Major Institutional Investors Adjust Their Holdings in Intercontinental Exchange (ICE) Stock

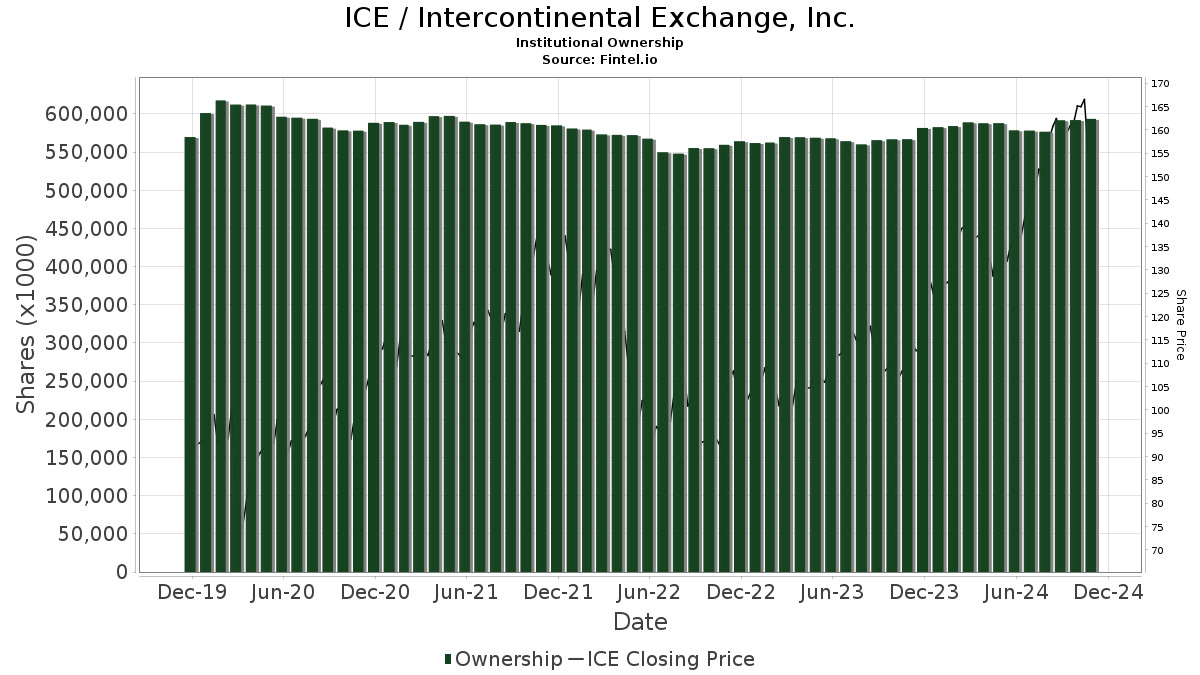

Recent filings with the Securities and Exchange Commission (SEC) reveal significant shifts in institutional investor holdings of Intercontinental Exchange, Inc. (NYSE: ICE). These adjustments, ranging from minor reductions to more substantial divestitures, have sparked interest and raised questions about the future trajectory of ICE stock. Understanding these changes is crucial for investors seeking to navigate the complexities of the financial markets.

Analysis of Institutional Investor Activity

Several prominent institutional investors have reduced their stakes in ICE during recent quarters. Howe & Rusling Inc., for example, decreased its position by 8.2%, selling 9,489 shares. This reduced their total ownership to 106,933 shares, representing approximately 1.5% of their investment portfolio. Similarly, MAI Capital Management decreased its holdings by 21.7%, selling 35,301 shares and now holding 127,347 shares. These sales represent significant shifts in their investment strategies regarding ICE.

However, the picture isn't entirely negative. Other institutional investors have increased their holdings. O Shaughnessy Asset Management LLC, for instance, raised its position by 30.7%, acquiring an additional 9,340 shares, bringing their total to 39,759 shares. This suggests a contrasting view on the company's prospects.

The varied responses from institutional investors underscore the complexities surrounding ICE's current market position. While some perceive potential risks, others remain bullish on the company's long-term growth.

Further Notable Changes

- Lake Street Advisors Group LLC increased its stake in ICE by 31.9%.

- Delap Wealth Advisory LLC boosted its holdings by 7.5%.

- EP Wealth Advisors LLC increased its stake by 4.2%.

- First Commonwealth Financial Corp PA grew its holdings by a substantial 69.9%.

These changes reflect a diverse range of opinions on ICE's future performance among institutional players, highlighting the inherent uncertainties within the market. The collective institutional ownership remains substantial at 89.30%, indicating continued confidence in the underlying business, despite the individual adjustments.

Insider Trading Activity

In addition to institutional activity, insider trading provides another lens through which to analyze ICE. Several insiders have sold shares recently, including General Counsel Andrew J. Surdykowski who sold 2,048 shares, and Director Martha A. Tirinnanzi, who offloaded 509 shares. While individual sales do not automatically signal a negative outlook, the collective sales volume raises questions about the internal sentiment towards the company's stock price.

