The Search for the Next Nvidia: Can These Stocks Become AI Giants?

Semiconductor company — and stock market darling — Nvidia has been on quite the run in the last few years, riding the wave of growing interest in cryptocurrency and then the emergence of artificial intelligence (AI). A $1,000 investment just five years before would have grown to more than $30,000 by July 2024. Not surprisingly, investors have set their sights on finding the stocks that could become the next Nvidia.

One good place to begin is by looking for companies that can benefit from the growing interest and investment in AI or other highly scalable businesses riding a similar decades-long trend.

Nvidia now sits among a rarefied group as one of the world’s most valuable companies, but the stocks below won’t need to become that large for investors to enjoy strong returns over the years. (Data below as of Aug. 27, 2024)

Top Contenders for the Next Nvidia

Broadcom: A Leader in Application-Specific Integrated Circuits (ASICs)

Broadcom is the largest stock on this list, and yet it’s only a quarter of the size of Nvidia. The semiconductor company produces application-specific integrated circuits, or ASICs, that are designed for specific jobs. ASICs are useful in AI applications, and Broadcom is a demonstrated leader in this growing area of the market.

The company already counts many of the largest tech companies among its clientele, including Alphabet and Meta Platforms, and analysts expect strong growth in the years ahead.

Market cap: $753 billion

Super Micro Computer: Strong Growth in AI Servers

Super Micro Computer has been one of the strongest tech stocks of late, and while it’s declined a good bit from its peak earlier in 2024, the stock is still valued at a relatively small (compared to Nvidia) $36 billion. The company builds servers and storage for cloud data centers, including AI servers, using chips from leaders such as Nvidia, and the company is poised to gain market share.

While revenue grew briskly in the fiscal year ending June 2024 – up 110 percent year over year – they soared even faster in the final quarter, up 143 percent. Sales could double again in the coming year if the top end of management’s guidance is correct. All good news, but the biggest knock on the company is its high teens gross margin, which means the company won’t scale as well as a well-run software outfit. But strong sales growth makes that easier to overlook for now.

Market cap: $32 billion

AMD: Gaining Share in the Graphics Card Market

AMD has been rising for some time, and rival chipmaker Intel is on its heels. AMD’s graphics cards compete favorably with Nvidia’s, and the company has been gaining share in recent years. That’s led to a strongly advancing share price, but AMD remains just a fraction of the size of the juggernaut that is Nvidia, less than 8 percent as large, to put a finer point on it.

While AMD may never become as large, the demand for computing power is expected to rise strongly for years, not only due to AI but also due to the increasing prevalence of entertainment and media in our lives. This megatrend means there’s plenty of room for innovative chip companies to thrive.

Market cap: $243 billion

Snowflake: Making Sense of Massive Data

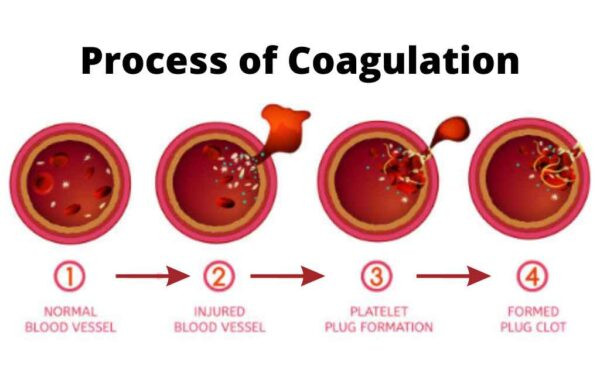

Some 400 million terabytes of data are produced each day, according to various sources, and Snowflake helps companies make sense of it all with its cloud data platform. The amount of data is only going to increase as our world sits flush in the middle of computerization, an ongoing megatrend. In the quarter ending July 31, 2024, the company grew revenue 29 percent year-over-year. And importantly, its customers signed up for even more services, so they like what they’re getting.

While legendary investor Warren Buffett may have sold his small position in Snowflake recently, that doesn’t mean the cloud data play won’t do well in the future. The company already counts nearly 37 percent of the Forbes Global 2000 as customers, so it seems like there’s room to run.

Market cap: $39 billion

Crowdstrike: A Leader in Cybersecurity

You may remember Crowdstrike from its recent appearance in the news cycle, but not for the reason you’d want. The cybersecurity firm was at the center of a real mess when an update to its security software caused mass disruption across the world, including at airlines. But ironically, this incident shows just how important Crowstrike is to our computerized world.

The company has seen strong growth over time, and cybersecurity is only going to become more vital over time, as witnessed by a breach where virtually all Americans’ Social Security numbers were exposed. Crowdstrike is a proven leader in the space, and its software benefits from a network effect, where emerging threats can be neutralized, the solution incorporated into its software and then shared with other clients quickly, helping increase the future immunity of every client.

Market cap: $65 billion

Navigating the AI Investing Landscape

The advantage of buying individual stocks is that you can do much better than if you buy an index fund, even one concentrated in a hot sector such as semiconductors or information technology. It’s just simple math. If you can identify the companies bringing up the average, they’re going to do better than the average, which itself is the index’s performance. The trick is finding them.

Many hot stocks can perform well for long periods, and it’s not unusual to see the best stocks return 25 to 30 percent annually, even over decades. That beats strong returns from top index funds such as Vanguard S&P 500 ETF (VOO) and the Nasdaq-tracking Invesco QQQ Trust (QQQ), which earned 15.6 percent and 21.2 percent per year in the last five years, respectively.

The disadvantage of buying individual stocks, however, is that it requires extensive research and tracking to keep up with them and the competition. The competitive landscape changes fast, especially in the tech world. So, if you’re not a tech-savant, you can be quickly left behind. What was once the wave of the future is now just a ripple when the tides of industry shift yet again.

However, investors can still earn attractive returns without taking on the concentrated risks of individual stocks and without having to do all that much research. Thematic exchange-traded funds (ETFs) can be an attractive and low-cost way to achieve a diversified portfolio and earn strong returns.

For example, the best tech ETFs have made some compelling annual returns over the last five years:

- VanEck Semiconductor ETF (SMH): 19.9%

- Invesco QQQ Trust (QQQ): 21.2%

- Technology Select Sector SPDR Fund (XLK): 18.3%

- iShares Semiconductor ETF (SOXX): 19.4%

- VanEck Vectors Semiconductor ETF (SMH): 19.9%

Finding funds with strong long-term track records can be a much simpler process than doing the necessary work on dozens of stocks yourself. And you’ll still have investments in some of the hottest stocks with the increased safety of diversification. Strong returns, low cost and less work – That’s why investors both new and advanced turn to sector ETFs such as those above.

The Takeaway: Seeking the Next Big AI Win

Identifying the next Nvidia could be well worth your time, because of the prospect of decades of strong returns if you’re right. But investors can do just fine by buying index funds that hold some of the best tech stocks, adding to their position over time regularly and then holding on.