A few weeks ago, I started researching trips for my family and me over the winter holiday season. After pricing out flights, hotels, and rental cars for vacations in Europe or tropical islands, I decided to pivot my planning. While it's been 15 years since my last cruise, I was able to find deals that were affordable for a family of three. But I wanted to make sure that if we booked the cruise now, we'd have proper coverage in case something stood in our way from going in December.

While some travel insurance policies cover cruises, not all do. I decided to look into getting cruise travel insurance. Here's what it covers and how much it would cost for a family of three.

What Is Cruise Travel Insurance?

Cruise travel insurance is a type of insurance that provides coverage for cruise-related events. It offers similar coverage to standard travel insurance but includes additional add-on benefits specifically for cruises. The coverage provided by cruise travel insurance can vary depending on the policy, but typically includes:

- Trip cancellation: This coverage reimburses you for non-refundable cruise expenses if you need to cancel your trip due to a covered reason, such as illness, injury, death, or natural disaster.

- Trip interruption: This coverage helps cover the cost of getting home if your cruise is interrupted due to a covered reason.

- Medical expenses: This coverage provides financial assistance for medical expenses incurred during the cruise, including emergency medical evacuation.

- Baggage loss or damage: This coverage reimburses you for lost or damaged luggage.

- Personal liability: This coverage protects you from financial responsibility if you accidentally injure someone or damage property during the cruise.

Why You Need Cruise Travel Insurance

There are several reasons why cruise travel insurance is important for families.

- Peace of mind: Cruise travel insurance can provide peace of mind knowing that you're covered in case of unexpected events.

- Financial protection: Cruise travel insurance can help you avoid significant financial losses if your cruise is canceled or interrupted.

- Medical coverage: Cruise travel insurance offers medical coverage that can be crucial in case of a medical emergency while at sea.

What's Covered by Cruise Travel Insurance?

- Trip cancellation: This coverage reimburses you for non-refundable cruise expenses if you need to cancel your trip due to a covered reason.

- Trip interruption: This coverage helps cover the cost of getting home if your cruise is interrupted due to a covered reason.

- Medical expenses: This coverage provides financial assistance for medical expenses incurred during the cruise, including emergency medical evacuation.

- Baggage loss or damage: This coverage reimburses you for lost or damaged luggage.

- Personal liability: This coverage protects you from financial responsibility if you accidentally injure someone or damage property during the cruise.

Additional Coverage Options

In addition to the standard coverage options listed above, many cruise travel insurance policies offer additional add-on benefits that can be customized to your specific needs. These benefits include:

- Cancel for any reason: This coverage allows you to cancel your trip for any reason and receive a partial refund, typically 75% of the cost of your trip.

