The NFL Embraces Private Equity: A Major Shift in Ownership Landscape

As private equity has made inroads into every aspect of the American economy, one highly popular and profitable sector has resisted it: Professional football. But that could change on Tuesday, when NFL owners plan to vote on whether to change the league’s ownership rules to allow private equity investments into teams.

All 32 NFL owners are gathered in Minneapolis to vote on the matter. The rule changes will pass if 24 teams vote to ratify the measure.

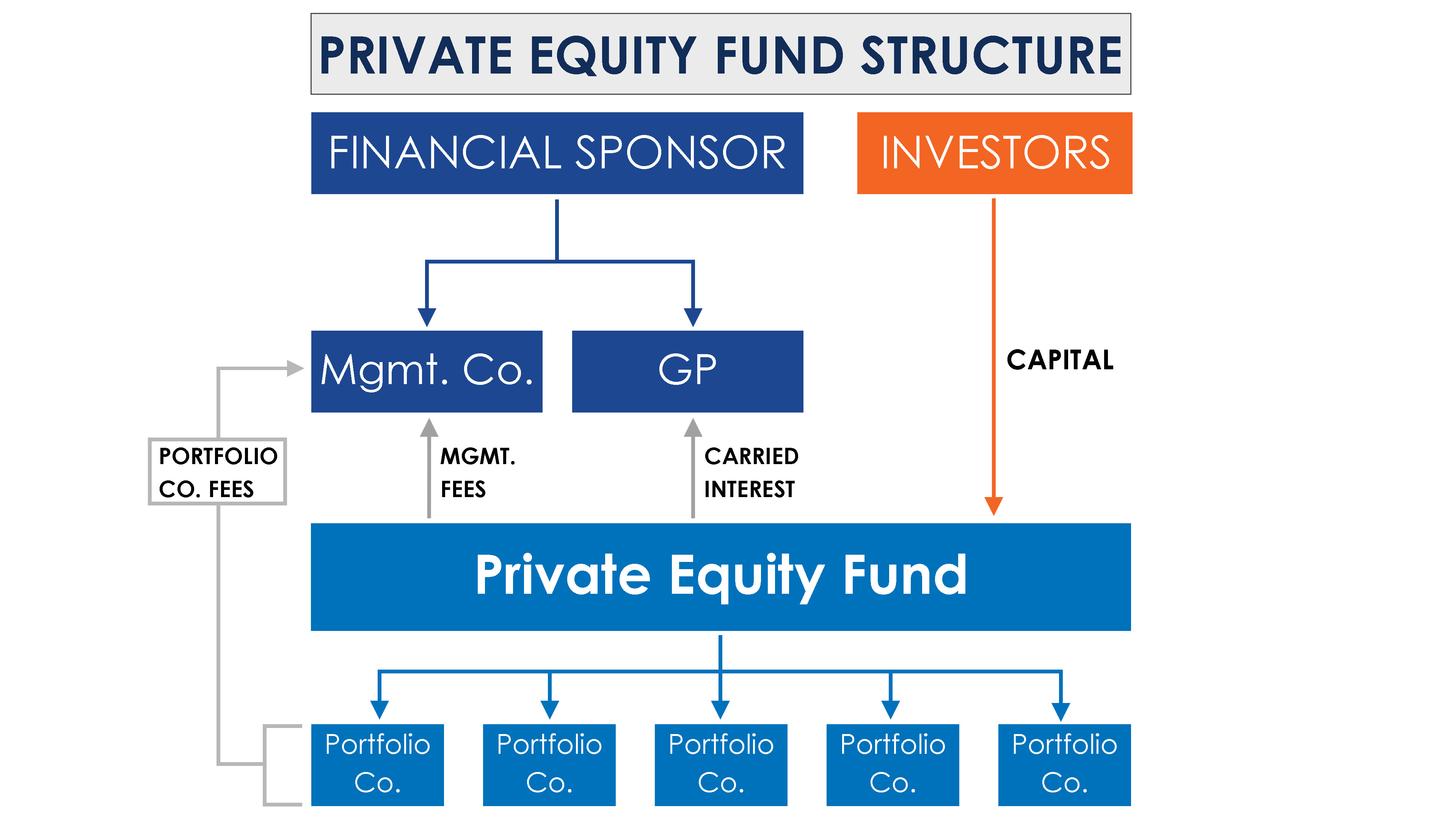

Allowing a private equity investment into teams would represent the first time the NFL allowed institutional capital into its franchises. Until now, teams were owned by wealthy individuals, or at most a consortium of investors, who put up their own personal money. The league has long been defined by legendary, larger-than-life teams owners. Among the most famous are the likes of Dallas Cowboys owner Jerry Jones or Robert Kraft, who owns the New England Patriots.

A Long Time Coming: The Evolution of NFL Ownership

The possible rule changes have been in the works for over a year. In September 2023 the NFL put together a committee to explore revamping its ownership policies. The decision to form the committee came after two mammoth sales: the Denver Broncos to Walmart heir Rob Walton for $4.65 billion and the Washington Commanders to Apollo Global Management co-founder Josh Harris for $6.05. (Harris invested his own money, not Apollo’s).

