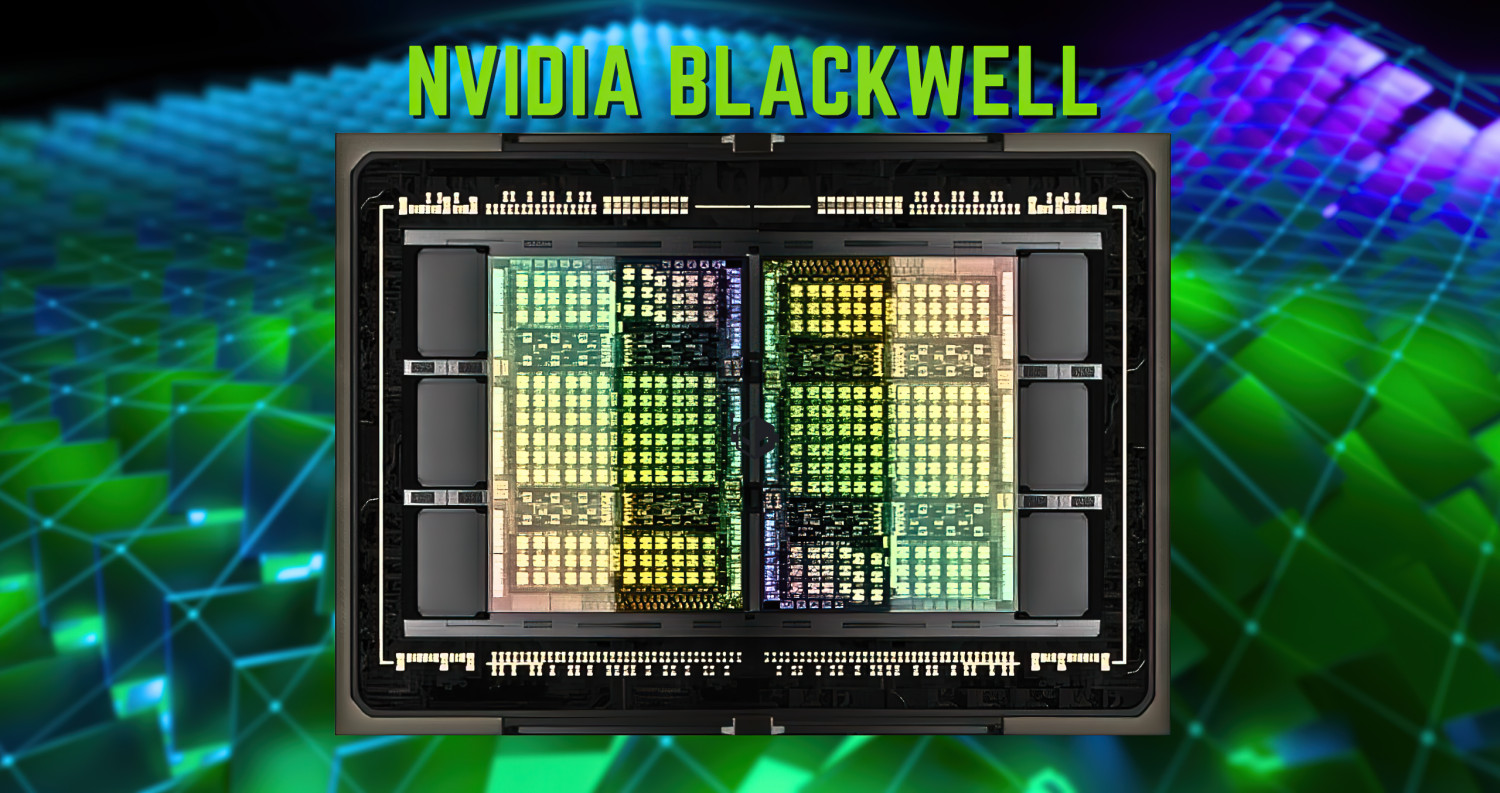

Nvidia shares plummeted over 7% in early trading Monday following reports that the company's highly anticipated Blackwell system, including its next-generation artificial intelligence (AI) chips, will be delayed, amid a global sell-off driven by worries about the state of the U.S. economy.

The Blackwell AI chip could be held up by three months or more because of design flaws, The Information reported, citing anonymous sources close to the company. Nvidia told Microsoft (MSFT) and another large cloud provider there was a delay, the article said.

Impact on Big Tech Companies

A delay would affect Amazon (AMZN), Alphabet's (GOOGL) Google, Meta (META), Microsoft, ChatGPT maker OpenAI, Tesla (TSLA), and Elon Musk's xAI, among others.

These tech giants are eager to get their hands on the Blackwell chips to power their AI software and services. The delay could lead to delays in the development and rollout of new AI products and services, which could ultimately impact their competitive advantage in the AI race.

Nvidia's Potential Losses

The impact of the delay could be significant for Nvidia. Strong demand for Blackwell ahead of its rollout played a key role in helping drive Nvidia's stock higher this year, and was expected to lift Nvidia partners like Micron Technology (MU) and Monolithic Power Systems (MPWR), as well as benefit others in the AI space.

Citi analysts, who removed Nvidia from their "upside catalyst watch" following reports of the delay, said it could raise demand for Nvidia's older AI chips and products from competitors like Advanced Micro Devices (AMD). This could also create an opportunity for other chipmakers to gain market share in the AI chip market.

What's Next for Nvidia?

Despite the setback, Nvidia remains a dominant player in the AI chip market. The company has a strong track record of innovation and has a wide range of products that are in high demand. The delay could be a temporary setback, and Nvidia could still be in a strong position to benefit from the continued growth of the AI market.

A Look at the Bigger Picture

It's important to remember that this delay is just one factor that could impact Nvidia's future performance. The company faces other challenges, such as competition from other chipmakers, the potential for regulatory scrutiny, and the overall macroeconomic environment. However, Nvidia has a strong brand, a loyal customer base, and a solid financial position. The company is well-positioned to weather the current storm and emerge stronger in the long term.

The Future of AI

The AI market is still in its early stages of development, and it is expected to grow significantly in the coming years. The demand for powerful AI chips is only going to increase, and Nvidia is likely to continue to be a major player in this space. This delay could provide an opportunity for other chipmakers to catch up, but Nvidia's strong position and commitment to innovation could help the company maintain its leadership in the AI market.

The Bottom Line

The delay of the Blackwell AI chip is a setback for Nvidia, but it's not necessarily a sign of weakness. The company remains a leader in the AI chip market, and its long-term prospects remain strong. Investors should continue to monitor the situation closely, but they should also remember that the AI market is still in its early stages of development, and there is a lot of potential for growth in the years to come.

A Note on the Stock Market

It's important to note that the broader market is also experiencing volatility. The global sell-off is driven by concerns about the state of the U.S. economy and the potential for a recession. This is contributing to the overall decline in stock prices, and it's not just Nvidia that is being affected.

Investors should consider these broader market dynamics when evaluating Nvidia's stock performance. The current volatility is likely to continue in the short term, but the long-term prospects for the AI market remain positive.

Nvidia's stock is still trading at a premium valuation, reflecting the company's strong growth prospects. However, the recent decline in the stock price could be a buying opportunity for investors who are bullish on the long-term growth of the AI market.

Nvidia is facing another, unrelated snag, too. Officials at the Department of Justice are reportedly investigating complaints from Nvidia’s rivals for allegedly abusing its dominance of the AI chip market. This investigation could have a significant impact on Nvidia’s business, and it's a development that investors should continue to monitor closely.