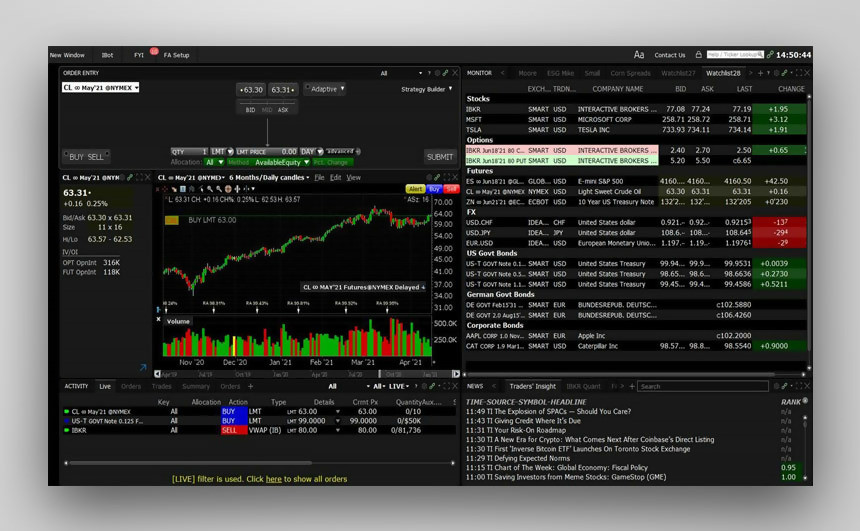

The company's latest monthly performance metrics show a 38% year-over-year rise in Daily Average Revenue Trades (DARTs), reaching 2.756 million. This figure also represents a 12% increase compared to the previous month.

Key Performance Indicators

Interactive Brokers' performance was driven by several key metrics. Here are some highlights:

- Daily Average Revenue Trades (DARTs): The company recorded 2.756 million DARTs in July, a 38% increase from the same month last year and a 12% increase from June 2024.

- Client Equity: Client equity ended at $509.5 billion, reflecting a 32% year-over-year growth and a 2% climb from June.

- Client Margin Loan Balances: Ending client margin loan balances reached $56.1 billion, marking a 30% increase from the previous year and a 2% gain from the preceding month.

- Client Credit Balances: Interactive Brokers reported an 11% year-over-year increase in ending client credit balances, totaling $109.2 billion, which includes $4.2 billion in insured bank deposit sweeps.

- Client Accounts: The number of client accounts reached 3.00 million, representing a 29% surge from the previous year and a 2% hike from June.

- Clears DARTs per Account: Interactive Brokers saw an annualized average of 206 cleared DARTs per client account.

- Average Commission: The average commission per cleared Commissionable Order was $2.78, inclusive of exchange, clearing, and regulatory fees.

Trade Execution Costs

In terms of trade execution costs, Interactive Brokers quantified the all-in cost for IBKR PRO clients trading U.S. Reg.-NMS stocks in July at approximately 3.6 basis points of trade money, based on a daily VWAP benchmark. This reflects a net cost of 3.3 basis points for the rolling twelve months.

Market Performance and Valuation

Interactive Brokers Group, Inc. (NASDAQ:IBKR) has demonstrated a robust performance, as reflected in their latest trading activity report. To add to the understanding of the company's financial health, InvestingPro data and tips offer a deeper dive into the firm's valuation and growth prospects.

InvestingPro data underscores the company's solid financial metrics with a market capitalization of $49.94 billion and a healthy price-to-earnings (P/E) ratio of 18.6. This valuation is supported by a strong revenue growth of 22.02% over the last twelve months as of Q2 2024, indicating a positive trend in the company's earnings capacity.

One InvestingPro Tip highlights that Interactive Brokers is trading at a low P/E ratio relative to its near-term earnings growth, suggesting that the stock may be undervalued given its growth potential. Additionally, the firm has been able to maintain dividend payments for 15 consecutive years, which could be appealing to income-focused investors.

With an impressive six-month price total return of 31.63%, Interactive Brokers has also shown a significant price uptick, reflecting investor confidence in the company's trajectory. For those seeking more detailed analysis, there are several additional InvestingPro Tips available at https://www.investing.com/pro/IBKR, which can provide further insights into the company's performance and investment potential.

Looking Ahead

Interactive Brokers' strong performance in July suggests the company is well-positioned for continued growth. The firm's robust trading activity and healthy financial metrics are likely to attract investors, particularly those seeking exposure to the brokerage sector. However, investors should keep an eye on the evolving interest rate environment and global economic conditions, which could have an impact on the company's future prospects.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.