Amazon stock whenever its price has touched $200 U.S. per share or exceeded that threshold. Interestingly, these sales have ceased each time the share price has dipped below $200 U.S. This recurring pattern strongly implies that Bezos has set $200 U.S. as his personal estimate for the fair value of Amazon stock.

Bezos' Most Recent Sale: $1.73 Billion in Proceeds

Bezos, now Amazon's executive chairman, executed his latest automated stock sale on July 11. This transaction saw 8,645,380 Amazon shares sold for a substantial $1.73 billion U.S., with the average sale price hitting $200.12 U.S. per share. Notably, this was the last time Amazon stock traded above the $200 U.S. mark and the last time Bezos triggered a sale.

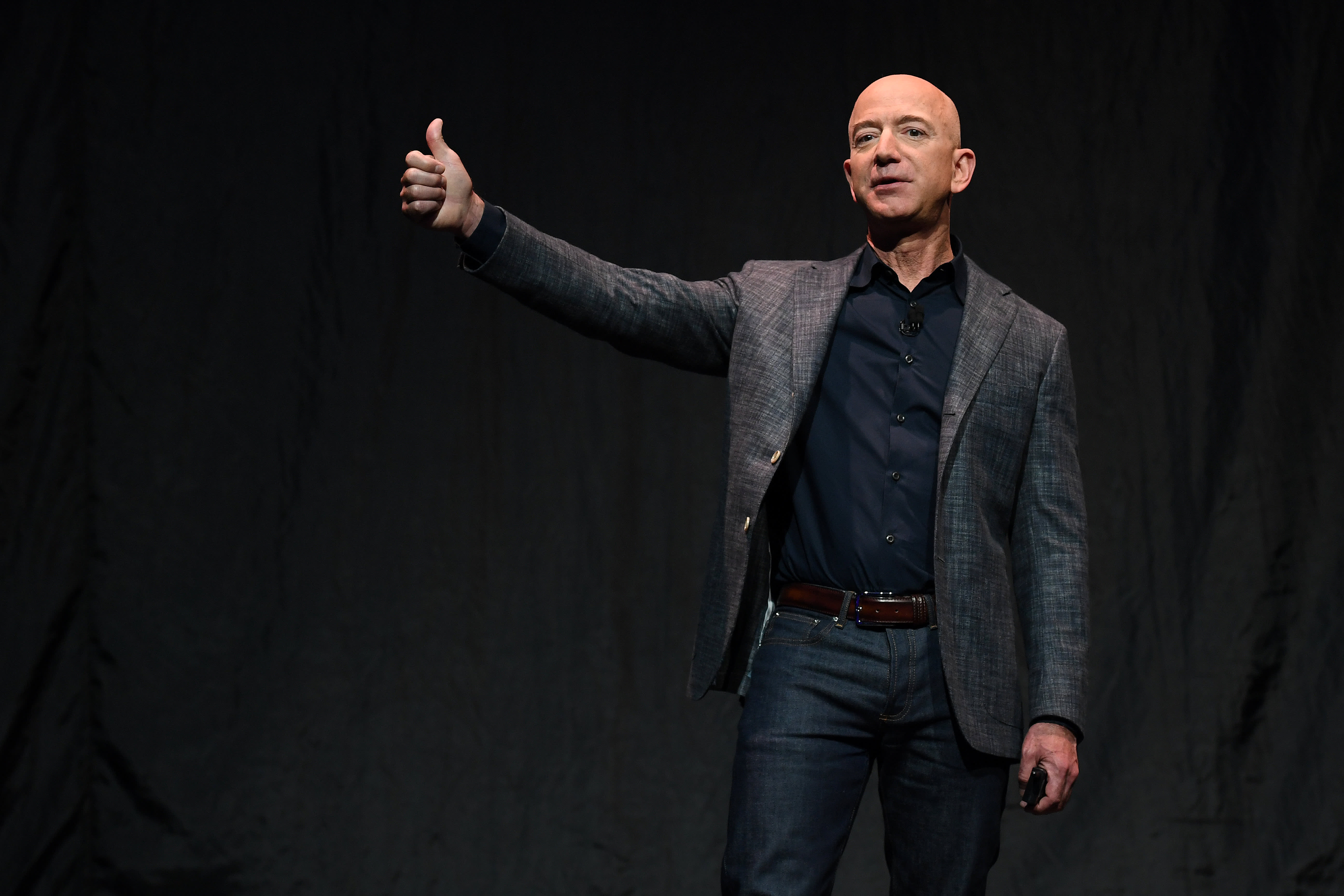

Amazon's Recent Performance and Bezos' Future Sales

With Amazon's share price currently hovering below $160 U.S. after the company's disappointing second-quarter financial results and weak forward guidance, it's unlikely that Bezos will trigger another sale anytime soon. His 10b5-1 plan allows him to sell up to 25 million shares through December 31, 2025, but the current market conditions suggest that further sales are unlikely.

A Large Position: Bezos' Continued Stake in Amazon

Despite these recent sales, Bezos remains a major stakeholder in Amazon, owning over 925 million shares worth more than $150 billion U.S. This substantial stake underscores his belief in the long-term potential of the company.

The Bigger Picture: What Does Bezos' Valuation Mean for Amazon?

While Bezos's personal valuation doesn't necessarily dictate the future of Amazon's stock price, it provides a valuable insight into the mindset of the company's founder and former CEO. His actions suggest that he believes the company's current share price is below its intrinsic value. This perspective is particularly notable given the recent market volatility and challenges facing the tech sector.

Moving Forward: The Future of Amazon

Amazon's recent financial performance has raised questions about the company's growth trajectory. The company faces strong competition in e-commerce, cloud computing, and advertising. However, Amazon remains a dominant force in its core markets and is investing heavily in new technologies, such as artificial intelligence and robotics.

The market will continue to closely watch Amazon's performance and its ability to navigate the evolving landscape. Bezos's recent stock sales provide a unique perspective on the company's future. As a long-term investor, his actions offer a glimpse into his view of Amazon's value, suggesting that he believes the company's share price is currently undervalued. Only time will tell if the market will agree with his assessment and if Amazon will ultimately meet his high expectations.