GBPJPY Breaks Above Pivotal 200DMA: Bullish Continuation Signal Emerges

GBPJPY rose to a one-month high on Monday and generated an initial signal of bullish continuation on a probe above the top of the month-long range (192.16), reinforced by the 200-day moving average (DMA).

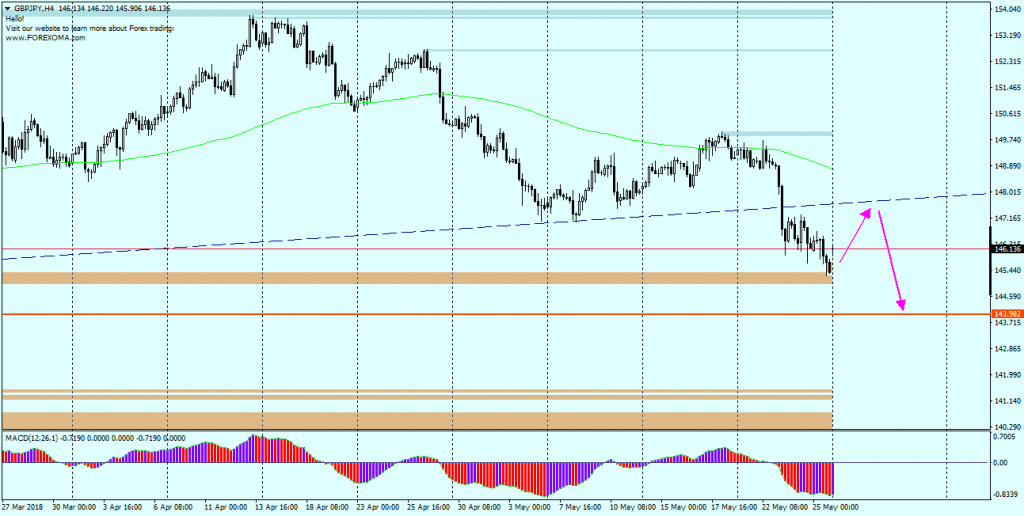

Breakout Confirmation and Upside Potential

A firm break above this level would confirm the bullish signal and open the way for fresh upside. The immediate target is at 194.10, representing the 50% retracement of the 208.11/180.09 downtrend. A breach of this level would then expose further barriers at the 197.00 zone.

Positive Technical Indicators

Improving daily studies, including a Tenkan-sen / Kijun-sen bull-cross and strong positive momentum, contribute to a brighter outlook. However, the reaction at the 200DMA will be a key factor to watch.

Caution on a False Break

Caution is warranted if the price fails to clear the 200DMA, as this could signal a false break higher and keep the price in an extended sideways mode.

Key Resistance and Support Levels

- Resistance: 193.25, 194.10, 195.86, 196.92

- Support: 192.16, 191.33, 190.79, 189.60

Fundamental Considerations

While the technical picture appears bullish, fundamental factors could also influence the GBPJPY trajectory. The Bank of Japan's hawkish stance on monetary policy, coupled with rising inflation in Tokyo, supports a potential for further rate hikes. However, recent weak manufacturing data in Japan has led to speculation that the BoJ might postpone further tightening.

At the same time, the Bank of England is expected to maintain a more hawkish stance than the BoJ, with the possibility of a 25 basis points interest rate cut in November. This could favor the GBPJPY pair in the longer term.

Impact of Carry Trade

The carry trade remains a major factor in GBPJPY dynamics. If this trade continues to be favorable, the market could surge higher, particularly if we witness a “FOMO trading” event after a break above the 200-Day EMA. In such a scenario, the British pound could target the ¥200 level.

Potential Pullback Levels

On the other hand, if the pair experiences a pullback from current levels, the ¥189 level is expected to provide support, followed by the ¥187 level, which previously acted as short-term resistance.

Conclusion: A Bullish Outlook With Potential for Further Gains

The recent breakout above the 200DMA suggests a bullish continuation in GBPJPY, with the potential for further gains. However, traders need to stay vigilant and monitor both technical and fundamental developments. While the carry trade remains a major driver, a potential for a pullback cannot be ruled out. Ultimately, the interplay of these factors will determine the future direction of the GBPJPY pair.

This article is for informational purposes only and does not constitute investment advice. It is essential to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.