First time buyers and prospective homeowners with small deposits are now beginning to see lower mortgage rates. And the Bank of England will reduce its base rate to 3% from 5% within a year, according to a major bank.

Nationwide and Clydesdale now both offer rates close to 5% for those buying a home with a 5% deposit, the Daily Telegraph reports. Clydesdale is offering a 5.02% five-year fixed rate, while with Nationwide it is now 5.04% following a 0.25% cut by the lender.

TSB has cut its rate by up to 0.35%, NatWest by up to 0.19% and HSBC by 0.15%. NatWest is offering a five-year fix at 3.77% for those with a 40% deposit, which is currently the best rate on the market.

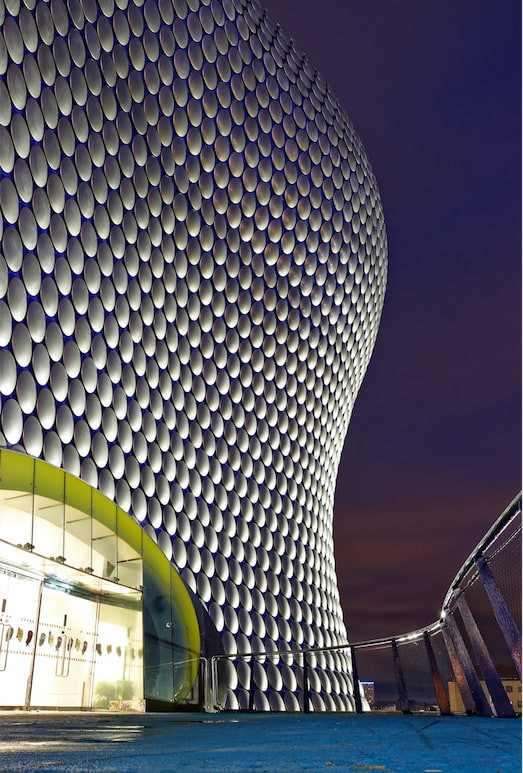

Nick Mendes of brokerage John Charcol (main picture), told the Telegraph: “As lenders respond to lower funding costs and increased competition, we could see even more attractive mortgage deals. This would not only provide financial relief to homeowners, but also encourage first-time buyers and motivate home movers, boosting both the housing market and the wider economy.”

Meanwhile, American bank Goldman Sachs predicts the Bank of England will cut the base interest rate at every meeting from November onwards until it falls to 3% in September next year. The Bank reduced its base interest rate by 0.25% from a 16-year high of 5.25% to 5%, last month. Members of the Bank’s Monetary Policy Committee voted narrowly for a cut by five votes to four.

Goldman Sachs said the Bank will follow other countries as they reduce their base rates in 2025.

Mortgage Rate Cuts: Who Benefits the Most?

Homeowners are being left with high monthly bills despite mortgage rate cuts because the best deals are being reserved for new buyers, analysis shows. Mortgage rates have been going down since earlier this summer, and cuts accelerated when the Bank of England slashed interest rates last month for the first time in four years.

But in that time, the gap between the cost of the deals on offer to those remortgage homes they already own and those getting fresh mortgages on new properties has grown. Three months ago, the best deals on the market were virtually identical for buyers and current homeowners, but now existing homeowners could end up paying hundreds of pounds a year more than new purchasers.

As of Wednesday, the lowest two-year fixed-rate mortgage for buyers is 4.07 per cent from NatWest, while Halifax is offering the lowest rate for remortgagors at 4.25 per cent. Moneyfacts calculations show that on a £250,000 mortgage, someone taking out the NatWest deal would pay £33,447.48 over two years – once a £1,495 fee is factored in – while someone taking out the Halifax deal, which comes with a £999 fee, would pay £33,883.40. This is a difference of £436 or £218 per year.

For five-year fixed-rate deals, buyers can get a rate of 3.71 per cent, whereas those remortgaging can only get 3.88 per cent.

David Hollingworth, associate director of communications at L&C Mortgages, said lenders are “often reserving their keenest rates for first-time buyers and home movers”. He said one possible reason for this is that lenders are trying to attract new business, which means enticing prospective buyers with cheap offers.

