Copart, Inc. (CPRT) reported quarterly earnings of $0.33 per share, missing the Zacks Consensus Estimate of $0.37 per share. This compares to earnings of $0.34 per share a year ago. These figures are adjusted for non-recurring items.

Copart, which belongs to the Zacks Auction and Valuation Services industry, posted revenues of $1.07 billion for the quarter ended July 2024, surpassing the Zacks Consensus Estimate by 0.39%. This compares to year-ago revenues of $997.59 million. The company has topped consensus revenue estimates three times over the last four quarters.

The sustainability of the stock's immediate price movement based on the recently-released numbers and future earnings expectations will mostly depend on management's commentary on the earnings call.

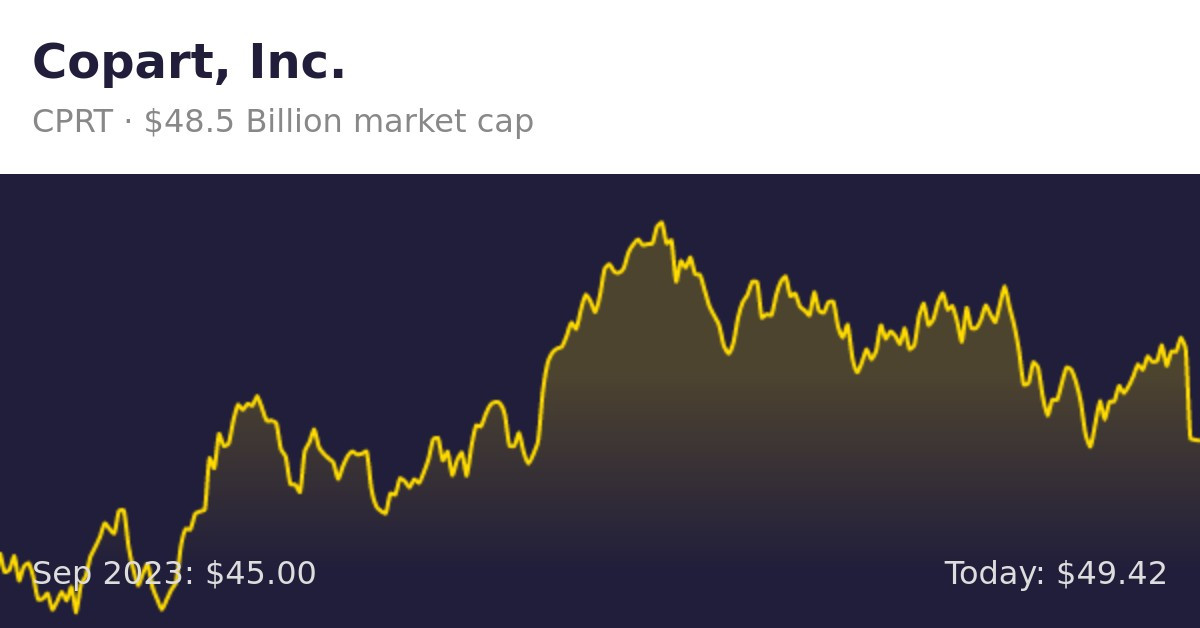

Copart shares have added about 9.2% since the beginning of the year versus the S&P 500's gain of 15.9%.

While Copart has underperformed the market so far this year, the question that comes to investors' minds is: what's next for the stock?

There are no easy answers to this key question, but one reliable measure that can help investors address this is the company's earnings outlook. Not only does this include current consensus earnings expectations for the coming quarter(s), but also how these expectations have changed lately.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. Investors can track such revisions by themselves or rely on a tried-and-tested rating tool like the Zacks Rank, which has an impressive track record of harnessing the power of earnings estimate revisions.

Ahead of this earnings release, the estimate revisions trend for Copart: mixed. While the magnitude and direction of estimate revisions could change following the company's just-released earnings report, the current status translates into a Zacks Rank #3 (Hold) for the stock. So, the shares are expected to perform in line with the market in the near future.

