AngloGold Ashanti Share Price Performance: A Closer Look

AngloGold Ashanti plc (NYSE:AU) has been a standout performer in the stock market, with its share price surging a remarkable 76% over the past three years. This impressive growth far outpaces the overall market return of around 13% (excluding dividends), attracting attention from investors seeking to outperform the average market return.

While the stock's recent performance is captivating, it's crucial to delve deeper into the company's fundamentals to understand whether this surge is driven by genuine business growth or simply a wave of positive market sentiment.

Earnings Per Share (EPS) and Market Sentiment

The relationship between a company's share price and its earnings per share (EPS) can offer valuable insights into how market perception has evolved over time. AngloGold Ashanti's recent profitability within the last three years is generally considered a positive development, aligning with the expectation of an upward trend in share price.

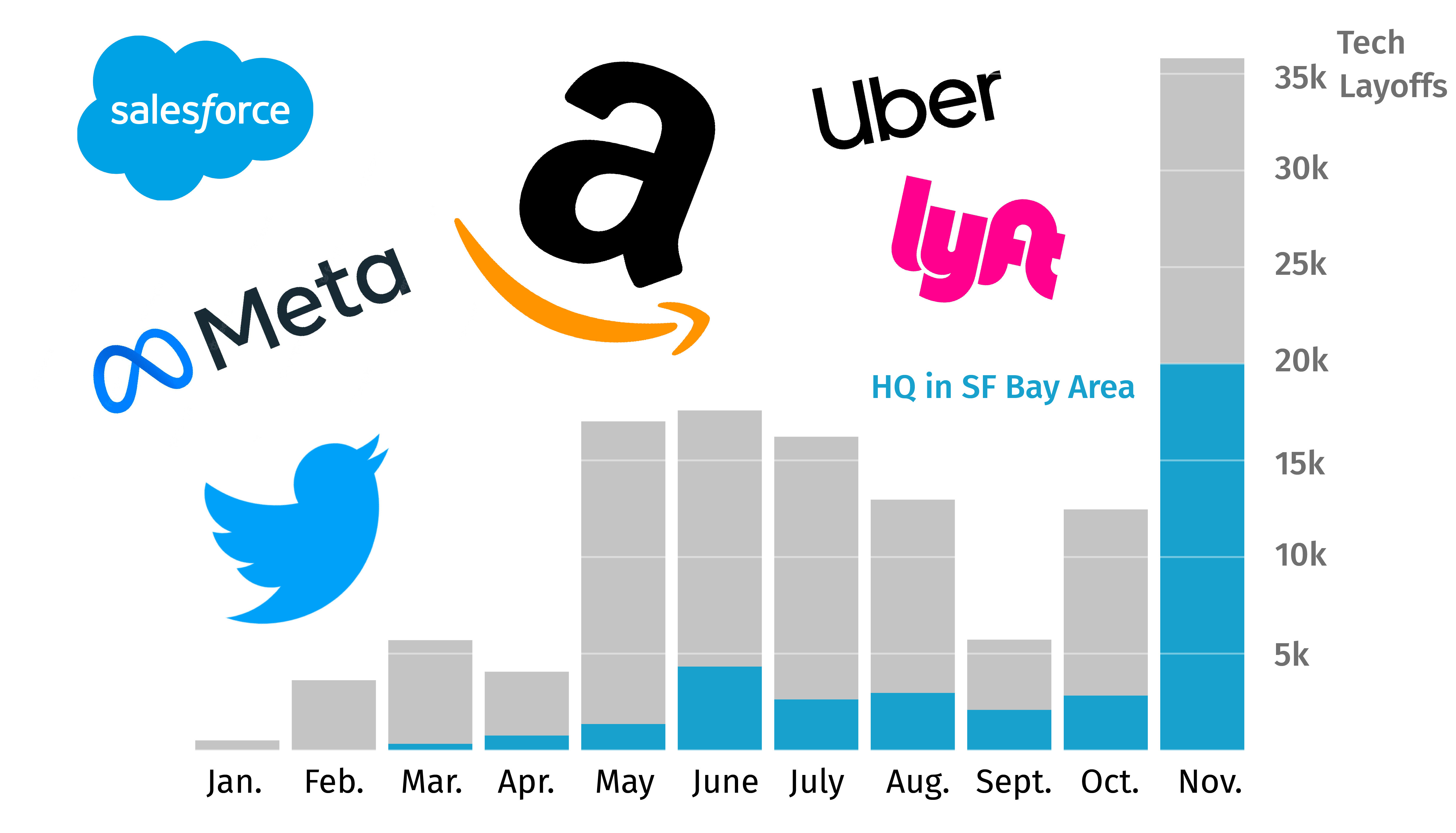

Examining AngloGold Ashanti's EPS Trajectory

The graphic below illustrates how AngloGold Ashanti's EPS has changed over time. By clicking on the image, you can access the precise values to gain a more comprehensive understanding of the company's earnings growth trajectory.

CEO Remuneration and Future Growth Potential

While CEO compensation is always worth considering, the paramount question is whether the company can sustain and grow its earnings in the future. It's reassuring to note that AngloGold Ashanti's CEO is compensated more modestly than most CEOs at companies with similar market capitalizations.

Total Shareholder Return (TSR): A More Comprehensive Picture

When evaluating investment returns, it's important to look beyond share price return and consider total shareholder return (TSR). TSR encompasses the value of dividends (assuming reinvestment), as well as any discounted capital raisings or spin-offs. This broader perspective offers a more holistic view of the return generated by a stock.

For AngloGold Ashanti, the TSR over the last three years has reached 84%, exceeding the share price return. This impressive TSR is largely attributed to the company's dividend payments, highlighting their significant contribution to shareholder returns.

Recent TSR Performance: A Positive Sign?

AngloGold Ashanti has rewarded shareholders with a remarkable 77% TSR over the past year, including dividends. This outperformance surpasses the company's five-year annual TSR of 9%. The recent positive TSR trend suggests a growing optimism surrounding the company's prospects.

Beyond Share Price: A Deeper Dive

While tracking share price performance is valuable, understanding AngloGold Ashanti requires considering a broader range of factors. It's essential to identify potential risks and delve into the company's underlying business operations to gain a more comprehensive perspective. For instance, we've identified one warning sign for AngloGold Ashanti that investors should be aware of.

Conclusion: A Promising Future, But With Cautions

AngloGold Ashanti's impressive share price performance and recent TSR gains are undoubtedly positive signs. However, investors should not solely rely on these metrics. A thorough examination of the company's fundamentals, including potential risks, is crucial to make informed investment decisions. Ultimately, the company's ability to sustain and grow earnings will be a key determinant of its future success.

Finding Undervalued Gems

If you're seeking undervalued gems with growth potential, this free list of undervalued small caps that insiders are buying might be of interest.

Disclaimer

Please note that the market returns quoted in this article represent the market-weighted average returns of stocks currently traded on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based solely on historical data and analyst forecasts, employing an unbiased methodology. Our articles are not intended to be financial advice. They do not constitute a recommendation to buy or sell any stock and do not take into account your objectives, financial situation, or needs. Our goal is to deliver long-term focused analysis driven by fundamental data. It's important to note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.