“That can leave remortgage rates slightly behind, which will be disappointing for hard pressed borrowers reaching the end of their current deal and facing a hike in rates,” he added.

The differences between rates for homeowners and buyers have become starker in the last couple of months. On 3 June, the lowest rates for five-year fixes were 4.32 per cent for both purchasing and remortgages, according to Moneyfacts.

For two-year fixes, the lowest rate was actually for remortgaging at 4.65 per cent, while the lowest rate for purchasing was 4.75 per cent, Moneyfacts data shows.

Mortgage Rates: Trends and Insights

Current Trends

Mortgage rates have been tumbling for the previous two months. As recently as 22 July, there were no mortgages at all on the market below 4 per cent, and now the cheapest is at 3.71 per cent.

Impact on Homeowners

Even with recent falls, mortgage rates are still far higher than the rates most people coming remortgage are currently on. In 2019, rates well below 3 per cent were common, and so those coming off five-year fixes are still likely to see an increase in their monthly payments, even with the recent reductions.

Good News for Borrowers

But the cuts are still generally good news, as they will mean households paying less than they otherwise would have.

Why Do Lenders Favor New Buyers?

Rachel Springall, finance expert at Moneyfactscompare.co.uk, said: “Seeking out a competitive mortgage deal can seem daunting, and those borrowers looking to remortgage may be disheartened to find the lowest rates on the market are not available to them.”

“Getting advice is always wise to navigate all the different options, but also to ensure a borrower considers a deal that provides the best overall package. The lowest rate mortgages may not always offer the best value overall, so its vital to keep this in mind,” she added.

Elliott Culley, director at Switch Mortgage Finance, told i mortgage lenders prioritise buyers over existing clients because homeowners usually have no option but to remortgage. “Once you are a homeowner, unless you are selling or have come into some money, you will need to remortgage again, so they don’t need to work as hard to secure a deal, as no homeowner wants to be on the standard variable rate of the lender,” he said.

Nicholas Mendes, mortgage technical manager and head of marketing at John Charcol, said lenders were trying to stimulate activity in the housing market by “prioritising competitive rates for new home purchases to rekindle demand”.

What Does the Future Hold?

While mortgage rates are falling, they are set to remain high relative to rates people locked in five years previously. This means that someone who took out a £200,000 75pc loan-to-value mortgage on a five-year fixed rate deal in September 2019 would see their payments increase from £827 to £1,016 if they remortgaged today – a £189 rise.

Homeowners who locked in their five-year deal in September 2022 or later will see their mortgage repayments fall when they remortgage from September 2027. Those who remortgage between September 2027 and September 2028 will see their repayments fall by an average of £95.

David Fell, of Hamptons, said: “The rise of the fixed rate mortgage means there’s a big lag between interest rates going up and borrowers feeling the pain in their pocket. And the same is true on the way down when rates are falling.

“Households who locked in during the last two years will probably be paying higher rates than new borrowers today. While historically, older generations generally saw the cost of their mortgage fall over time, anyone who bought for the first time in the last decade is likely to face higher housing costs for longer.”

The Hamptons analysis used forecasts of future mortgage rates based on Bank of England data. The Bank’s decision to reduce rates in August raised hopes that the move will kick off a downward cycle. Mortgage holders and first-time buyers have long held out for a reprieve as the current interest rate cycle has caused mayhem in the property market over the past two years. Economists are betting on the Bank Rate falling to 4.75pc before the year is out. However, mortgage rates are still much higher than five years ago, putting pressure on those who need to remortgage.

In September 2022, the average two-year fixed rate mortgage was 4.24pc and the average five-year was 4.33pc. At the start of this month, the average two-year rate was 5.56pc and the five-year average was 5.20pc.

Navigating the Remortgage Maze

If you’re coming to an end now or within six months, you can start the process of hunting around for a deal now. This will help having a smooth transition instead of slipping on to SVR which is still way higher than fixed or tracker rate.

Lots of people are going for fixed rates because they prefer security. But we’ve seen an uptick in two-year products, as people hope rates will improve. The margin between trackers and fixed rate deals will narrow as interest rates fall, and we will see more people considering a tracker rate.