S&P 500 futures were marginally higher Wednesday as investors waited for Nvidia's quarterly earnings announcement. Futures tied to the broad market index traded just above the flatline, along with Nasdaq-100 and Dow Jones Industrial Average futures.

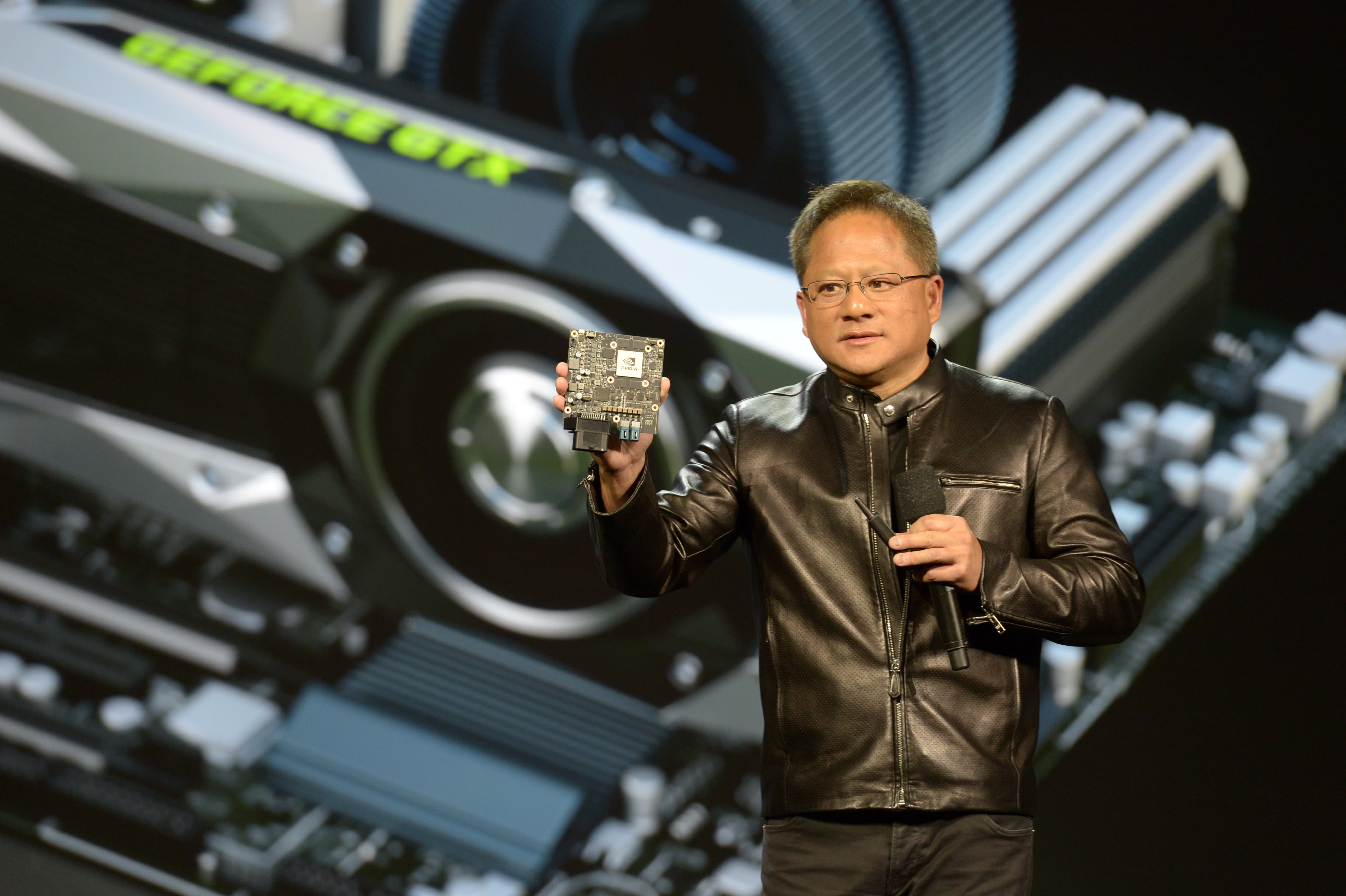

Wall Street is keeping an eye on Nvidia to gauge the broader sustainability of the broader tech and AI trade. The semiconductor giant — slated to report after the close — has surged 159% in 2024, raising questions of how much more room there is for the stock to run.

Focal points for investors include the delivery schedule for Nvidia's Blackwell chips and an update on the demand for AI.

"It's hard to say that there's not a lot of optimism priced into the market tomorrow," Erin Browne, Pimco managing director and portfolio manager, told CNBC's "Closing Bell" on Tuesday.

