SBI's Ambitious Goal: Rs 1 Lakh Crore Profit in Next 3-5 Years

State Bank of India (SBI), the country's largest public lender, has set an ambitious target: to become the first financial company in India to achieve a net profit of Rs 1 lakh crore within the next 3-5 years. SBI Chairman C S Setty expressed confidence in the bank's ability to reach this milestone, stating, “We have potential to be the first company in India to reach that milestone.”

SBI's FY24 performance serves as a solid foundation for this ambitious target. The bank reported a net profit of Rs 61,077 crore, representing a 21.59 percent increase from the previous year. Total revenue for the fiscal year reached Rs 3.32 lakh crore, showcasing the bank's strong financial position.

Strong Growth Prospects Fueling SBI's Ambitions

Chairman Setty attributes SBI's growth aspirations to the robust economic growth projected for India. He believes that this positive outlook will create a favorable environment for large-scale banks to expand their operations rapidly. He highlighted the government's emphasis on the manufacturing sector, which will provide significant financing opportunities for banks, leading to an expansion of their loan books and ultimately driving higher profits.

Public and Private Sector Investments Driving Growth

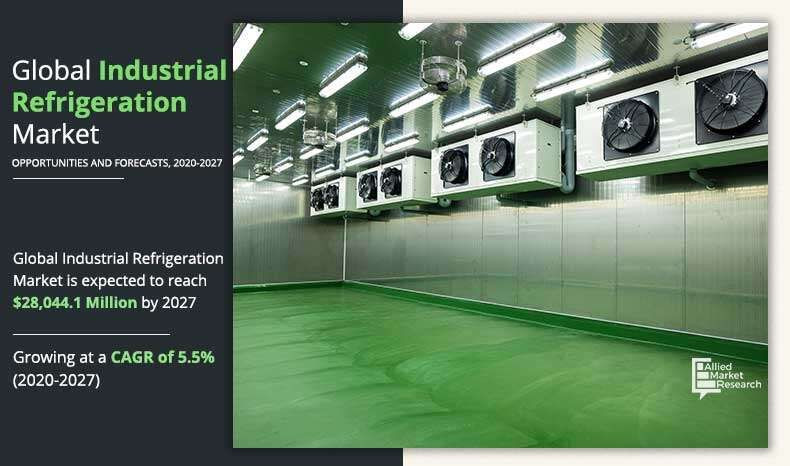

The government's commitment to infrastructure development is also expected to fuel SBI's growth. In the Budget 2024, Finance Minister Nirmala Sitharaman proposed a substantial increase in capital expenditure, raising the target to Rs 11.11 lakh crore. This represents 3.4 percent of the country's GDP and signifies a significant investment in infrastructure projects.

While government expenditure is expected to be a key driver of growth, Setty also anticipates a resurgence in private capital expenditure, particularly in the latter half of the current financial year. This will further boost the financing opportunities available for banks, leading to an expansion of their loan books and a subsequent increase in business activity. SBI's current loan book size stands at Rs 35 lakh crore.

SBI's Loan Pipeline and Private Sector Confidence

SBI has already secured a strong credit pipeline of ₹4 lakh crore from India Inc., reflecting the confidence of the private sector in the bank's lending capabilities. This pipeline encompasses both sanctioned but undisbursed loans and proposals currently under review. SBI's Chairman expressed optimism that private capital expenditure will gain momentum in the coming months, further strengthening the bank's loan portfolio.

Setty highlighted the growing interest in private capital expenditure, particularly in sectors like infrastructure, roads, renewable energy, and refineries. While some corporates have funded their brownfield expansions through internal cash flows and cash balances, there is a growing trend of drawing term loans for such projects. This signifies an increasing demand for financing solutions, which aligns with SBI's ambitious growth strategy.

SBI's Subsidiaries and Capital Allocation

Concerning the monetization of SBI's stake in its subsidiaries, Setty clarified that there are no immediate plans for divestment. However, he emphasized that the bank would carefully evaluate any capital requirements for these subsidiaries to ensure their continued growth. Currently, none of the large subsidiaries require additional capital from the parent bank to scale up their operations.

In the 2023-24 fiscal year, SBI infused an additional capital of ₹489.67 crore into SBI General Insurance Company Ltd. The bank also allotted ESOPs to employees, which resulted in a slight decrease in its stake from 69.95 percent to 69.11 percent.

SBI's Outlook on Interest Rates

Looking ahead, Setty anticipates that the Reserve Bank of India (RBI) is unlikely to ease the benchmark policy rate during 2024, citing concerns over food inflation. This perspective contrasts with the recent decision by the US Federal Reserve to cut interest rates by 50 basis points, the first cut in more than four years. The decision to lower the federal funds rate to a range of 4.75-5 percent has prompted central banks in other economies to consider similar measures. However, SBI's Chairman believes that India's unique economic context, particularly the need to manage food inflation, necessitates a cautious approach to interest rate adjustments.

SBI's Journey to Profitability

SBI's ambitious target of achieving Rs 1 lakh crore in net profit underscores the bank's unwavering commitment to growth and its ability to capitalize on India's burgeoning economic landscape. By leveraging its strong financial position, extensive loan book, and strategic investments, SBI aims to solidify its position as a leading financial institution in the country. The bank's focus on capital expenditure, both public and private, coupled with its proactive approach to subsidiary management, positions it for continued success and a potentially record-breaking financial performance.

SBI: A Force to Be Reckoned With

SBI's bold vision and aggressive growth strategy are not merely about achieving a numerical target. They represent a commitment to driving economic development, empowering businesses, and contributing to the overall prosperity of the Indian economy. With its strong financial foundation, strategic focus, and a seasoned leadership team, SBI is well-positioned to not only meet its ambitious goals but also to shape the future of Indian finance for years to come.