Masimo Corporation (MASI): A Deep Dive into Valuation and Growth Potential

Masimo Corporation (NASDAQ:MASI), a mid-cap player in the Medical Equipment industry, has been attracting significant attention due to its volatile stock price on the NASDAQGS. Over the last few months, the stock has seen a dramatic rise, reaching US$138 at its peak, before plunging to US$106 at its lowest point. This fluctuation begs the question: is the current trading price of US$107 a true reflection of Masimo's value, or does it present an opportunity for investors to buy at a discount?

To answer this, we delve into Masimo's financial performance, growth prospects, and industry dynamics to determine if its current price reflects its true worth or if it's undervalued.

Analyzing Masimo's Valuation Through a Price Multiple Model

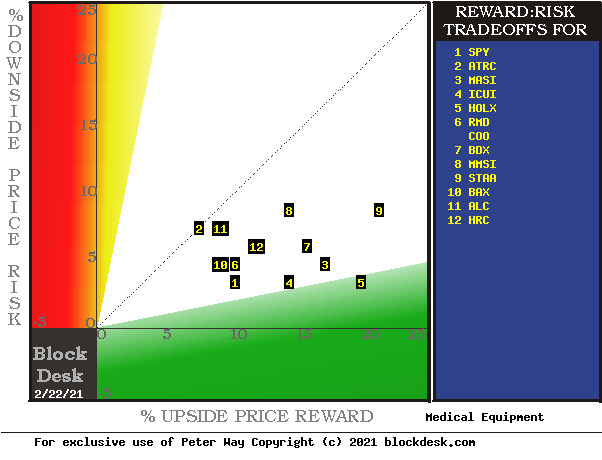

Masimo's valuation, when assessed through a price multiple model, indicates the company is currently expensive. This analysis involves comparing the company's price-to-earnings (PE) ratio to the industry average. In this case, Masimo's PE ratio of 71.93x is significantly higher than the industry average of 35.67x, suggesting the stock is trading at a premium compared to its peers in the Medical Equipment sector.

However, it's important to consider the stability of Masimo's share price relative to the market. Its low beta suggests that it's less volatile than the overall market. This implies that if the share price is expected to align with its industry peers over time, it might not reach that level soon, and once it does, it could be difficult for it to fall back into an attractive buying range.

Growth Potential and Future Prospects

Investors seeking growth in their portfolios would be interested in Masimo's future prospects. While value investors prioritize intrinsic value relative to the price, a compelling investment case often involves high growth potential at a favorable price. Masimo's projected profit doubling in the next couple of years paints a promising picture. This anticipated increase in cash flow is likely to positively impact the stock's valuation.

Should Existing Shareholders Sell?

For existing Masimo shareholders, the optimistic future growth seems to be already reflected in the current share price, with the stock trading above industry price multiples. This raises the question of whether selling is a viable option. If you believe MASI should trade below its current price, selling high and repurchasing it at a lower price, closer to the industry PE ratio, could be profitable. However, before making this decision, it's crucial to assess any fundamental changes that may have occurred.

Is it the Right Time for Potential Investors to Enter?

For potential investors who have been observing MASI, the current moment might not be the most opportune time to enter. The price has surpassed its industry peers, indicating there might be limited upside from mispricing. Nonetheless, MASI's promising outlook is encouraging. It's worth delving deeper into other factors to capitalize on the next potential price drop.

Risks to Consider: A Warning Sign

While the future appears promising for Masimo, it's essential to acknowledge any potential risks. We've identified one warning sign for Masimo that investors should be aware of. This warning sign may indicate potential challenges or uncertainties that could affect the company's performance or stock price.

Exploring Alternatives: A Wider Universe of Stocks

If Masimo doesn't resonate with your investment strategy, consider exploring our free platform. It features a curated list of over 50 stocks with high growth potential, providing a broader range of investment opportunities.

The Ultimate Portfolio Companion: Your Free Toolkit

We've developed a comprehensive and free portfolio companion designed to empower stock investors. This tool allows you to:

- Connect an unlimited number of Portfolios: Track all your portfolios seamlessly, viewing your total holdings in a single currency for unified oversight.

- Receive real-time alerts: Stay informed about new Warning Signs or Risks through email or mobile notifications, ensuring you're always in the loop.

- Monitor the Fair Value of your stocks: Gain insights into the true worth of your investments, enabling informed decision-making.

Disclaimer

This article is for general informational purposes only and should not be considered as financial advice. It is not a recommendation to buy or sell any stock and does not take into account your individual objectives, financial situation, or needs. We strive to provide you with long-term focused analysis based on fundamental data. Please note that our analysis may not include the latest price-sensitive company announcements or qualitative material. We encourage you to seek professional advice before making any investment decisions.