The Taxing of Unrealized Appreciation: A Bold Policy with Uncertain Consequences

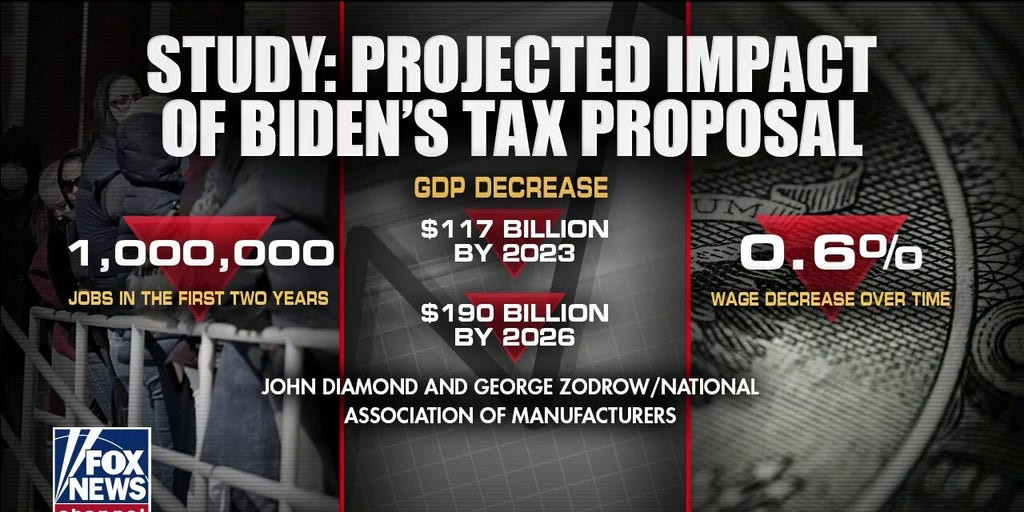

The 2024 presidential campaign has witnessed a growing divide between left and right on the issue of taxing unrealized appreciation of assets. President Joe Biden has championed this idea, arguing that it addresses the “inefficient sheltering of income for decades or generations” by the wealthiest Americans. He contends that the “billionaire minimum tax” is a fair measure, generating $360 billion to offset costs for families and reduce the deficit. However, critics, including billionaire investor Mark Cuban, warn of its potential to cripple the economy.

The “Billionaire Minimum Tax”: A Deep Dive into its Mechanics

This tax plan primarily targets individuals with a net worth of $100 million or more. It imposes a minimum 25% tax on the total unrealized appreciation of all capital assets, including stocks, bonds, real estate, and even art. The plan also extends the tax to unrealized appreciation at death, effectively replacing the existing estate tax.

Is Taxing Unrealized Appreciation Really a Fair Approach?

While the Biden administration champions this policy as a means to tackle wealth inequality, critics argue it has far-reaching negative consequences. Here are some key criticisms:

-

Disincentivizes Investment: Taxing unrealized appreciation discourages investment, as it effectively penalizes those who hold assets for long periods. This can lead to a slowdown in economic growth.

-

Creates Market Volatility: The need to sell assets to pay the tax could trigger widespread selling, creating significant market instability and volatility.

-

Challenges Valuation: The value of assets, particularly those held by the ultra-wealthy, can be challenging to determine. This creates difficulties in accurately calculating and enforcing the tax.

-

Distorts the Tax Code: It disrupts the established principle of taxing only realized income, creating a complex and potentially unfair tax system.

-

May Not Deliver Expected Revenue: Taxing unrealized appreciation might not generate the anticipated revenue. Wealthy individuals could find ways to shield assets or reduce their overall holdings, impacting the government's tax collection.

The Consumption Tax: An Alternative Perspective

The debate surrounding the Biden administration's tax proposal has sparked renewed interest in the consumption tax as a potential alternative. This tax model focuses on taxing spending rather than income, with the goal of encouraging saving and investment.

Advantages of a Consumption Tax:

-

Promotes Economic Growth: By taxing spending rather than income, a consumption tax incentivizes saving and investment, potentially leading to higher economic growth.

-

Simplicity: A consumption tax simplifies the tax code, eliminating the need for complex rules and regulations surrounding different types of income and assets.

-

Neutrality: It treats all sources of income equally, removing the need for special treatment of capital gains or other investment income.

Challenges of a Consumption Tax:

-

Higher Rates: A consumption tax might require higher rates to generate the same revenue as an income tax.

-

Impact on Low-Income Households: A consumption tax could disproportionately impact low-income households, as they spend a higher proportion of their income on essential goods and services.

Transitioning Towards a Consumption Tax:

Despite the potential benefits of a consumption tax, shifting away from an income-based system presents significant challenges. Many argue that gradually phasing in a consumption tax system while gradually reducing reliance on the current income tax structure could be a prudent approach.

The Uncertain Future of Tax Policy

The debate over the Biden administration's tax proposal and the broader conversation surrounding consumption taxes highlight the complex and evolving nature of tax policy. As the world grapples with economic challenges, the need for a sustainable and equitable tax system that promotes both growth and fairness will remain a critical issue.

Looking Ahead: Finding Common Ground in Tax Reform

Ultimately, achieving a tax system that benefits all Americans requires a commitment to constructive dialogue and a willingness to find common ground. While the Biden administration's tax proposal has sparked controversy, it offers a valuable starting point for a broader conversation about how to ensure a fairer and more sustainable tax system for the future.