A Wave of Green: Materials Sector Earnings Beat Expectations

The materials sector has been a beacon of strength in a turbulent market. In a recent surge of positive earnings announcements, a remarkable 80% of S&P 500 materials companies surpassed analysts' expectations, painting a promising picture for the sector's growth trajectory. This performance reflects the underlying strength of the materials industry and its ability to navigate the challenging economic landscape.

Unraveling the Earnings Momentum

The materials sector's earnings performance can be attributed to a confluence of factors, including strong demand, robust pricing power, and a favorable supply-demand dynamic. The ongoing infrastructure investments worldwide, driven by government stimulus packages and private sector initiatives, have fueled demand for materials such as steel, copper, and aluminum. This surge in demand has translated into higher prices, bolstering companies' revenue and profitability.

Moreover, the materials sector has benefited from a healthy supply-demand balance, which has enabled companies to maintain pricing power. This has been particularly evident in the metals and mining sub-sectors, where production constraints and supply chain disruptions have resulted in elevated prices.

Looking Ahead: Potential Headwinds and Growth Drivers

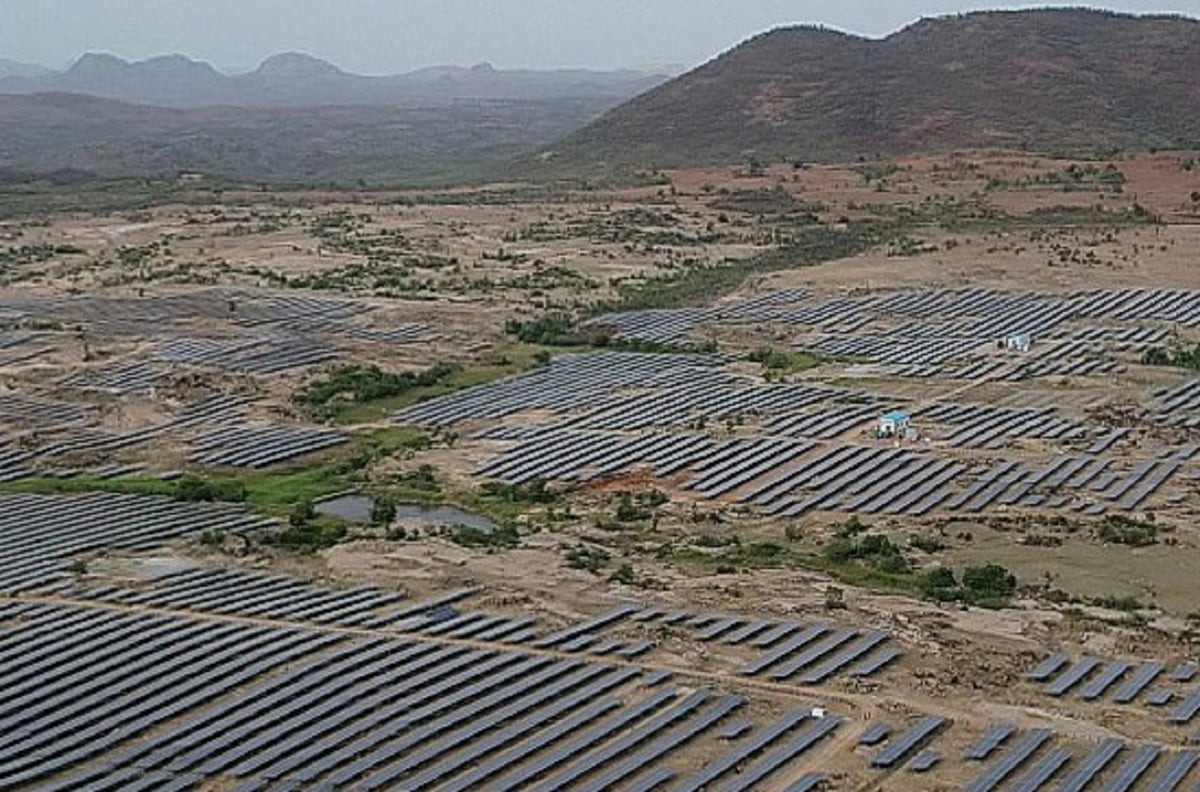

Despite the positive earnings momentum, the materials sector is not without its challenges. Global economic uncertainties, rising inflation, and potential interest rate hikes could dampen demand and impact profitability. The sector is also exposed to volatility in commodity prices, which can fluctuate significantly based on supply and demand dynamics. However, these headwinds are tempered by several growth drivers that point towards continued expansion in the coming months. The global transition towards renewable energy is expected to boost demand for materials such as lithium, cobalt, and copper, which are essential components of electric vehicles and renewable energy infrastructure. Additionally, the continued investment in infrastructure projects, particularly in emerging markets, is anticipated to provide a sustained demand for materials, supporting the sector's long-term growth potential.

