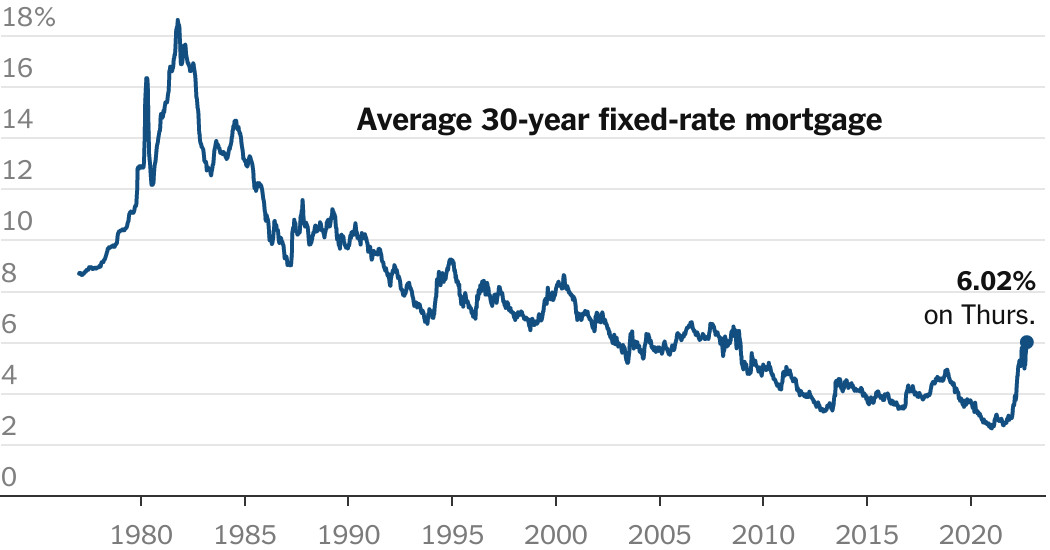

The mortgage rate landscape is undergoing a rapid transformation now that inflation is cooling. For starters, there has been a notable drop in mortgage rates over the past few weeks, with rates hitting a two-year low on Wednesday. This shift has already begun to stir excitement, as more affordable borrowing costs open doors for those previously priced out of homeownership.

The Federal Reserve also conducted its first rate cut since 2020 on September 18, reducing the federal funds rate by an unexpected 50 basis points. Most analysts expected the Fed rate cut to be just 25 basis points, making this decision larger and more impactful than anticipated.

The Federal Reserve is expected to make its first interest rate cut in four years on Wednesday, and while mortgage rates don't follow the Fed exactly, they are influenced by policy. It is likely they will move on Fed Chairman Jerome Powell's remarks following the decision.

"The most important takeaway is that lower mortgage rates are not only not remotely guaranteed by [the] Fed rate cut. They're actually already baked in," wrote Matthew Graham, chief operating officer at Mortgage News Daily. "The directionality depends on the dot plot and Powell's comments in the press conference. Things could go either way and the volatility could be significant."

Total mortgage application volume rose 14.2% last week compared with the previous week, according to the Mortgage Bankers Association's seasonally adjusted index. Last week's results included an adjustment for the Labor Day holiday.

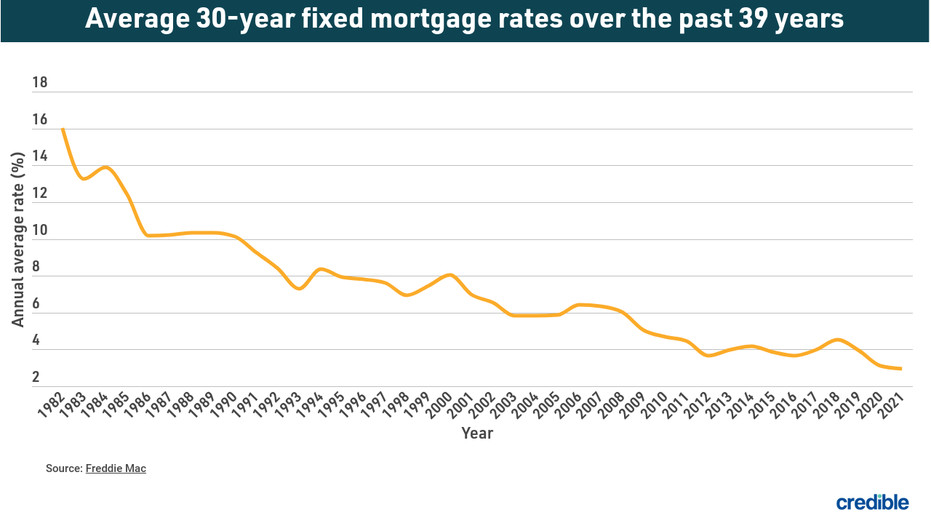

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $766,550 or less decreased to 6.15% from 6.29%, with points increasing to 0.56 from 0.55, including the origination fee, for loans with a 20% down payment. That is the lowest rate since September 2022 and is 116 basis points lower than it was the same week one year ago.