It will be interesting to see how estimates for the coming quarters and current fiscal year change in the days ahead. The current consensus EPS estimate is $0.37 on $1.12 billion in revenues for the coming quarter and $1.61 on $4.69 billion in revenues for the current fiscal year.

Investors should be mindful of the fact that the outlook for the industry can have a material impact on the performance of the stock as well. In terms of the Zacks Industry Rank, Auction and Valuation Services is currently in the top 40% of the 250 plus Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Copart's Q4 Earnings Miss Highlights Challenges

Copart Inc. CPRT shares are trading lower after the company reported its fourth-quarter financial results after Wednesday's closing bell. Here's a look at the details from the report.

The Details: Copart reported quarterly earnings of 33 cents per share, which missed the analyst consensus estimate by 8.33%. Quarterly revenue came in at $1.068 billion, which missed the analyst consensus estimate of $1.081 billion. Gross profit and net income were $454 million and $323 million, respectively.

For the fiscal year ending July 31, 2024, revenue, gross profit, and net income were $4.2 billion, $1.9 billion, and $1.4 billion, respectively. These represent an increase in revenue of $367.3 million, or 9.5%; an increase in gross profit of $170.3 million, or 9.8%; and an increase in net income of $125.3 million, or 10.1%, respectively, from the same period last year.

CPRT Price Action: According to Benzinga Pro, Copart shares are down 5.56% after-hours at $50.10 at the time of publication Wednesday.

The Challenges Ahead for Copart

Copart's recent earnings report highlights a mixed performance, with revenue growth countered by rising costs and profitability challenges. The company has been industriously investing to enhance capacity by expanding its infrastructure and real estate, racking up its operating expenses.

The company has also absorbed modest impacts of dropping value for used cars, squeezing auction selling prices.

Analysts are focusing on several key factors that could impact Copart's future performance.

-

Cost Management: Copart's expansion efforts have driven up operating expenses, particularly in yard operations and general and administrative areas. Investors will be watching closely to see how the company manages these costs and improves profitability in the coming quarters.

-

Macroeconomic Factors: The used-car market is highly sensitive to economic conditions, with factors like interest rates, consumer confidence, and inflation impacting demand. Copart's ability to navigate these macroeconomic challenges will be crucial for its success.

-

Competition: The online vehicle auction market is increasingly competitive, with players like IAA and KAR Auction Services vying for market share. Copart's ability to maintain its leadership position and attract customers through innovative platforms and services will be essential.

Investing in Copart: A Cautious Approach

Despite the challenges, Copart remains a leader in the online vehicle auction space. Its global reach, strong brand recognition, and commitment to technological innovation give it a competitive edge. However, investors should take a cautious approach, considering the company's near-term profitability pressures and the uncertainty surrounding the used-car market.

Investors looking to invest in Copart should carefully consider the company's risk factors, the industry's outlook, and the potential for continued growth. Copart's ability to manage its costs, navigate macroeconomic challenges, and maintain its competitive edge will determine its long-term success.

Looking Ahead: What to Watch for in Copart's Future

Despite the current dip in earnings, Copart is still a company to watch. The company's expansion and technological advancements, particularly in AI and machine learning, could drive future revenue growth and boost efficiency.

Here are some key areas to watch:

-

Cost Management: Investors will be looking for evidence that Copart is effectively managing its costs and improving profitability margins.

-

Global Expansion: Copart's growth strategy hinges on expanding its global footprint. Investors should pay attention to the company's progress in new markets and its ability to adapt to local conditions.

-

Technological Advancements: Copart's investments in AI-driven platforms could enhance its auction processes, attract new customers, and provide a competitive advantage. Investors should monitor the company's progress in implementing these technologies and their impact on its operations.

The Final Word: Copart's Future is Uncertain

Copart's recent earnings report has brought the company's challenges to light. Investors should remain cautious, considering the company's near-term profitability pressures and the uncertainty surrounding the used-car market. However, Copart's long-term prospects are promising, with its global reach, strong brand, and commitment to innovation positioning it for continued growth. Time will tell how the company will navigate these challenges and deliver sustainable value for its shareholders.