ASX300 Daily Winners and Losers: August 2nd, 2024

The Australian Securities Exchange (ASX) witnessed a flurry of activity on August 2nd, 2024, with a multitude of stocks experiencing significant price swings. This daily report delves into the top performers and laggards within the ASX300, providing insights into the market dynamics that shaped the day's trading session.

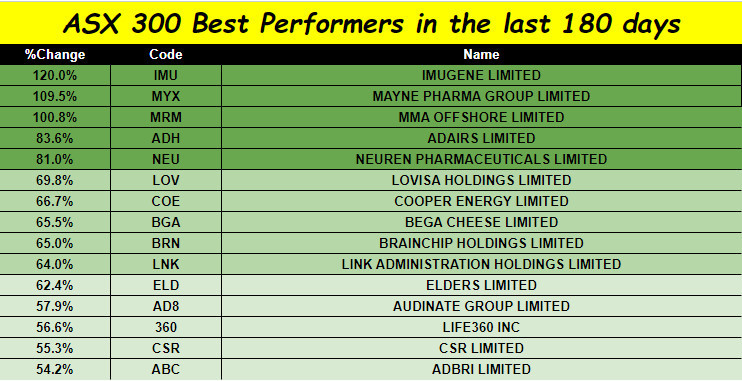

Top Gainers: A Glimpse into the Rising Stars

The top 20 gainers on the ASX300 on August 2nd, 2024, showcased strong upward momentum, attracting investor attention with their impressive performance. These stocks, representing a diverse range of sectors, demonstrated resilience and growth potential, driving investor optimism.

Key Factors Influencing Gains

Several key factors contributed to the rise in stock prices, including:

- Positive Earnings Reports: Stronger-than-expected earnings reports from several companies boosted investor confidence and fuelled a surge in stock prices. Companies exceeding analysts' revenue and profit projections often see their share prices appreciate as investors anticipate future growth.

- Industry-Specific Tailwinds: Certain sectors experienced positive industry-specific developments, driving up the prices of related stocks. For example, rising commodity prices could benefit mining companies, while favorable government policies could propel growth in the renewable energy sector.

- Market Sentiment: Overall market sentiment played a significant role in driving stock prices. A bullish market, characterized by investor optimism and a belief in continued economic growth, can lead to widespread stock price appreciation.

Top Losers: Understanding the Declining Stocks

While some stocks soared, others faced downward pressure on August 2nd, 2024. The top 20 losers on the ASX300 experienced a decline in their share prices, reflecting various challenges and headwinds.

Factors Contributing to Losses

Several factors can contribute to a decline in stock prices, including:

- Disappointing Earnings Reports: Companies failing to meet analysts' expectations for earnings and revenue often witness a drop in their share prices. Negative earnings surprises can indicate underlying business challenges or a slowdown in growth.

- Industry-Specific Headwinds: Certain sectors might experience headwinds due to industry-specific challenges. For example, increased competition or regulatory changes could negatively impact specific industries, leading to a decline in stock prices.

- Market Volatility: Fluctuations in the broader market can impact individual stocks, even those performing well. Increased market volatility can lead to profit-taking by investors, resulting in downward pressure on stock prices.

Beyond the Numbers: A Deeper Dive

The daily ranking of ASX300 winners and losers offers a snapshot of the market's direction. However, understanding the underlying factors driving these changes is crucial for investors. It's important to consider factors beyond just the price movement, such as the company's financials, industry trends, and overall market sentiment.

The Importance of Context and Interpretation

While the rankings provide a useful starting point for understanding daily market volatility, it's essential to seek context and interpretation beyond raw data. Investors should consider factors such as:

- Company fundamentals: Analyzing a company's financial statements, management team, and competitive landscape provides insights into its long-term prospects and ability to generate sustainable returns.

- Industry trends: Understanding the broader trends within a company's industry can help assess its potential for growth or challenges. For example, the rise of e-commerce has significantly impacted traditional retail businesses.

- Economic environment: Factors such as interest rates, inflation, and government policies can influence stock prices. Understanding the current economic environment provides context for interpreting market movements.

The Bottom Line: Navigating the Market

The daily winners and losers on the ASX300 reflect the dynamic nature of the stock market. Investors should approach these rankings with a critical eye, considering a wide range of factors beyond just the price movements. By understanding the underlying causes and interpreting data in context, investors can make more informed decisions and navigate the complexities of the market successfully.