Boeing's Future: A New Airplane or a Bleak Outlook?

The long-term case for buying Boeing (NYSE: BA) stock is powerful. After all, despite its issues in recent years, the company's global market position won't disappear anytime soon. In addition, Boeing has almost 6,200 unfilled orders, and many of its issues are in its own hands. With a new and highly respected CEO, Kelly Ortberg, at the helm, Boeing's best days lay ahead.

Former CEO Dave Calhoun pulled back on plans to develop a mid-sized airplane after he took over in early 2020, and last year, he told the market that there wouldn't be a new airplane in place before 2035.

Will Boeing Be Able to Fund a New Airplane?

Developing new airplanes, let alone a pivotal one like a new narrowbody airplane from Boeing or Airbus, is costly and time-consuming. As Boeing investors know, concerning the 737 MAX, it also involves risk.

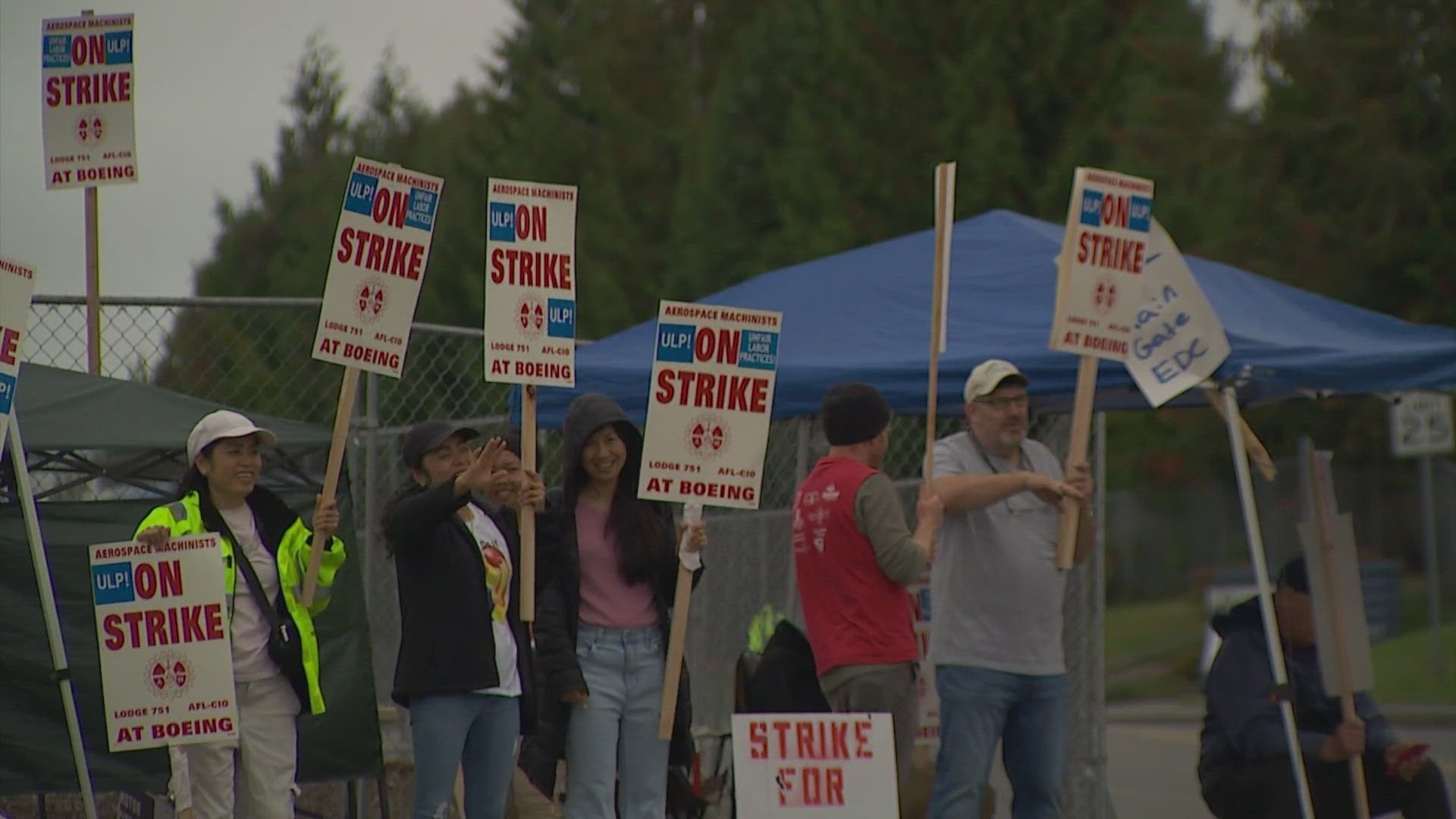

Unfortunately, a combination of high-profile crashes (which led to the plane's grounding), travel lockdowns imposed on the populace, and quality control issues (such as the blowout on an Alaska Air flight earlier in the year) on the 737 MAX mean that Boeing's long-term plans are in jeopardy.

Boeing's Financial Woes

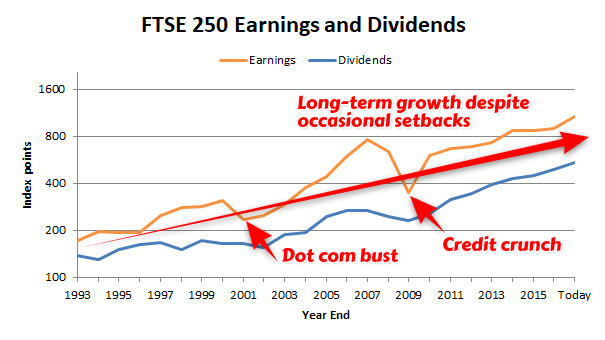

Typically, the years after a new airplane is released are characterized by a gradual increase in production, which leads to margin expansion as volume increases and Boeing learns how to lower the airplane's cost per unit of production. This is supposed to be a period of significant earnings and cash flow increases for Boeing. However, it's been anything but that with the 737 MAX. The first 737 MAX was delivered in late 2018, and here's how Boeing's free cash flow (FCF) has gone down while net debt ballooned simultaneously.

Data source: Boeing presentations. Estimates are Wall Street consensus from marketscreener.com

As such, Boeing will have to use a lot of the FCF in the coming years to pay down debt. That could negatively impact its ability to invest in developing a new airplane.

The issue is compounded by ongoing losses at Boeing's defense arm, which also drains cash. Meanwhile, it's uncertain if Boeing will need to invest in fuselage supplier Spirit AeroSystems after it completes its intended acquisition in mid-2025.