The NFL's Unique Stance

The NFL is the only one of the major four U.S. sports leagues that does not allow any institutional investment. The NBA, NHL, and MLB all allow teams to sell up to 30% to such investors. In overseas sports, in particular European soccer, institutional investment is much more common.

Even the NFL’s new ownership rules, should they pass on Tuesday, would be more restrictive than other leagues. The NFL would likely only allow 10% of a team to be sold to a select group of investors approved by the league, according to the Wall Street Journal.

The PE Firms Lined Up for NFL Ownership

As of June the NFL had identified seven private equity firms that it believed would be suitable for investment, according to Sportico. Six of the seven firms—Ares Capital, Carlyle Group CVC Partners, Sixth Street Arctos Partners and Dynasty Equity—all have varying degrees of expertise in sports investments. Blackstone is the only one of the NFL’s pre-selected firms that does not have previous sports investments, but it does have roughly $1 trillion in assets under management. Each firm would be able to invest in up to six different teams. The NFL won’t allow sovereign wealth funds to invest in teams, as is the case in other sports leagues.

Sixth Street, Arctos, and Dynasty Equity in particular have made names for themselves as specialists in the sports business. Sixth Street invested in Spanish soccer team Real Madrid’s new stadium, Arctos owns a minority stake in the NBA’s Golden State Warriors, and Dynasty Equity bought a stake in English soccer team Liverpool Football Club, which is owned by Fenway Sports Group, John Henry’s company that also owns the Boston Red Sox.

Why Private Equity Is Seeking a Slice of the NFL Pie

NFL franchises are among the most highly valued assets in sports, making them both highly coveted and prohibitively expensive. Easing the ownership rules would allow a greater number of investors to be involved in owning a team, while providing existing owners a liquidity should they want or need it. The NFL’s soaring valuation comes from the league’s massive media rights deals, estimated to be worth around $110 billion dollars over 10 years. As the most popular sport in America, football and NFL also occupy an extraordinary role in the nation’s culture. That too has translated to success in the marketplace, where in 2023 93 of the top 100 U.S. television broadcasts were NFL games.

The Dallas Cowboys are the most valuable sports team in the world, valued around $10 billion in 2024, according to Sportico. The second most valuable sports franchise is the baseball powerhouse New York Yankees, worth around $7.1 billion, according to Forbes. The NBA’s most valuable franchise, the Golden State Warriors, was valued around the same amount. While in European soccer Real Madrid, the legendary Spanish team, is the continent’s most valuable, pegged at $6.1 billion.

The NFL's Potential PE Investors: A Deep Dive

In less than a week NFL owners are likely to vote on allowing private equity firms to become part owners of one or more iconic football franchises. In a review of the sports investments the league’s potential PE investors already have, the NFL would be a significant addition. Even so, sports would still constitute just a sliver of their business.

As Sportico has reported, the league has advanced seven PE firms during its process, with at least three others culled after preliminary talks. The final seven break down like this: four very large PE firms—Ares Capital, Blackstone Partners, Carlyle Group and CVC Partners; one medium-sized firm, Sixth Street; and two small sports-centric outfits, Arctos Partners and Dynasty Equity. Four of those have pitched themselves as a consortium, comprised of Blackstone, CVC, Carlyle and Dynasty. The other three are believed to be stand-alone potential investors.

As a group, their heft is huge. The final seven have nearly $2.2 trillion in assets under management across some 2,025 portfolio holdings, according to S&P Global Market Intelligence data. Sports investments comprise just 43 of those two-thousand-plus holdings, excluding betting enterprises and general businesses that may touch sports along with other sectors. The sports investments are worth $22 billion total, based on publicly disclosed deal terms, Sportico reporting and S&P data. That’s just 1% of the group’s total assets.

Should the NFL permit PE to invest in its clubs, it probably wouldn’t even double sports assets for the group: The league has discussed limiting PE stakes in clubs to 10% ownership or less, compared to 30% for the other major North American leagues. All 32 NFL franchises combined are worth $190 billion, meaning just $19 billion would be available to PE under that proposal, even if every owner wanted to sell.

Given the three largest PE firms in the running—Blackstone, Carlyle and Ares—have $1.9 trillion in assets among them, the NFL is a drop in the bucket. Why even pursue the league?

“You can describe it as a drop in the bucket, as you have so aptly done, but a lot of drops start coming and you get a puddle,” Irwin Kishner, co-chair of the Sports Law Group at Herrick Feinstein, said on a phone call. “Sports, live sports programming and gambling rights associated with that are a tremendous value proposition, where smart money sees opportunity to achieve the returns that they are looking to achieve. It’s still big numbers.”

