Neo Performance Materials Inc. (TSE:NEO) announced a healthy earnings result recently, and the market rewarded it with a strong uplift in the stock price. According to our analysis of the report, the strong headline profit numbers are supported by strong earnings fundamentals.

To properly understand Neo Performance Materials' profit results, we need to consider the US$6.1m expense attributed to unusual items. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual expenses don't come up again, we'd therefore expect Neo Performance Materials to produce a higher profit next year, all else being equal.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Because unusual items detracted from Neo Performance Materials' earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Neo Performance Materials' statutory profit actually understates its earnings potential! And it's also positive that the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Neo Performance Materials at this point in time. For example, Neo Performance Materials has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

Today we've zoomed in on a single data point to better understand the nature of Neo Performance Materials' profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

A Deep Dive into Neo Performance Materials' Recent Performance

In a recent interview with InvestorNews host Pat Bolland, Rahim Suleman, President, CEO, and Director of Neo Performance Materials Inc. (TSX: NEO), discussed the company’s strategic positioning and recent developments in the rare earth industry. With three decades of experience in the sector, Suleman highlighted Neo’s resilience amidst a volatile market, emphasizing that despite a significant drop in rare earth prices, the company has maintained strong margins and profitability. Suleman remarked, “What we see in this industry tends to see a lot of volatility, but fundamentally, an end demand growth that is growing at a tremendous pace,” driven by the demand for energy-efficient applications like electric vehicles and wind farms. Neo’s unique positioning as a midstream and downstream player allows it to pass through commodity prices, focusing instead on value-added solutions that meet customer needs.

Suleman also touched on Neo’s strategic initiatives, including the construction of a new sintered magnet facility in Europe, which is essential for producing traction motors for electric vehicles. “Customers require a diverse supply base,” Suleman noted, stressing the importance of reducing geographic concentration in critical supply chains. The facility, which remains on time and on budget, has already secured a major Tier 1 commercial award, further solidifying Neo’s role in the global shift toward a more geographically balanced supply chain.

Neo's Operational Highlights and Strategic Initiatives

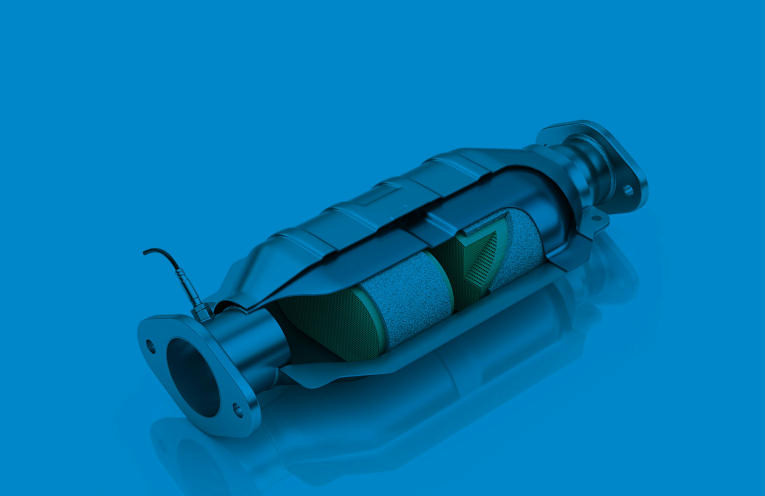

Neo manufactures the building blocks of many modern technologies that enhance efficiency and sustainability. Neo’s advanced industrial materials – magnetic powders and magnets, specialty chemicals, metals, and alloys – are critical to the performance of many everyday products and emerging technologies. Neo’s products help to deliver the technologies of tomorrow to consumers today. The business of Neo is organized along three segments: Magnequench, Chemicals & Oxides and Rare Metals. Neo is headquartered in Toronto, Ontario, Canada; with corporate offices in Greenwood Village, Colorado, United States; Singapore; and Beijing, China. Neo has a global platform that includes ten manufacturing facilities located in Canada, China, Estonia, Germany, Thailand, the United Kingdom, and the United States, as well as one dedicated research and development centre in Singapore.

Neo Performance Materials' Q2 2024 financial results showcase the company's continued focus on operational improvement and strategic initiatives. Despite the challenging market environment marked by declining rare earth prices, Neo achieved impressive financial performance with a 390 basis points increase in Adjusted EBITDA(1) margin from the previous year. This robust performance highlights the company's strength in downstream businesses and its successful operational improvements.

New European Magnet Facility: A Strategic Move

One of Neo's key strategic initiatives is the construction of a new sintered magnet facility in Europe. This facility is crucial for producing electric vehicle traction motors and highlights Neo's commitment to catering to the growing demand for sustainable transportation solutions. The facility has already secured a major Tier 1 commercial award, demonstrating the confidence that key players have in Neo's capabilities and positioning in the global electric vehicle market.

Simplification of Business: Focus on Core Operations

As part of its ongoing efforts to optimize its operations, Neo has entered into an agreement to sell its majority ownership interest in the gallium trichloride facility in Quapaw, Oklahoma. This strategic decision reflects the company's commitment to simplifying its business model and focusing on core end-markets and products. This move will allow Neo to allocate resources more efficiently and enhance its operational efficiency.

Strategic Review: Maximizing Shareholder Value

Neo's Special Committee of independent directors is leading a comprehensive strategic review process to explore opportunities to maximize shareholder value. The committee has appointed Barclays Capital Inc. and Paradigm Capital Inc. as independent financial advisors to guide the review process, which aims to identify and evaluate potential strategic alternatives. The strategic review is expected to continue, and Neo will update the market when appropriate.

Neo's Future Outlook: A Path Towards Growth and Sustainability

Neo's commitment to innovation and strategic initiatives positions it for continued growth in the future. The company's focus on downstream businesses, with its ability to leverage value-added solutions, mitigates its exposure to commodity price fluctuations. The new European magnet facility further strengthens Neo's position in the rapidly evolving electric vehicle market. Additionally, Neo's strategic review process demonstrates its dedication to maximizing shareholder value and exploring new opportunities for expansion.

Neo's business model, focused on producing critical components for modern technologies, makes it a vital player in the drive towards a more sustainable future. With its commitment to operational excellence, strategic initiatives, and shareholder value, Neo is well-positioned to navigate the evolving market landscape and achieve its long-term growth objectives.