Insider Sale Details

- Surdykowski's sale represented a 4.37% decrease in his holdings.

- Tirinnanzi's sale represented a 11.39% decrease in her holdings.

- COO Stuart Glen Williams sold 468 shares in a separate transaction, a 3.34% decrease.

- Insider Christopher Scott Edmonds sold 602 shares, resulting in a 4.11% decrease in his holdings.

Overall, insiders sold a total of 7,489 shares worth $1,202,259 during the last quarter. This represents 1.10% of the company’s stock. This data, alongside the varied institutional activity, presents a complex picture that requires comprehensive analysis to interpret accurately.

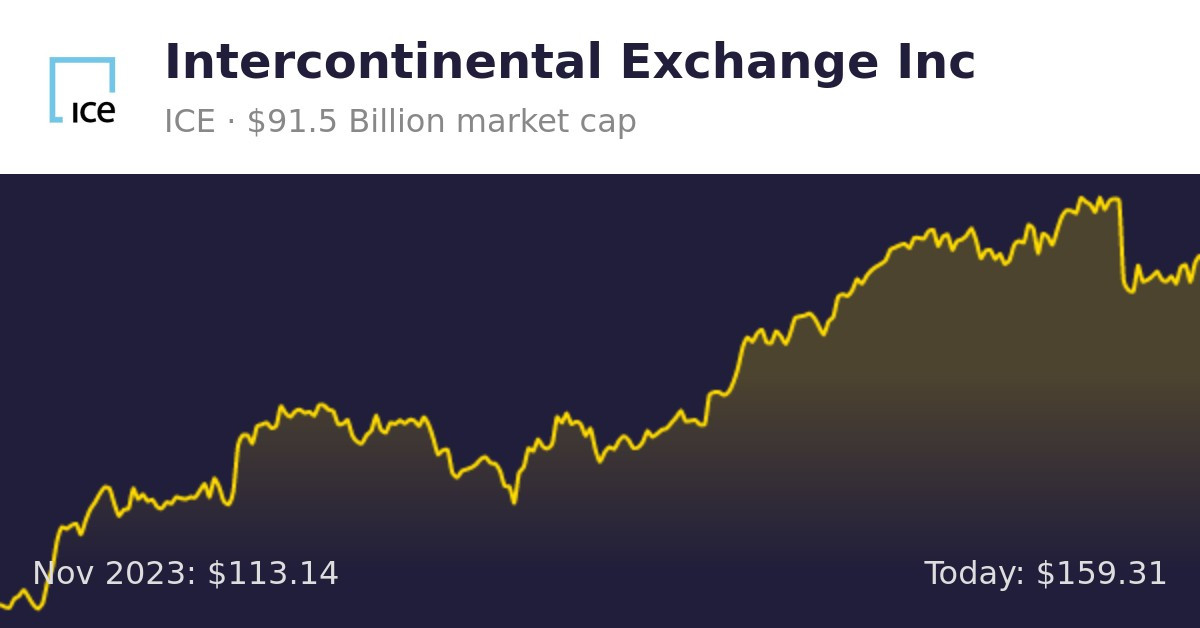

Financial Performance and Analyst Ratings

Intercontinental Exchange reported strong financial performance in its most recent quarterly earnings report, exceeding analysts' expectations for both earnings per share ($1.55) and revenue ($2.35 billion). This positive performance is notable, but should be considered in conjunction with the previously discussed selling pressure from institutional investors and insiders.

Key Financial Metrics

- Net margin: 21.31%

- Return on equity: 12.75%

- Year-over-year revenue growth: 17.3%

- Analysts' forecast for current fiscal year EPS: 6.07

The company's financial health is generally solid, as indicated by the strong financial metrics above. However, the divergence between these positive results and the actions of some institutional investors and insiders requires investors to consider the broader context and potential underlying factors that might be impacting the stock's valuation.

Despite this mixed signal, analyst ratings remain largely positive. A number of firms, including JPMorgan Chase & Co. and Royal Bank of Canada, have issued buy ratings and raised their price targets, indicating continued optimism for ICE's future. However, other firms like StockNews.com have expressed a more cautious stance, shifting their ratings from sell to hold.

The overall consensus rating from MarketBeat is a “Moderate Buy,” with an average price target of $174.13. This positive sentiment, although tempered by the cautious perspectives, underscores the continued interest among many analysts in ICE's long-term potential.

Navigating the Market Uncertainty: A Balanced Perspective

The recent activity surrounding Intercontinental Exchange presents a compelling case study in the inherent complexities of market dynamics. While strong financial results and positive analyst ratings suggest a fundamentally sound business, the substantial selling by key institutional investors and insiders warrants caution. This scenario is a reminder that even companies with strong fundamentals can experience periods of volatility influenced by diverse market forces. Thorough due diligence and careful consideration of all available information are essential for informed investment decisions in such circumstances. Remember, the stock market can be unpredictable, and it's always advisable to have a well-diversified portfolio.