Browne noted that other AI stocks are trading around 10% below their all-time highs. Nvidia's current valuation is not expensive relative to the five-year average, she added.

"So while certainly there's a lot of optimism priced in, I think that they still can deliver upside and surprise the market to the upside," Browne said.

Nvidia's upcoming quarterly results are "pretty important," according to Citi's Scott Chronert.

"There's no question from a basic index weighting perspective the importance of Nvidia is very clear on this," the firm's U.S. equity strategist told CNBC's "Squawk on the Street," citing the artificial intelligence darling's influence on the midyear gains of the S&P 500. In June, Nvidia's weighting in the broad market index had reached 6.6%, per FactSet.

In terms of whether an AI spending and AI productivity enhancing tailwind is taking place, Chronert believes more evidence is needed. "It won't be the earnings result per se as much as it is what we're talking to in terms of guidance going forward," he added.

Nvidia is set to report its second-quarter earnings for fiscal 2025 after market close on Wednesday. Shares of the company have surged 159% this year.

Nvidia's Business Segments: Data Center Leads the Way

A majority of revenue contribution is from Nvidia's data center business. In the first quarter, the company derived about 87% of its total revenue from the segment, which raked in record revenue of $22.56 billion. Gaming and AI PC contributed $2.65 billion, Professional visualization $427 million and Automotive $329 million.

What to Watch for on Earnings Call: Blackwell Chip Delay and AI Demand

The rumored delay in the Blackwell 200 AI accelerator has caused uneasiness among traders. Fund manager Louis Navellier expects investors to be glued in more on the management commentary regarding the timeline for the chip than on the quarterly revenue and earnings.

Morgan Stanley semiconductor analyst Joseph Moore said in a recent note that the Blackwell delay may not hurt Nvidia much as customers have rapidly pivoted to the H200 AI chips. He flagged “exceptionally strong demand” for Hopper 200 among cloud service providers and also hinted at some of the hyperscalers going in for more Hoppers.

The analyst expects the China-specific H2 AI accelerator to bring in revenue of more than $10 billion over the next three quarters.

TFI analyst Ming-Chi Kuo said he would look for whether the Blackwell 200 re-tape-out would impact profit and margin in the near term. The rumored delay in the AI chip was attributed to a design flaw. Kuo said if the company can provide details to allay investors’ concerns about GB200 shipment schedules, it would benefit the stock performance of both Nvidia and its supply chain in the next three months.

Nvidia Stock: AI Momentum Continues to Drive Gains

The Jensen Huang-led company’s stock has been a stellar performer, having gained 159% year-to-date. This compares to the 18% gain for the S&P 500 Index and the 16.4% advance by the Nasdaq 100 Index. The iShares Semiconductor ETF SOX has added a little over 20% during the same period.

The AI beneficiary is up roughly 30% after the sell-off earlier this month, the firm's Solita Marcelli noted. However, current options pricing shows another spike of 10% is possible on the back of the results set to release Wednesday after the close.

Marcelli is bullish on the long-term potential of artificial intelligence, but noted that global tech stocks could see "more gradual" gains after the comeback of the past month.

"We have said that future gains in global tech stocks should be more gradual after the quick rebound over the past three weeks, with potential headwinds from US macroeconomic data and further news on semiconductor export controls likely contributing to rising volatility," Marcelli wrote.

Nvidia's Earnings: A Catalyst for Market Momentum?

Data from the brokerage shows more than 460,000 orders were put on shares Tuesday. Of those, 246,273 were buys and 214,969 were sales. Retail traders on the platform were also making moves in the options space, with more than 125,000 trades on that front being placed.

"In case you harbor any doubts about the broader market impact of tomorrow's NVDA earnings, see [the data]," chief strategist Steve Sosnick wrote. "We've gotten quite used to seeing NVDA atop the leaderboard most weeks, cementing its key role in investor psychology. Looking beyond that, it is quite clear that the company plays a crucial role affecting a wide range of other popular investment vehicles."

Nvidia's upcoming quarterly results are "pretty important," according to Citi's Scott Chronert.

"There's no question from a basic index weighting perspective the importance of Nvidia is very clear on this," the firm's U.S. equity strategist told CNBC's "Squawk on the Street," citing the artificial intelligence darling's influence on the midyear gains of the S&P 500. In June, Nvidia's weighting in the broad market index had reached 6.6%, per FactSet.

In terms of whether an AI spending and AI productivity enhancing tailwind is taking place, Chronert believes more evidence is needed. "It won't be the earnings result per se as much as it is what we're talking to in terms of guidance going forward," he added.