After such a magnificent run, there’s inevitably a fair bit of froth and speculation in the share price. If the get-rich-quick squad bank their profits and chase their next adrenaline hit, Rolls-Royce shares could fall at speed too.

I’m wondering if we’re at that point. The aircraft engine maker’s stock is up 133% over one year but just 10% in three months. It’s now the 16th biggest company on the FTSE 100 with a market cap of £42.2bn, one place above defence giant BAE Systems.

Rolls-Royce shares are starting to look expensive, trading at 36.38 times earnings. That’s more than double the FTSE 100 average of 15.3 times.

Given the impact of transformative CEO Tufan Erginbilgic’s leadership, Rolls can justify that top-end valuation. It started August by lifting full-year profit guidance to between £2.1bn and £2.3bn, after first-half underlying operating profit rose 74% to £1.15bn.

First-half revenues grew 19% to £8.18bn while cost savings helped lift operating margins by 4.4 points to 14%. The group is on course to generate free cash flow of up to £2.2bn, and will reward shareholders by resuming the dividend. The shares are forecast to yield 1.08% in 2024, creeping up to 1.23% in 2025.

Credit Ratings Can Be Crucial for Growth

Much of the recovery has been driven by the post-pandemic recovery in flying. Rolls-Royce makes much of its money from aircraft engine maintenance contracts, which are based on miles flown.

For both, they dictate how much credit can be accessed and at what cost. They also influence how willing financial institutions are to discuss future opportunities for either.

All companies are ranked according to their overall creditworthiness by the world’s rating agencies. These range from levels of ‘speculative’ quality at the bottom to degrees of ‘investment’ quality at the top.

S&P had already increased its ranking for Rolls-Royce to investment grade earlier this year. The other two major global ratings agencies – Moody’s, and Fitch – also promoted it to that level in the past year or so.

This latest upgrade underlines that the company is consolidating its position in this most rarefied of credit rating brackets.

At its Capital Markets Day on 28 November last year, Rolls-Royce highlighted the securing of this top ranking as a key to its future growth.

A Clear Roadmap for Success

The firm committed back then to three broad strategies to be achieved by 2027. First, to become a high-performing, competitive, and resilient business. Second, to grow sustainable cash flows. And third, to build a strong balance sheet and to increase shareholder returns.

More specifically, it is targeting an operating profit of £2.5bn-£2.8bn, an operating margin of 13%-15%, and a return on capital of 16%-18% by that point. It also aims for free cash flow of £2.8bn-£3.1bn by then.

These targets imply significant growth from now, reflected so far in very strong full-year 2023 results and H1 2024 results.

Potential Challenges on the Horizon

The major risk to Rolls-Royce in my view is that the pace of expansion puts a strain on its production capabilities. In fact, Airbus stated on 25 June that Rolls-Royce engines for its A330neo were behind schedule.

Repeated comments of this nature would damage the firm’s reputation and ultimately damage sales prospects.

Rolls-Royce: A Value Stock With Exceptional Growth Prospects

That said, as of 21 August, S&P believes Rolls-Royce’s prospects are at least as good as the firm itself thinks.

The ratings agency expects adjusted EBITDA margins at 18%-19% in 2024 and 2025, and free operating cash flow of £2.1bn-£2.3bn in the same years.

It also expects the balance sheet to keep strengthening, with adjusted debt-to-EBITDA remaining well below 1.5 times in 2024-2025. This debt level is considered healthy for firms in its sector.

On the key price-to-earnings (P/E) stock valuation measurement, Rolls-Royce trades at 18.1.

This is at the bottom of its peer group, which averages a P/E of 34.6.

A discounted cash flow analysis shows the stock to be 57% undervalued at the present price of £4.97.

Therefore, a fair price for the stock would be £11.56, although it may go lower or higher than that.

If I did not already own other shares in the same sector, I would buy Rolls-Royce today for this extreme undervaluation and exceptional growth prospects.

Investors remain wary of airline stocks generally, as they realise what a bumpy sector this can be, vulnerable to war, terror, strike action, weather and volcanoes. Yet in the case of Rolls-Royce, investors are having too much fun to worry about that.

