Nifty Forms Neutral Doji Candle, Signaling Uncertain Market Action on Wednesday

The Nifty index concluded Tuesday's trading session with a neutral Doji candle on the daily chart. This pattern suggests indecision in the market, leaving traders with limited clarity on the immediate direction of the index. However, analysts believe that support levels around 25,100 will be crucial to watch out for, as they could provide an indication of the market's resilience.

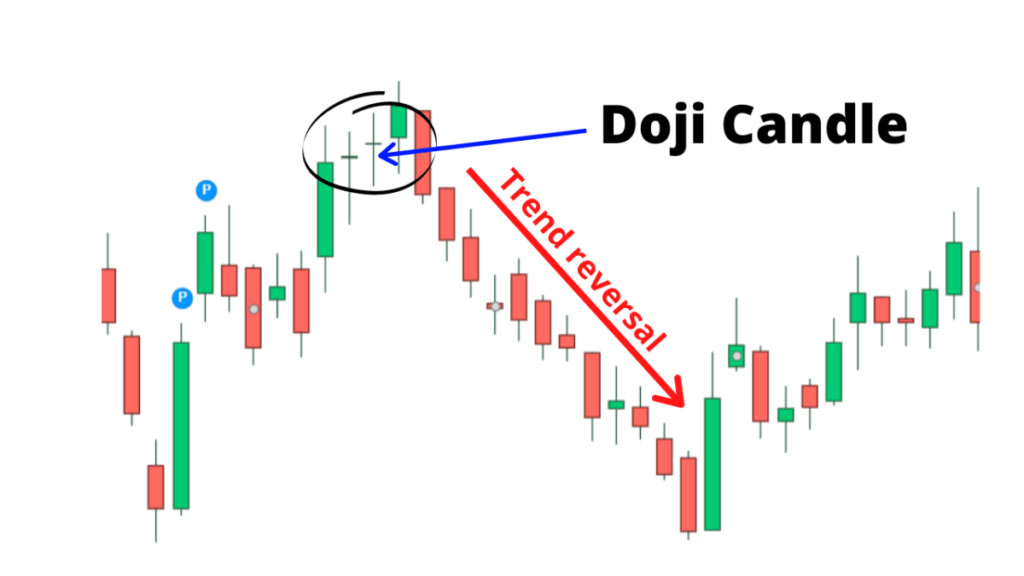

Understanding the Doji Candle

The Doji candle is a technical pattern formed when the opening and closing prices of an asset are nearly identical, with the upper and lower shadows extending equally in both directions. This pattern often indicates a period of consolidation or uncertainty in the market. It suggests that buyers and sellers are evenly matched, leading to a stalemate in price action.

While a Doji candle doesn't offer a clear signal about the future direction of the market, it can be an important indicator when considered within the broader context of price action and other technical indicators.

Support Levels and Key Triggers

Analysts recommend that traders focus on the 25,100 support level for the Nifty index. If the index manages to hold above this level, it could suggest that buying sentiment remains strong, potentially leading to a continued upward trend. However, if the index falls below this level, it could indicate a shift in momentum, potentially leading to a correction.

Several factors could influence the market's direction on Wednesday. Global cues, including the performance of US markets, will be key to watch out for. Additionally, any announcements from the Reserve Bank of India (RBI) on monetary policy or other economic factors could impact market sentiment.

Trading Strategies for Wednesday

Given the uncertainty surrounding the market's direction, traders should exercise caution and consider a wait-and-see approach on Wednesday. However, for those seeking opportunities, a few potential strategies can be employed.

1. Wait for Confirmation

Traders can wait for a clear breakout above the 25,100 support level or a decisive breakdown below this level before taking a directional position. This strategy allows traders to avoid entering the market at a time of uncertainty and reduces the risk of potentially losing money on a false breakout or breakdown.

2. Scalping Opportunities

Scalping involves taking short-term profits on small price movements. This strategy can be effective in sideways or range-bound markets. However, scalping requires a high level of expertise and quick reflexes, as trades must be entered and exited rapidly to capture small profits.

3. Use Stop-Loss Orders

Regardless of the trading strategy employed, it is crucial to use stop-loss orders to limit potential losses. Stop-loss orders automatically close a position when a pre-defined price level is reached, preventing further losses in case of adverse market movement.

Conclusion: A Day for Cautious Trading

The Nifty's formation of a Doji candle on the daily chart suggests a period of uncertainty and consolidation. While this doesn't automatically signal a bearish reversal, it does emphasize the need for caution. Traders should pay close attention to support levels, global cues, and potential market triggers to make informed decisions and avoid unnecessary risks.

The market remains highly dynamic, and it is crucial to stay updated on the latest developments and interpret technical signals accurately to navigate the trading landscape effectively. Remember, responsible trading requires a thorough understanding of market dynamics, risk management strategies, and a willingness to adapt to changing conditions.