PE firms are in the business of finding outsized returns, and the NFL, at least historically, has provided that: Over the past 20 years, the league’s total value has risen from $23.46 billion to $190 billion, a 710% gain. By comparison, the S&P 500 index has risen 660% the past 20 years. Not only do franchises provide outsized returns, but team values tend to be less volatile than other investments like stocks and bonds—or, in Wall Street-speak, they are more highly non-correlated with other securities, a characteristic valued by long-term investors that hand PE firms their money.

Ares, with $447 billion under management, has been targeting sports as one of its growth areas in recent years. “When you look at what we're building for the future in places like Asia-Pacific private equity, credit, secondaries [and] sports, media and entertainment, I have a hunch that when we're together with you in a couple of years, you'll see movement of those new strategies at an accelerated pace as well,” co-founder and CEO Michael Arougheti told analysts in May.

Three years ago, Ares began raising capital for an SME fund, eventually exceeding its target and pulling in $2.2 billion of assets. The fund has mainly debt-related investments, including about $100 million (as of mid-2021) in loans to the San Diego Padres. It also has soccer investments in Inter Miami, Olympique Lyonnais and Atlético Madrid.

By comparison, Blackstone, the world’s largest PE firm, and Carlyle have barely dipped their toes into sports. Blackstone has just a handful of investments that touch sports (like Outerstuff, which makes licensed apparel), and only one that is mainly sports: a 13% stake in the YES Network, the regional sports channel that shows Yankees and Nets games, according to S&P data. Carlyle’s only identified sports investment is majority ownership of the Seattle Reign, the NWSL team valued at $58 million when it invested this spring. Beyond seeking returns, Carlyle’s interest in sports could be driven by its recent aim to extend its business into private wealth management. Being able to own a sliver of an NFL franchise could have huge appeal to well-off clients who aren’t rich enough to buy into a team on their own.

More active has been CVC, which has about $6 billion in sports, mainly rugby and French and Spanish soccer, and Sixth Street, the largest sports investment of which is probably Legends, the hospitality and experiences firm it owns with minority partners the Yankees and Cowboys. Sixth Street also has majority ownership of the NWSL's Bay FC; a 20% stake in the San Antonio Spurs, probably acquired for $360 million in 2021; and $200-million-plus deals with Barcelona and LaLiga in soccer.

The remaining two NFL finalists are sports-centric: Dynasty Equity is a sports-franchise-focused fund that manages $343 million, according to a recent regulatory disclosure. Founded two years ago by sports banking veteran Don Cornwell and PE veteran Jonathan Nelson, Dynasty has two investments, in Liverpool FC and TMRW Sports.

Arctos is a name known in the sports business as the most successful pioneer of the sports franchise investment model. Arctos has $9.8 billion under management, according to a 2024 SEC filing, all in sports franchises and some related businesses, including limited partner stakes in six MLB teams, five NBA teams and three NHL teams.

Interestingly, Arctos is seeking to expand outward from sports, deploying a version of its limited partner investment approach into helping other private equity firm owners with liquidity. It’s closing on its first investment in that sector, helping management of a Canadian asset manager buy out their firm.

Every business, it seems, could use people willing to buy minority stakes.

The NFL's Historic Decision: A New Era Begins

EAGAN, Minn. — The NFL is set to make league and sports industry history Tuesday, even if the outcome has been increasingly a foregone conclusion.

The league will hold a special meeting here, where a vote is expected to formally approve the introduction of private equity in team ownership. The result of months of study and consideration, the move will make the NFL the last, but the largest and most notable, of the major U.S. sports leagues, to allow this type of outside investment.

It’s anticipated that private equity firms will be initially capped at 10% of a team’s equity—below other comparable leagues that allow up to 30%. The institutional investors will also be required to be entirely passive and not hold any voting rights with teams.

“We believe that would be something that could make sense for us in a limited fashion,” NFL commissioner Roger Goodell said last month regarding the introduction of private equity. “That would be something we think could complement our ownership and support our ownership policies.”

Even as the NFL has taken a more measured path toward allowing private equity, the need for this vote has become increasingly urgent. The Commanders sold for $6.05 billion last year, a figure that could soon look quaintly small amid the league’s continued growth. Already, the NBA is potentially taking aim at the Commanders’ figure with the forthcoming sale of the Celtics.

Those soaring valuations have made it increasingly difficult for even the wealthiest individuals to meet traditional NFL ownership and liquidity requirements—led by the primary investor having at least 30% equity in a team purchase and a cap on ownership groups at 25 people.

Several NFL teams are expected to take immediate advantage of the new private equity provisions and close deals before the end of the year. Those individual transactions will still require vetting and approval by the league.

It’s also expected the NFL will disclose a list of approved private equity partners, a group that could include titans of that industry such as Arctos Partners, Ares Management, Sixth Street Partners, and a consortium of Blackstone Partners, CVC Capital Partners, Carlyle Group, and Dynasty Equity.

Many of these firms have already been highly active across many other parts of the sports industry, including buying into teams in other pro leagues, concessionaires and hospitality firms, and stadium management entities.