As such, at least one Wall Street analyst thinks Boeing will have to dilute existing shareholders by raising cash through selling equity in the business. The logic makes perfect sense because if there's one thing that's certain, Boeing will do anything it can to protect its investment rating and fund the development of a new airplane, particularly a narrowbody.

Two Possible Outcomes

A glass-half-full view sees Boeing successfully ramping its commercial airplanes and delivering on its backlog while profit margins increase in line with volume increases. In addition, the rosy view sees Boeing passing through developmental milestones in its problematic fixed-price contracts in its defense business. If it does so, Boeing can avoid an equity raise, even though it may need to issue more debt at some point. Boeing is an integral part of the U.S. economy and tends to be America's largest manufacturing exporter.

If Boeing's investment rating is in good shape and the FCF improvements that Wall Street expects will happen (see chart above), it will significantly help. Boeing will surely be able to issue debt without diluting existing shareholders, and a new plane will be funded.

A glass-half-empty view also sees Boeing delivering a new narrowbody by the end of the next decade but having to dilute existing shareholders through an equity raise. Given that its current market cap is only $97 billion, a multibillion-dollar equity raise would significantly dilute existing shareholders. Moreover, Boeing will likely do that if it's not ramping up commercial airplane deliveries and/or failing to raise defense company margins.

Boeing's Future: A Long-Term Play

Given its backlog, lowly valuation (based on the Wall Street consensus for FCF of $8 billion in 2026 and its market cap of just $97 billion), and potential for improvement under Ortberg, it's hard not to see Boeing's stock going significantly higher over the next decade in both scenarios discussed above.

That said, entry points into stocks matter, and returns on Boeing stock may be much higher if it avoids an equity raise than if it has one after you buy the stock. For many investors, monitoring the stock for tangible improvement signs before buying makes sense. However, for long-term investors who are able to tolerate the potential for near-term bad news, Boeing looks attractive.

Before You Buy Stock in Boeing, Consider This:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Boeing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $662,392!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 9, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.