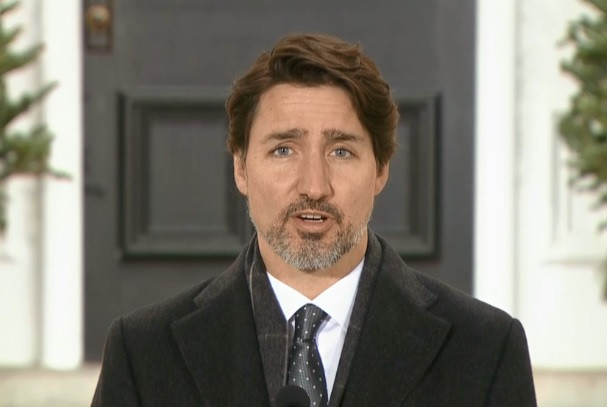

Trudeau's Holiday Surprise: $250 Cheques & a Two-Month GST Break for Canadians!

Prime Minister Justin Trudeau announced a suite of new measures to combat affordability pressures, including a two-month GST holiday on various goods and services, starting December 14th and running through February 15th, 2025. This follows two stinging byelection defeats and persistent unpopularity in the polls, with Trudeau's Liberals trailing the Conservatives by about 17 percentage points, according to CBC's Poll Tracker. The government aims to shore up public support with these cost-of-living initiatives.

A Holiday Tax Break

The GST/HST holiday will offer tax relief on a wide range of items, effectively making all food in Canada tax-free for two months. This includes staples like fresh, frozen, canned, and vacuum-sealed fruits and vegetables; breakfast cereals; milk products; meat, poultry, and fish; eggs; and coffee beans. The exemption also extends to restaurant meals, snacks, beer and wine, prepared foods, children’s toys, books, print newspapers, puzzles, and Christmas trees. The government estimates a family spending $2,000 on eligible goods will save around $100, with higher savings in provinces with HST (like Ontario, where savings could reach $260 on the same $2,000 spend).

Estimated Savings and Cost

The two-month GST holiday is projected to cost the federal treasury an estimated $1.6 billion in lost revenue. This significant financial commitment reflects the government's aim to provide substantial relief to Canadians struggling with rising costs of living. This initiative is coupled with another significant outlay: $4.68 billion for the "Working Canadians Rebate," a $250 cheque to be sent to the approximately 18.7 million Canadians who worked in 2023 and earned $150,000 or less. These cheques are expected to arrive in early spring 2025.

Political Fallout and Economic Implications

The government's affordability measures have sparked debate among political figures and economists. While Trudeau asserts the measures "are not going to stimulate inflation," citing the Bank of Canada's success in taming inflation to its two per cent target, concerns remain about the potential impact of additional stimulus on already elevated prices. Economists highlight that unprecedented government stimulus during the pandemic contributed to inflation. Finance Minister Chrystia Freeland echoed Trudeau’s confidence, stating that the Bank of Canada’s actions have put Canada on a more solid economic footing. She emphasized that "We've done the hard work we needed to do to get inflation down." However, Trudeau acknowledged the government’s significant debt, currently at $1.4 trillion, and the associated servicing costs of $54.1 billion for 2024-25.

Conservative Leader Pierre Poilievre criticized the measures as a temporary "trick," pointing to the permanent carbon tax hike scheduled for the spring as a counterpoint. He argued that the Liberals' economic policies haven't effectively addressed the rising cost of housing, food, and home heating, and that these new measures could exacerbate inflation. In contrast, NDP Leader Jagmeet Singh voiced his party’s support for the measures, emphasizing the need for middle-class relief and pledging to expedite passage through Parliament.

Parliamentary Logjam and NDP Support

The passage of the affordability measures hinges on securing the support of an opposition party, given the current parliamentary logjam stemming from a weeks-long standoff over documents related to a federal green technology program embroiled in scandal. The NDP, having previously advocated for permanent GST relief on essential items, has agreed to temporarily suspend their filibustering to allow the tax measures to pass. However, they maintain their commitment to a permanent GST break on essentials, highlighting the temporary nature of the Liberal proposal.

A Holiday Gift or Political Maneuvering?

The timing of the announcement, just before the holidays, raises questions about its intent. While the government frames it as genuine relief for struggling Canadians, critics see it as a politically motivated move to boost public approval. The debate highlights the complex interplay between economic policy, political strategy, and public perception. The measures present a mixed bag: while potentially offering short-term financial relief to many Canadians, concerns remain about long-term economic effects and the broader structural issues affecting affordability in the country. Ultimately, the success of the initiatives will depend not only on their immediate impact but also on the government’s ability to address the root causes of the economic challenges faced by Canadians. The measures’ lasting effectiveness will be judged not just by short-term financial relief, but by their contribution to sustainable economic stability and a broader solution to long-term affordability problems. Whether this holiday relief will translate into long-term support for the Liberals remains to be seen. The coming months will be crucial in evaluating the actual impact of these measures and whether they represent a genuine step toward easing financial pressures or simply a pre-election gesture.