Kenyan President Cancels Billions in Adani Deals Following US Bribery Indictment

Kenyan President William Ruto's decisive move to cancel two lucrative deals with the Adani Group, totaling approximately $2.6 billion, has sent shockwaves through the international business community. This dramatic action, taken mere hours after US authorities indicted Gautam Adani, founder of the Adani Group, on charges of orchestrating a massive bribery scheme, underscores the gravity of the situation and the far-reaching consequences of alleged corporate malfeasance.

The cancelled deals involved a $1.85 billion concession for Adani Airport Holdings Ltd. to manage Kenya's largest airport for 30 years and a $736 million contract for another Adani unit to build high-voltage power transmission lines in the East African nation. This swift response by President Ruto is a testament to his firm commitment to combating corruption and prioritizing transparency in government dealings. He explicitly stated that the decision was based on “new information provided by our investigative agencies and partner nations,” hinting at a possible collaboration with international law enforcement agencies in uncovering the alleged bribery scheme.

The Adani Group’s Response and Market Reactions

The Adani Group, yet to issue an official statement, has found itself at the center of a global storm. The US indictment alleges a vast bribery plot orchestrated by Adani and senior executives to secure lucrative renewable energy contracts in India, involving payments exceeding $250 million to Indian officials. The indictment further accuses Adani and his associates of misleading US and international investors about the bribery scheme while raising over $3 billion in capital. The Adani Group vehemently denies these allegations, branding them as “baseless” and vowing to pursue all available legal avenues.

Market Turmoil and Investor Concerns

The fallout from the indictment was immediate and severe. Shares of Adani Enterprises, the group's flagship firm, plummeted by 22% on the day of the announcement. Other group companies also experienced significant losses, underscoring the magnitude of investor concern. The damage extends beyond the Adani Group itself; investors in Adani Green Energy also felt the impact, with a substantial drop in share prices. The cancellation of a planned $600 million bond offering by Adani Green Energy further accentuates the growing apprehension among investors.

Kenya's Response and the Fight Against Corruption

President Ruto's decisive action reflects Kenya’s determination to maintain its commitment to transparency and accountability. The president, citing evidence from investigative agencies and partner nations, didn't hesitate to terminate the contracts with the Adani Group. This is a bold move that aligns with his prior public pronouncements on tackling corruption within the nation. His administration had previously faced criticism for perceived opacity in awarding the contracts to the Adani Group.

Ruto's Anti-Corruption Stance and Public Reaction

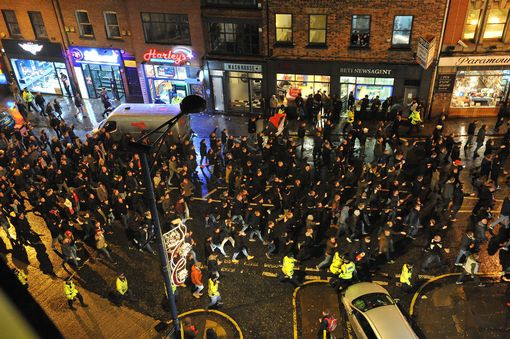

The president's consistent emphasis on fighting corruption underscores a broader governmental effort to address deep-rooted challenges within Kenya. Ruto's stance reflects a wider national concern over corruption, a sentiment that has manifested in public protests and demands for greater transparency and accountability from the government. The earlier protests in Kenya, resulting in significant loss of life, highlighted the deep-seated public frustration regarding mismanagement and perceived corruption. The cancellation of the Adani deals appears to be a direct response to these concerns, aiming to restore public trust and demonstrate the government's commitment to transparency in public procurement. The president's decisive action underscores the importance of international cooperation in combating global corruption and the potential consequences for businesses involved in alleged bribery schemes.

Geopolitical Implications and International Cooperation

The US indictment and Kenya's subsequent cancellation of the Adani Group contracts have far-reaching implications for both the Adani Group and the broader geopolitical landscape. The involvement of multiple nations in investigating the alleged bribery scheme exemplifies the growing importance of international cooperation in fighting corruption and enforcing anti-bribery laws across borders. The action highlights how multinational corporations, even those with significant global reach, are not immune to scrutiny and the consequences of alleged unlawful activities.

The impact on US-Kenya Relations

The collaboration between US and Kenyan investigative agencies, implied by President Ruto’s statement, showcases a growing partnership in combating corruption on an international level. The situation underscores the growing pressure on multinational corporations to adhere to strict anti-bribery regulations and to act with transparency and accountability in their global operations. The indictment's revelation of the alleged bribery scheme reaching into the US capital markets raises concerns about the potential risk of investor fraud and highlights the need for increased vigilance and oversight.

The Future of Adani and the Implications for Global Business

The US indictment against Gautam Adani and the subsequent cancellation of the lucrative Kenyan deals mark a significant turning point for the Adani Group. The outcome of the legal proceedings will undoubtedly have far-reaching consequences for the business empire, its future investments, and the way in which multinational corporations conduct their global operations. The events in Kenya, combined with the US charges, serve as a cautionary tale for businesses engaging in international projects, highlighting the importance of robust compliance programs, thorough due diligence, and transparency in all business dealings. The ongoing investigations and potential legal repercussions will likely influence future business strategies for companies operating globally, placing added emphasis on compliance with international laws and ethical practices.

The unfolding events underscore the growing importance of transparency and accountability in international business dealings and the significant repercussions businesses face when involved in alleged illegal activities. The Adani case showcases the increasingly interconnected nature of global investigations and the far-reaching consequences of corruption. The future implications remain uncertain, but one thing is clear: the global business landscape will be forever altered by this significant development. The repercussions from these events and actions taken will certainly be felt for years to come.