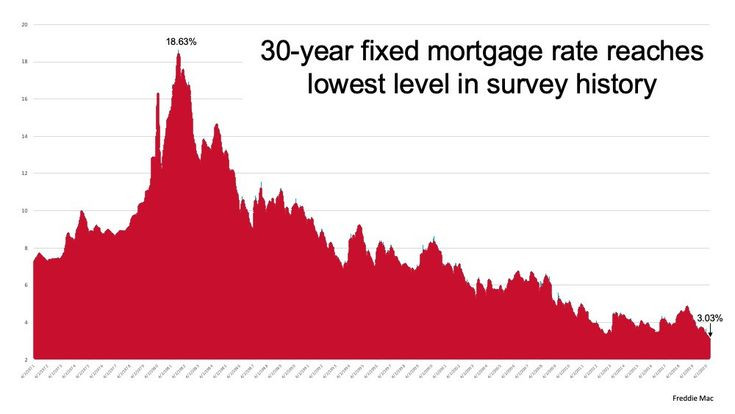

Mortgage Rates Fall to 15-Month Low as Recession Fears Grow

The recent decline in mortgage rates has captivated homeowners and prospective buyers alike. On August 5, 2024, the average interest rate on a 30-year fixed-rate mortgage dropped to 6.75 percent, marking the lowest point since May 2023. This decline can be attributed to a fall in the yield on the 10-year Treasury bond, which has dropped below 3.7 percent, its lowest level since the beginning of last year.

Why Are Mortgage Rates Dropping?

The recent drop in mortgage rates is largely driven by investor concerns about the U.S. economy. Last week's jobs report revealed that unemployment had risen to 4.3 percent, the highest it has been since the beginning of the COVID-19 pandemic. This news triggered a market sell-off, with investors shifting their investments from riskier assets to safer ones, like U.S. Treasury bonds.

Is This a Good Time to Buy or Refinance?

The decline in mortgage rates presents a window of opportunity for both homebuyers and refinancers. If you're thinking about purchasing a home, these lower rates could significantly reduce your monthly payments. Similarly, if you have an existing mortgage with a rate above 7 percent, refinancing could save you money over the long term.

What Should You Consider Before Buying or Refinancing?

While the current mortgage rate environment may seem attractive, it's crucial to consider the broader economic picture and your individual financial situation before making any decisions. Here are some key points to ponder:

The Federal Reserve's Role

The Federal Reserve has indicated that it might cut interest rates in September. The recent jobs report, along with slowing wage growth and a higher unemployment rate, supports this move. However, the Fed's decision will hinge on whether the next inflation report confirms that price growth is also slowing.

Market Volatility

While the recent drop in mortgage rates is encouraging, the market is still volatile. There's no guarantee that rates will continue to fall, and they could potentially rise again in the future.

Your Individual Circumstances

Ultimately, the decision of whether to buy or refinance depends on your personal financial situation. Consider your budget, your long-term financial goals, and your risk tolerance before making any commitments.

What's Next for Mortgage Rates?

The future of mortgage rates remains uncertain. The next Consumer Price Index (CPI) report, scheduled for August 14, will provide insights into inflation's trajectory. If inflation falls within the Fed's target range of 2 percent, a rate cut in September becomes more likely, potentially pushing mortgage rates even lower.

Understanding the Connection Between Treasury Bonds and Mortgage Rates

The Federal Reserve doesn't directly set home loan rates. However, its monetary policy decisions influence interest rates, impacting investor decisions. When investors seek out Treasury bonds, the bonds' prices rise, and their yields fall. Since mortgage rates are closely tied to the 10-year Treasury yield, they follow suit.

Navigating the Homebuying Process

If you're ready to take the plunge into homeownership, it's essential to navigate the process wisely. Here are some tips to ensure a smooth journey:

Research and Compare Lenders

Don't settle for the first mortgage offer you receive. Take the time to research different lenders and compare their rates, terms, and fees. A mortgage broker can assist in this process, providing guidance and access to a broader range of options.

Get Pre-Approved for a Mortgage

Before you start house hunting, get pre-approved for a mortgage. This will give you a clear understanding of your buying power and strengthen your position during negotiations.

Seek Expert Advice

Consult with a real estate agent and a financial advisor to gain insights and support throughout the homebuying process.

Final Thoughts: Seizing the Opportunity

The current decline in mortgage rates offers a unique opportunity for homebuyers and refinancers. Whether you're considering a new purchase or seeking lower monthly payments on your existing mortgage, careful planning and research are essential to make informed decisions. By weighing the pros and cons, understanding the market dynamics, and seeking expert advice, you can navigate this favorable environment with confidence.