Nigerian Senate Tax Reform Bills: A Storm of Controversy

The Nigerian Senate is currently embroiled in a heated debate surrounding the controversial Tax Reform Bills, triggering a wave of reactions across the country. The situation has been further complicated by differing interpretations of recent events and accusations of overruling between key Senate figures. The bills, encompassing the Joint Revenue Board of Nigeria (Establishment) Bill, 2024; Nigeria Revenue Service (Establishment) Bill, 2024; and the Nigeria Tax Bill, 2024, have sparked significant opposition, particularly in the northern region.

The Alleged Overruling and Subsequent Clarifications

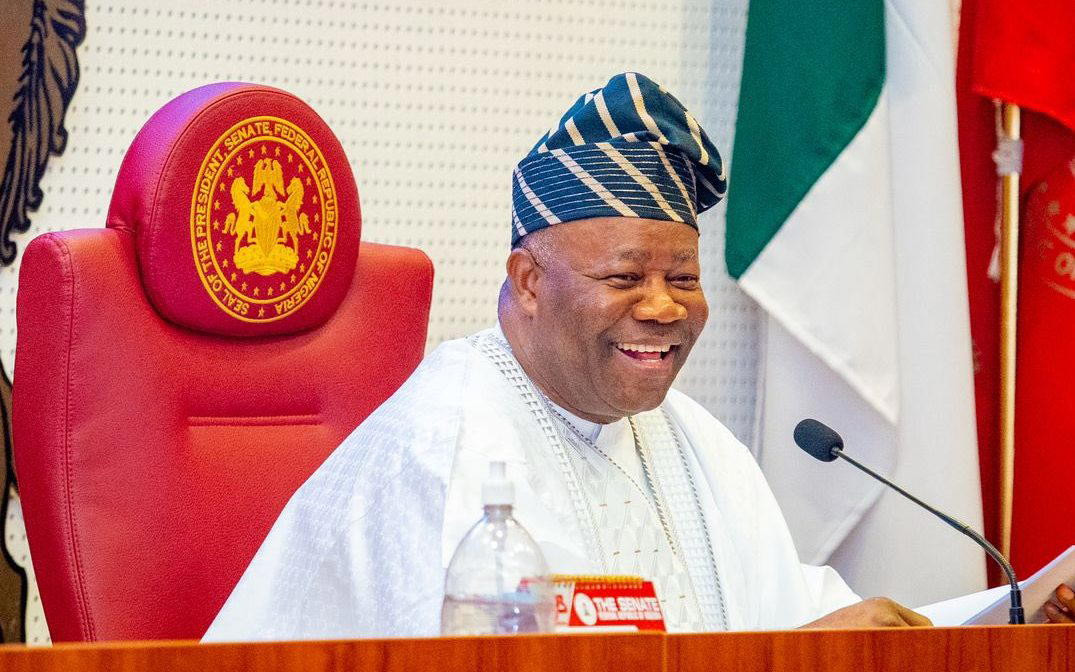

Reports emerged suggesting that Senate President Godswill Akpabio overruled his deputy, Jibrin Barau, regarding the handling of the Tax Reform Bills. This stemmed from conflicting announcements: Barau had announced a committee, led by Senator Abba Moro, to engage with the Attorney General of the Federation to address contentious aspects of the bills, while Akpabio subsequently reaffirmed the Senate's commitment to advancing the bills, stating that no aspect had been suspended or withdrawn. The Senate President’s statement has been interpreted in some quarters as overruling his deputy.

Senator Moro, who chairs the special committee on the Tax Reform Bills, clarified the situation in an interview with Channels Television's Sunrise Daily. He explicitly stated that there was no instance of overruling. "I don’t see it as an overruling as such," Senator Moro said. "The deputy Senate President presided over the session; on the next day, the Senate President presided over the session. This idea of setting up a committee, the idea of interfacing with the executive on the bills before the House was muted on Thursday the previous week. So, the list was drawn and of course under normal circumstances adjustments are permissible and that is what was done. I think it doesn’t have any insinuation of one overruling the other, it’s just a mere adjustment of membership and procedures to adopt in the process." According to Senator Moro, what happened was a mere adjustment of membership and procedures to adopt in the process.

Concerns from ASUU and Other Stakeholders

The Tax Reform Bills have also ignited concerns from various sectors of Nigerian society. Professor Emmanuel Osodeke, the President of the Academic Staff Union of Universities (ASUU), voiced apprehensions that the bills could negatively impact the Tertiary Education Trust Fund (TETFund), a crucial source of funding for universities. Osodeke further highlighted ASUU's exclusion from consultations regarding these bills. Senator Moro responded by assuring that ASUU would be involved in consultations if necessary, emphasizing the committee's primary mandate to interface with the executive branch of government.

Senate's Stance and Commitment to the Bills

Despite the controversies and concerns, the Senate has maintained its commitment to progressing the Tax Reform Bills. Senate President Akpabio repeatedly underscored the Senate's dedication to representing the interests of Nigerians and its resolve not to be swayed by external pressures. He explicitly denied reports suggesting that legislative action on the bills had been suspended or withdrawn, stating that the bills, being executive bills, can only be withdrawn by the President. The Senate emphasized its continued legislative work, including the establishment of a special committee representing Nigeria’s six geopolitical zones to engage with the Attorney General of the Federation on contentious issues. Furthermore, public hearings and discussions with stakeholders, including governors, religious leaders, and business leaders, were highlighted as crucial for resolving ambiguities and reaching a consensus.

Northern Division and Attempts at Consensus

The tax reform bills have also sparked considerable debate within the northern caucus of the Senate. Reports suggest that initially a majority of northern senators opposed the bills, raising concerns that they would negatively impact the northern economy. However, subsequent reports indicate a shift in sentiment, with some northern senators now supporting the bills or advocating for amendments to address specific concerns, particularly regarding the Value Added Tax (VAT) sharing formula. This division illustrates the complex dynamics at play, highlighting varying interpretations of the bills’ potential impact on different regions and the need for thorough consultations to achieve a broader consensus. A committee of northern leaders has been formed to review the bills and ensure they reflect the interests of the north, further complicating the already multifaceted debate.

A Call for Transparency and Inclusive Dialogue

The ongoing debate surrounding the Tax Reform Bills underscores the need for transparency and inclusive dialogue among all stakeholders. Open discussions, addressing regional concerns and ensuring that all voices are heard, are crucial for forging a path forward that benefits all Nigerians. This requires engaging with diverse opinions, accommodating diverse perspectives, and finding common ground that respects the needs of all regions while advancing the country’s overall economic interests. The Nigerian Senate’s handling of the situation should strive towards a consensus that reflects the country's complex political and economic realities.

The Road Ahead: Navigating the Tax Reform Maze

The Nigerian Senate is at a critical juncture. Successfully navigating the complex challenges presented by the Tax Reform Bills will require adept political maneuvering, open communication, and a commitment to inclusive decision-making. The process ahead will require careful consideration of diverse perspectives and potential amendments to address regional concerns and ensure that the reforms ultimately benefit all Nigerians. The future of these bills remains uncertain, but the ongoing discussions highlight the importance of balancing economic needs with political realities in a diverse nation.