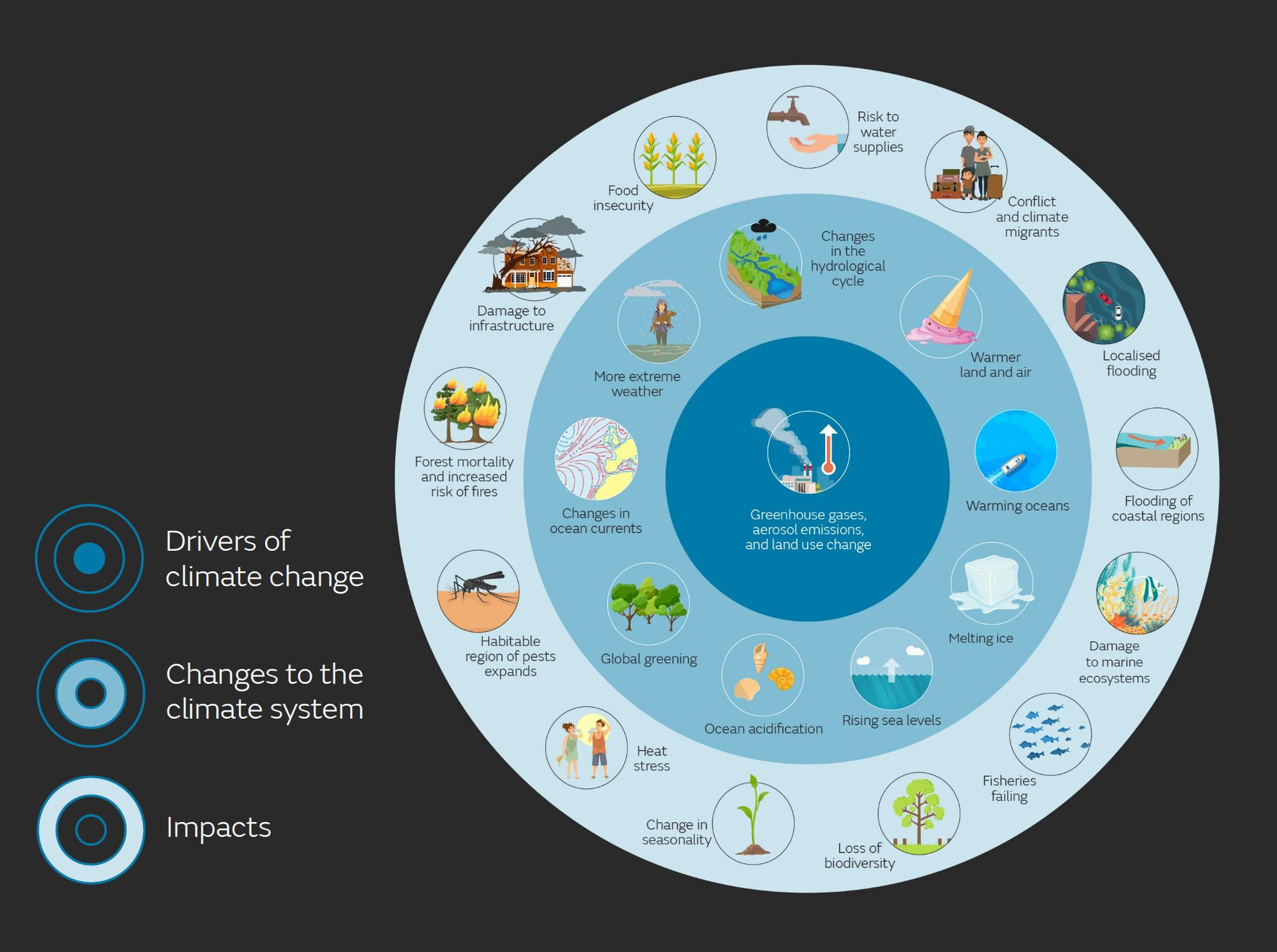

I could add recession to that list of troubles. If the US suffers a hard economic landing, business and consumer travel could fall and not just in the States. Given the high expectations built into the Rolls-Royce share price, even a slight revenue, earnings or margins miss could knock the share price.

Also, there’s a danger that we’re all investing too much in Mr Erginbilgic. He’s clearly done a brilliant job. But he was fortunate to take over after former CEO Warren East had navigated the worst. I like a lucky general as much as Napoleon did, but there’s a lot of hard work ahead.

Supply chain disruptions remain a worry, and looming trade wars won’t help. There’s a huge opportunity in the group’s proposed fleet of mini nuclear plants, but huge uncertainty, too. The green transition and volatile fuel and commodity prices could also drive up costs.

The Rolls-Royce share price is slowing, and I wouldn’t be surprised to see it idle or fall. I still think it’s an unmissable long-term buy-and-hold for me. I won’t be buying more shares at today’s valuation, but will definitely buy them on a dip.

The post Does another ratings upgrade set the stage for further Rolls-Royce share price gains? appeared first on The Motley Fool UK.