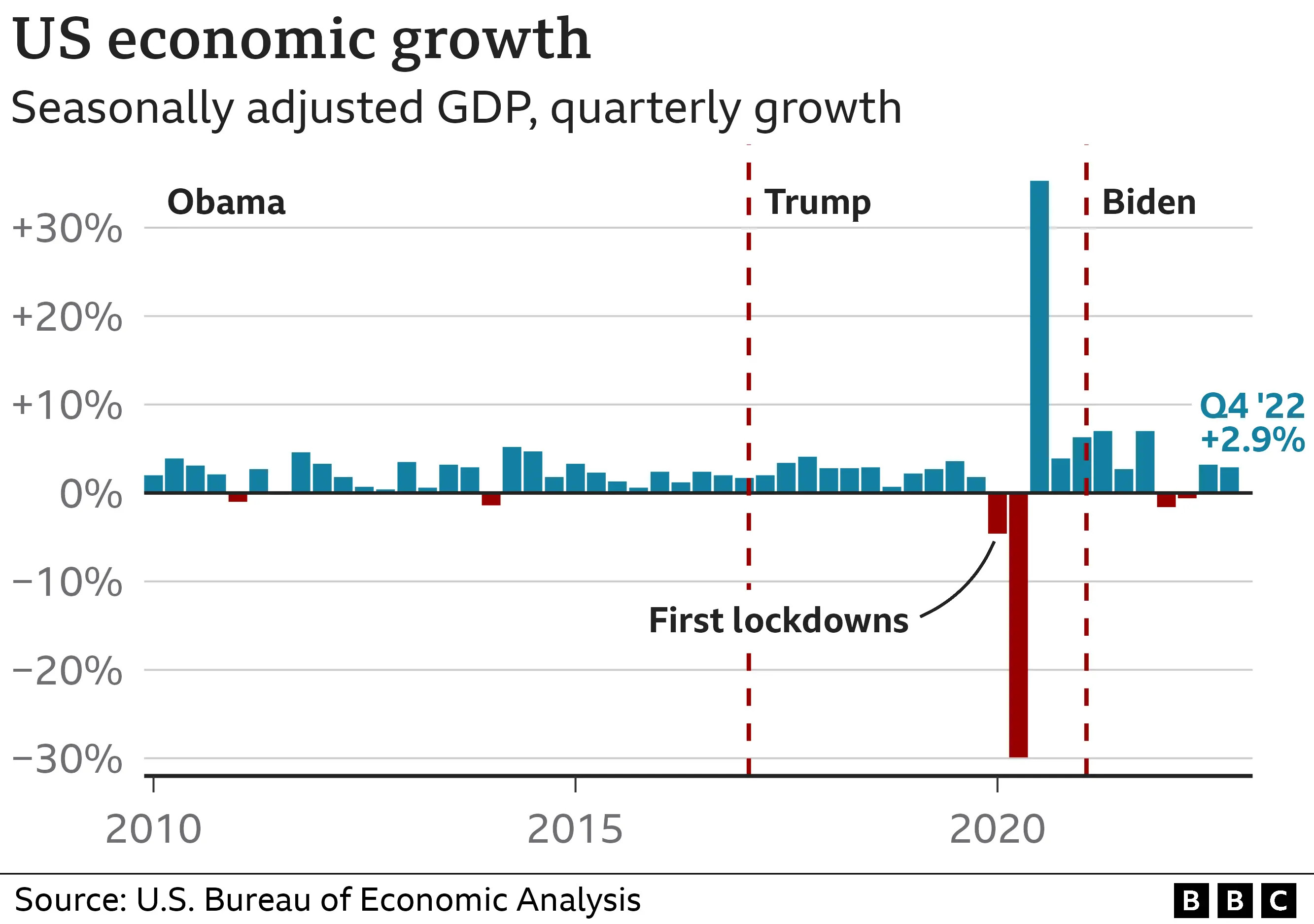

The Reserve Bank of Australia (RBA) governor, Michele Bullock, has delivered a sobering message to Australians grappling with high inflation and rising interest rates. In her first public comments since the release of June quarter GDP figures, Bullock warned that some Australians may have to sell their homes, highlighting the ongoing challenges facing the economy.