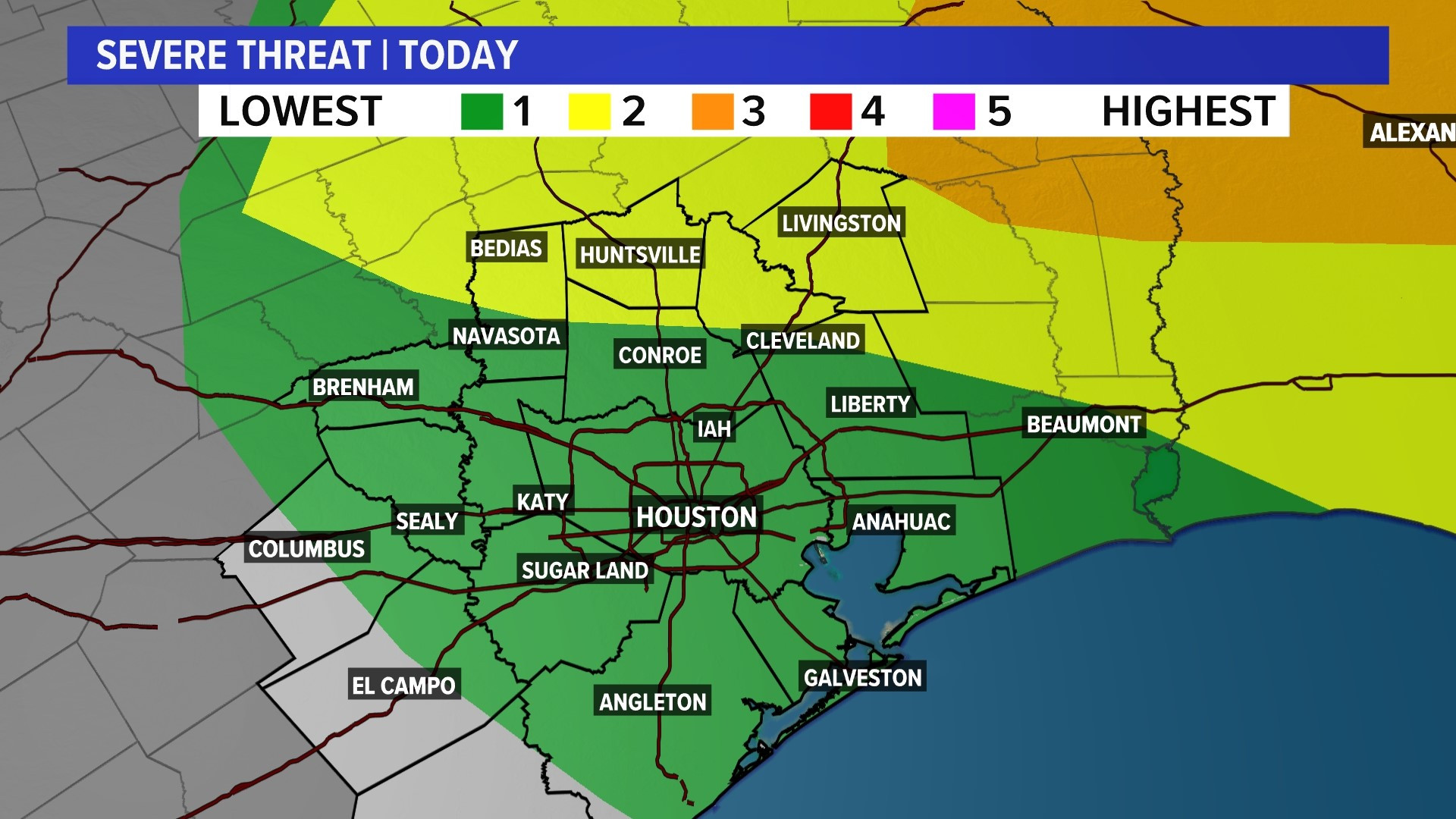

- Hurricane and weather: This coverage provides reimbursement for the cost of your cruise if it is canceled or interrupted due to a hurricane or other severe weather event.

- Medical evacuation: This coverage covers the cost of transporting you to a medical facility or back home if you require medical attention during your cruise.

- Repatriation: This coverage helps cover the cost of returning your body back home if you die during your cruise.

How Much Does Cruise Travel Insurance Cost?

The cost of cruise travel insurance varies depending on factors such as:

- Age of travelers: Younger travelers typically pay less for insurance than older travelers.

- Destination: Cruises to destinations with higher medical costs tend to be more expensive to insure.

- Length of cruise: Longer cruises typically cost more to insure.

- Type of coverage: The more coverage you choose, the more expensive the insurance will be.

Where to Buy Cruise Travel Insurance

Cruise travel insurance can be purchased from a variety of sources, including:

- Travel insurance brokers: These brokers compare quotes from multiple insurance companies to find the best deal for you.

- Cruise lines: Some cruise lines offer their own insurance plans.

- Travel agents: Many travel agents can help you purchase travel insurance.

Tips for Buying Cruise Travel Insurance

When buying cruise travel insurance, consider the following tips:

- Compare quotes: Get quotes from multiple insurance companies to compare prices and coverage.

- Read the fine print: Carefully review the policy document to understand the coverage and exclusions.

- Choose the right coverage: Select a policy that provides adequate coverage for your needs.

- Consider add-on benefits: Decide if you need any add-on benefits, such as cancel for any reason or hurricane and weather coverage.

Conclusion

Cruise travel insurance is a valuable investment for families traveling by cruise ship. It can provide peace of mind, financial protection, and medical coverage. When purchasing cruise travel insurance, compare quotes, read the policy document, and choose the right coverage for your needs. While cruise insurance policies offer a lot of the same coverage as travel insurance policies, they also offer additional add-on benefits that are relevant to cruises. I used a cruise travel insurance comparison site to find a plan through WorldTrips that covers all three of us for $386. As I searched through quotes from different cruise travel insurance companies, I was able to select add-on coverage that I felt we needed. A lot of these options aren't usually offered with standard travel insurance. For example, I added a hurricane and weather benefit. We live in New York City, and the cruise is in December. In case we're hit with a snowstorm or inclement weather, this policy allows us to cancel the cruise and receive a reimbursement. Without this coverage, we could miss the cruise and lose thousands of dollars. One offering that cruise travel insurance companies usually have is a cancel for any reason upgrade. If we decide in the winter months not to go on the cruise anymore for no specific reason, we're able to get 75% of the cost of our trip back. This perk is usually an add-on for cruise travel insurance policies, but it is worth it. Even though it doesn't give you a full refund, it allows you to recoup most of your cruise costs if you no longer want to go. The typical trip cancellation benefit offered by travel insurance companies only provides reimbursement if the trip is canceled due to specific things like illness, injury, or death. One of the biggest reasons I wanted cruise travel insurance for my family was to cover any and all medical costs that could happen while we're out at sea. In addition to standard coverage, like emergency medical coverage (the plan I picked offers $100,000 per person in coverage), the plan also covers medical evacuation and repatriation, up to $250,000 per person. This is important to me because if one of us gets very ill and has to be transported to a medical facility or return back home, this benefit covers the costs of that.