"Application activity was up significantly last week, as market expectations of a rate cut from the Fed pulled mortgage rates lower," said Joel Kan, an economist with the Mortgage Bankers Association.

Applications to refinance a home loan jumped 24% from the previous week and were 127% higher than the same week one year ago. Most of those applicants likely purchased their homes in the past two years, when rates rose sharply from the record lows seen in the first two years of the Covid-19 pandemic. Even with this large increase in volume, it is coming off a very low base, as the vast majority of borrowers have loans with interest rates well below 5%. Both conventional and government activity climbed to the fastest pace of refinancing since 2022.

Applications for a mortgage to purchase a home increased 5% for the week but were still 0.4% lower than the same week one year ago.

"It is notable that conventional purchase applications increased to a pace ahead of last year, which also drove overall purchase applications very close to year-ago levels," Kan said. "Homebuyers are seeing improving affordability conditions, sparked by lower rates and slower home-price growth."

What Does It All Mean?

The Federal Reserve's unexpected 50 basis point rate cut will likely have a noticeable effect on the mortgage market, but its exact impact remains uncertain. While lower rates may materialize in the short term, a range of factors will influence how mortgage rates move in the future. So, homebuyers and homeowners who plan to refinance should carefully consider their options, recognizing that waiting for the perfect moment could be risky in an unpredictable market. Securing a favorable rate now may be the best course of action instead, especially with rates already at a two-year low.

Beyond the Fed

The Federal Reserve's decision to implement a 50 basis point rate cut has injected a new layer of complexity into the mortgage market. While the impact of a standard 25 basis point reduction has likely been factored into current mortgage rates, which are sitting at an average of 6.15%, it's unclear exactly how mortgage rates will respond to this larger rate cut.

One outcome could be that the larger rate cut will cause mortgage rates to fall even further in the coming days and weeks, building on the recent trend of declining rates. This could create a more favorable environment for borrowers, with the possibility of mortgage rates dipping to levels not seen in years.

However, it's crucial to understand that the Federal Reserve's actions, while significant, are not the sole factor influencing mortgage rates. The mortgage market is a complex ecosystem affected by various economic indicators. Long-term bonds, particularly the 10-year Treasury yield, also play a pivotal role in determining mortgage rates. So while the Fed's rate cut will likely push these yields lower, other factors can also sway bond yields and, consequently, mortgage rates.

The mortgage industry itself may also play a role in tempering any dramatic rate drops. For example, lenders might be hesitant to lower rates too quickly or too far as they balance their desire to attract borrowers with the need to maintain profitability. This could result in a more gradual decline in mortgage rates rather than an immediate, sharp drop.

The Opportunity and the Challenge

For potential homebuyers or those considering refinancing, the Fed's larger-than-expected rate cut presents both opportunities and potential challenges. On one hand, the prospect of lower mortgage rates is certainly appealing. Lower rates translate to more affordable monthly payments and increased buying power, potentially allowing borrowers to qualify for larger loans or more desirable properties.

The allure of lower rates could also bring its own set of complications, however. If mortgage rates decline even further, it's likely to attract more buyers to the market. This increased demand could lead to heightened competition for available properties, potentially driving up home prices and offsetting some of the benefits of lower interest rates.

Those waiting for rates to bottom out before making a move may also find themselves in a precarious position. Timing the market is notoriously difficult, and there's a risk that rates could begin to rise again before you can act. After all, economic conditions can shift rapidly, which could reverse the current downward trend in rates.

Lenders are also more likely to see an uptick in inquiries and applications in the wake of the Fed's decision. This increased volume could lead to longer processing times and potentially stricter underwriting standards, so borrowers should be prepared for this possibility and consider getting pre-approved or starting the application process early.

It's Time To Act?

The mortgage market is a dynamic environment, and the current situation is no exception. While a decline in rates could be an opportune time for many to take advantage of lower borrowing costs, it is essential to act with deliberation and not let the allure of a potential dip blind you to the complexities at play. This will allow you to make informed decisions that are in your best interests, whether you are planning to buy a home, refinance, or simply observe the market for now.

It's also important to remember that the Fed's actions are only one piece of the puzzle. Other economic factors, including inflation, employment, and long-term bond yields, will continue to influence mortgage rates in the coming months. Staying informed about these developments will be crucial as you navigate the mortgage market and make choices that align with your individual financial circumstances.