Bullock’s speech, titled "The Costs of High Inflation," provided a stark assessment of the current economic landscape. While acknowledging that the economy is slowing down, she stressed that demand for goods and services remains higher than the economy’s ability to supply them, keeping inflation elevated.

Despite a meagre 0.2 per cent expansion in the economy in the June quarter and a one per cent through-the-year increase, the RBA governor has ruled out any near-term interest rate cuts.

This news is sure to disappoint borrowers hoping for relief from the pressure of higher interest rates. Bullock’s remarks come as the federal government faces criticism over its handling of the economy, with the opposition seizing on the sluggish growth figures to attack the Labor government.

The RBA governor has reiterated the bank's commitment to tackling inflation, emphasizing the potential for further interest rate hikes if firms and households come to expect fast-rising prices. "Ultimately, we would need to slow the economy down by more, which would result in a larger rise in unemployment and higher risk of recession," she warned.

Bullock’s comments highlight the delicate balancing act faced by the RBA as it navigates a complex economic environment. With inflation stubbornly high and the economy showing signs of weakness, the central bank is under pressure to find a way to bring inflation down without triggering a recession.

The Impact on Borrowers

The RBA governor’s warning of potential home sales has raised concerns about the impact on borrowers, particularly those on lower incomes. Bullock acknowledged that a prolonged period of high inflation would disproportionately affect vulnerable households, potentially forcing them to make difficult decisions about their finances and their homes.

The RBA has estimated that around 5% of owner-occupiers on variable-rate loans are in a particularly challenging situation, with their essential spending and mortgage repayments exceeding their income.

While many borrowers have been able to cope with the rising cost of living through various measures, such as cutting back on spending, shifting to lower-quality goods and services, dipping into savings, or working more hours, Bullock cautioned that these adjustments may not always be enough.

Side Hustles and Second Jobs

As the cost of living continues to rise, many Australians are turning to side gigs and second jobs to make ends meet. A recent report by Great Southern Bank found that two in three Australians (64%) say their financial plans have been set back by at least 12 months due to the economic climate, leading to 67% seeking additional income streams.

The report also highlighted a growing trend of adult children moving back in with their parents to reduce housing costs, with 7% of Australians having either moved back in with family or had adult children move back home in the past two years.

This growing reliance on side hustles and parental support underscores the financial pressure faced by many Australians as they grapple with the impact of high inflation and rising interest rates.

The RBA’s Stance

Despite the challenges facing the economy, the RBA has signalled its intention to keep interest rates on hold for the remainder of the year.

Bullock emphasized that the RBA’s board remains vigilant about upside risks to inflation, and that policy will need to be sufficiently restrictive until the central bank is confident that inflation is moving sustainably towards its target range.

The RBA governor’s comments suggest that interest rate cuts are unlikely in the near term, despite market expectations for a cut before Christmas.

The Path Forward

The RBA faces a complex and challenging task in guiding the economy back to stability.

With inflation stubbornly high and the economy showing signs of weakness, the central bank must strike a delicate balance between controlling inflation and supporting economic growth.

The RBA’s decision to keep interest rates on hold for the remainder of the year is likely to disappoint many borrowers, but it reflects the bank’s commitment to ensuring that inflation is brought under control.

The coming months will be crucial in determining the trajectory of the Australian economy, and the RBA’s decisions will play a pivotal role in shaping the nation’s economic future.

A Time of Uncertainty

The current economic climate is a time of uncertainty for many Australians.

The combination of high inflation and rising interest rates has placed a significant strain on household budgets, and the potential for further interest rate hikes adds to the sense of unease.

The RBA’s commitment to tackling inflation is understandable, but its impact on borrowers and the broader economy cannot be ignored.

As the nation navigates these turbulent economic waters, it is essential that policymakers remain focused on finding solutions that support both economic stability and the well-being of Australian households.