But the Montreal commerce software company’s report for the three months ending June 30 underscored continued weakness in key areas where investors are looking for a notable lift before reigniting a stock that has shown little signs of life since crashing at the start of the tech downturn nearly three years ago. The company’s performance challenges resulted in the departure of CEO Jean Paul Chauvet earlier this year and return of founding CEO Dax Dasilva, as well as a 10-per-cent staff cut and stock buyback announced in April.

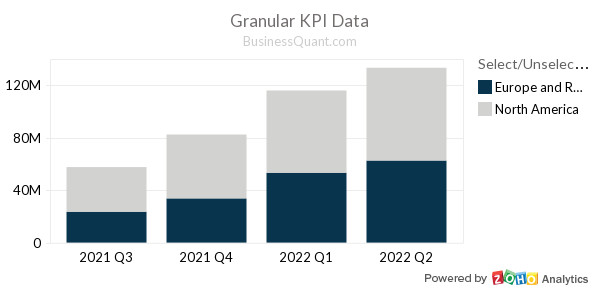

Subscription Revenue Growth

Subscription revenue, a key indicator of growth in the business, increased by six per cent over the same period a year earlier to US$83.3-million. The company in May said that revenue growth would be “consistent” with the seven per cent it posted in the fourth quarter.

Larger Customer Locations

Lightspeed also said that the number of larger customer locations generating more than US$500,000 and US$1-million in gross transaction volumes increased by four per cent year over year. That segment is important for Lightspeed as it has shifted its strategy in the past two years to serving these relatively larger clients while shedding smaller customers. The increases in both larger segments were lower than the five-per-cent and six-per-cent growth they posted, respectively, in the fourth quarter. It also marked the seventh straight quarter of declines in those segments.

Mr. Dasilva said on a conference call the company had started to turn its attention to initiatives to increase software revenue after bulking up its payments business, and that the impacts would start to be felt in the second half of its fiscal year.

Total Revenue and Transaction Revenue

Total revenue for the quarter was US$266.1-million, up 27 per cent year over year on stronger-than-expected transaction revenue from processing payments for customers. That was ahead of the company’s prediction three months ago that it would book US$255-million to US$260-million in the period.

The company made a focused push last year to get customers to adopt its payments processing solution, which increased average revenues per customer to US$502 in the first quarter from US$383 a year earlier and drove a 64 per cent increase in gross payments volume, which reached US$8.4-billion in the quarter. But that masked what appeared to be a declining amount of non-payment gross transaction volume (GTV), as the GTV total only increased by 1 per cent year over year, reaching US$23.6-billion.

Adjusted Operating Earnings

Adjusted operating earnings in the quarter were US$10.2-million, well ahead of the US$7-million the company had forecast, and up from an adjusted operating loss of US$7-million a year earlier. The measure, called adjusted EBITDA, considers such factors as share-based compensation and foreign exchange gains and losses, is not a recognized accounting standard, but is the metric Lightspeed most commonly uses when reporting results and which analysts closely follow to assess its operating performance.

Net Loss

Revenue Outlook

Lightspeed said it expected to post revenue of US$270-million to US$275-million in the second quarter, lower than the US$275.5-millilion consensus figure among analysts, according to Bloomberg, and generate approximately US$12-million in adjusted EBITDA, compared to analysts’ forecast of US$10.1-million. The company maintained its revenue growth forecast for this fiscal year of at least 20 per cent and upped its adjusted EBITDA forecast for the period to at least US$45-million, up from a prior forecast of at least US$40-million.

Growth in the Second Quarter

The company said sales growth in the second quarter would come “predominantly” from revenue gains in payments and its fast-growing business of fronting capital to customers. But it also noted it would start lapping a big revenue bump from its payments push last year, and that its initiatives to increase software sales “will only partially impact the upcoming quarter.”

Analyst Commentary

“At first glance I would say the results were positive,” said National Bank Financial analyst Richard Tse. He said Lightspeed is “making good on operating leverage gains while continuing to benefit from selling payments into the base. Going forward, the question will be whether they can accelerate new merchant additions which has been lagging as they focus on payments.

Conclusion: Lightspeed Still Needs to Prove It Can Grow Its Software Business

Overall, Lightspeed’s first-quarter results show that the company is making progress on its path to profitability. However, the company still needs to prove it can grow its software business in order to fully satisfy investors. The company’s focus on payments is helping to drive revenue growth, but it remains to be seen whether this will translate into sustainable long-term growth for the business.