Carbon Credit Trading Platform Market: A Thriving Sector Driven by Non-State Actors

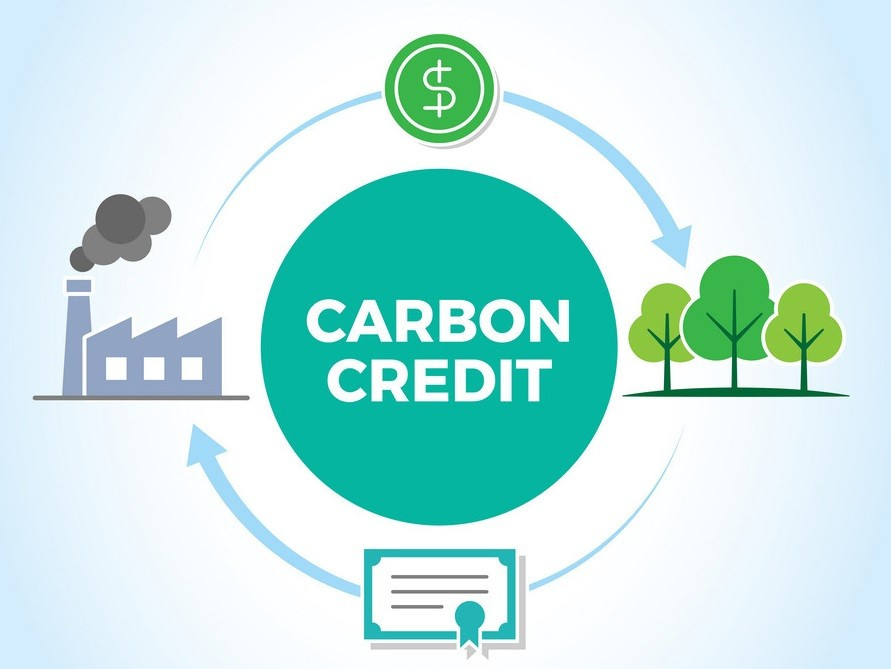

The global carbon credit trading platform market is a dynamic and growing sector within the broader environmental and financial markets. It focuses on facilitating the buying and selling of carbon credits, which are tradeable certificates or permits representing the reduction of one metric ton of carbon dioxide or its equivalent in other greenhouse gases.

Market Value and Growth Projections

The global carbon credit trading platform market is projected to reach USD 159.3 million in 2024, with a notable growth trajectory driven by increased involvement from non-state actors. This trend is expected to open up new opportunities within the market, leading to a projected Compound Annual Growth Rate (CAGR) of 17.7% from 2024 to 2034. By 2034, the market is anticipated to achieve a valuation of approximately USD 815.0 million.

The expansion of the carbon credit trading market is largely fueled by collaborations and partnerships among governments, businesses, environmental organizations, and technology providers. These strategic alliances are fostering innovation and scalability, promoting the development of integrated solutions, enhancing market interoperability, and generating new business models within the carbon credit ecosystem.

As the market evolves, these cooperative efforts are crucial in advancing the effectiveness and reach of carbon credit trading. "Expansion of decentralized finance platforms presents opportunities to innovate within the carbon credit trading market. DeFi solutions leveraging blockchain technology enable peer to peer trading of carbon credits, automated smart contracts for carbon offset projects, and decentralized carbon credit registries, fostering greater transparency and accessibility in the market," - says Nikhil Kaitwade, Associate Vice President at Future Market Insights (FMI).

Prominent Drivers of the Carbon Credit Trading Platform Market

Several factors are driving the growth of the carbon credit trading platform market:

- Increased participation of non-state actors: Non-state actors, such as corporations, financial institutions, and NGOs, are increasingly participating in carbon credit markets, driving demand for trading platforms.

- Growing awareness of climate change: The growing awareness of climate change and the need to mitigate its effects is leading to increased demand for carbon credits and trading platforms.

- Government regulations: Governments around the world are introducing regulations and policies to encourage the use of carbon credits, such as cap-and-trade systems and carbon taxes, which are further driving market growth.

Challenges Faced by the Carbon Credit Trading Platform Market

Despite the promising growth potential, the carbon credit trading platform market faces several challenges:

- Regulatory uncertainty: Fluctuations in regulations and policies across different regions can create uncertainty and impact market stability.

- Market fragmentation: The presence of multiple carbon markets with varying standards and rules can lead to fragmentation, complicating market interoperability.

- Verification and transparency issues: Ensuring the accuracy and transparency of carbon credits is crucial. Issues with verification and tracking can undermine market credibility.

- Price volatility: The carbon credit market can experience significant price volatility, which can affect investment and trading decisions.

- Technological integration: Integrating new technologies such as blockchain into existing systems can be complex and costly, posing challenges for platform development.

Key Players

The carbon credit trading platform market is dominated by a few key players, including:

- Climate Trade: Climate Trade is a leading platform for carbon credit trading and project development, offering a wide range of services, including market analysis, project development, and carbon credit trading.

- Verra: Verra is a non-profit organization that develops and manages carbon offset standards and registries, including the Verified Carbon Standard (VCS), which is a widely recognized standard for carbon offsets.

- Gold Standard: Gold Standard is another non-profit organization that develops and manages carbon offset standards, focusing on projects with additional social and environmental benefits.

Regional Analysis for the Carbon Credit Trading Platform Market

The carbon credit trading platform market is growing rapidly in all regions of the world, but the fastest growth is expected to occur in Asia Pacific, followed by North America and Europe.

Key Segmentations

The carbon credit trading platform market is segmented based on:

- Type: Voluntary carbon credits, compliance carbon credits

- System Type: Blockchain-based platforms, traditional platforms

- End Use: Energy, manufacturing, transportation, agriculture, forestry

- Region: North America, Europe, Asia Pacific, Middle East and Africa, South America

Conclusion: A Promising Future for the Carbon Credit Trading Platform Market

The global carbon credit trading platform market is poised for significant growth in the coming years. The growing awareness of climate change, the increasing participation of non-state actors, and the development of new technologies are all contributing to the market's expansion. However, challenges remain, such as regulatory uncertainty, market fragmentation, and the need for greater transparency and verification. As the market continues to evolve, it will be important to address these challenges to ensure the integrity and effectiveness of carbon credit trading.