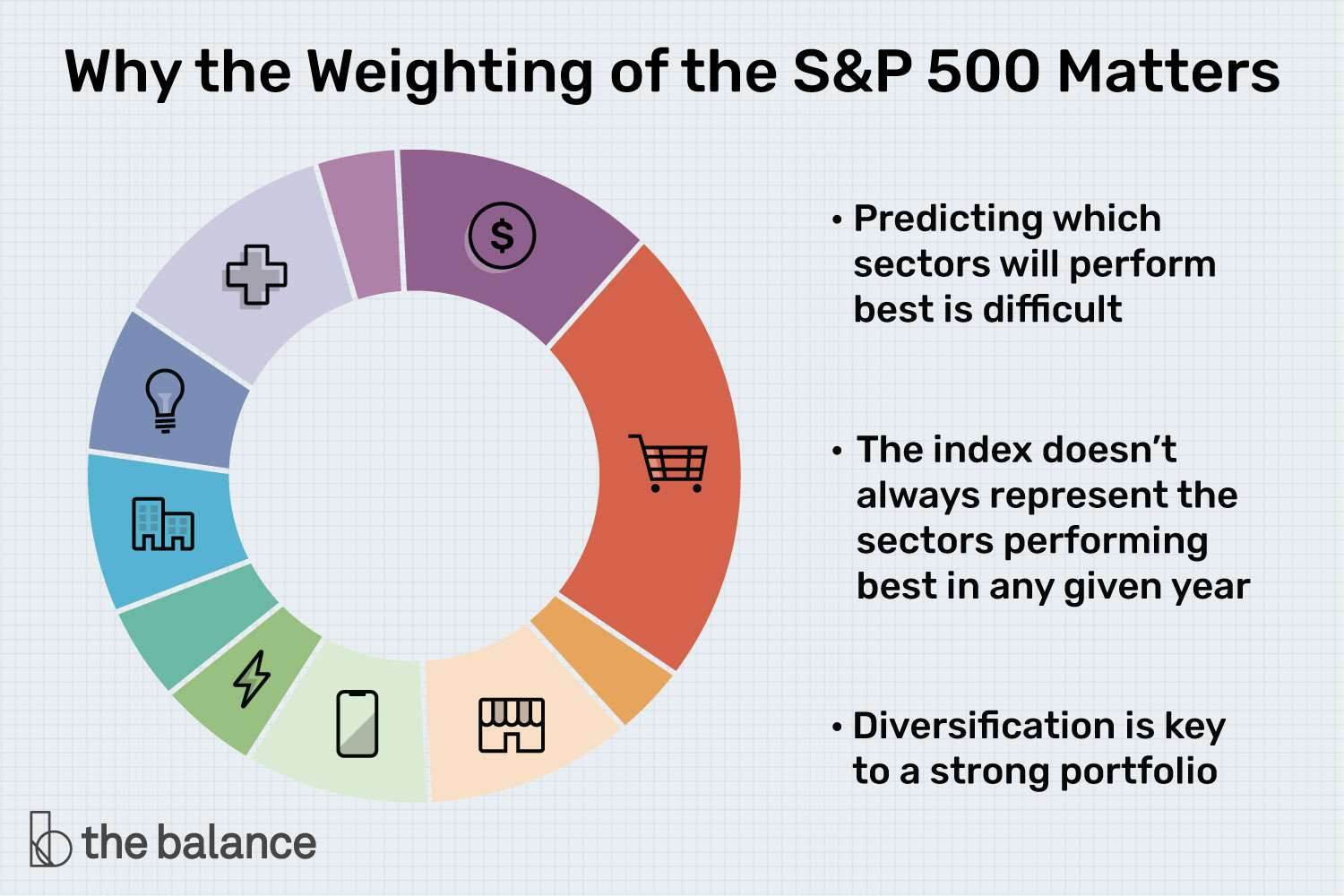

Navigating the Sector: Key Takeaways for Investors

The materials sector presents a compelling investment opportunity, particularly for investors seeking exposure to the global economic recovery and the shift towards sustainable energy. However, it's essential to approach the sector with a nuanced perspective, considering the potential risks and opportunities.

Here are key takeaways for investors considering an investment in the materials sector:

- Strong Demand: The global economy's reopening and increased infrastructure spending are driving robust demand for materials.

- Pricing Power: The materials sector's healthy supply-demand balance is enabling companies to maintain pricing power, boosting profitability.

- Growth Drivers: The transition towards renewable energy and continued infrastructure investment are key growth drivers for the sector.

- Global Economic Uncertainty: Potential headwinds include global economic uncertainties, rising inflation, and interest rate hikes, which could impact demand and profitability.

- Commodity Price Volatility: The sector is exposed to fluctuations in commodity prices, which can create volatility.

By carefully evaluating these factors and conducting thorough research, investors can make informed decisions about their investment strategy in the materials sector.

The Enduring Appeal: The Quiet Rally Persists

While the materials sector has faced cyclical challenges, it continues to exhibit a quiet resilience. Several factors contribute to the sector's ongoing strength, including robust infrastructure projects, a growing demand for critical minerals, and the transition towards a more sustainable energy landscape.

The resilience of the materials sector is evident in its recent performance. Despite ongoing economic headwinds, the materials sector has demonstrated a steady upward trend, defying market expectations. This resilience suggests that the sector is well-positioned to benefit from long-term growth trends, making it an attractive investment opportunity for discerning investors.

The materials sector's enduring appeal lies in its ability to adapt to evolving market dynamics and capitalize on emerging opportunities. The sector's ongoing rally reflects the confidence of investors in its ability to deliver sustainable value over the long term. As the world continues to prioritize infrastructure development and sustainable energy solutions, the materials sector is poised to play a critical role in shaping the future of global economic growth.

A Closer Look: The Materials Sector's Quiet Resilience

The materials sector's quiet rally is driven by several key factors:

- Infrastructure Investment: Government investments in infrastructure projects worldwide are a major driver of demand for materials such as steel, copper, and aluminum.

- Critical Minerals Demand: The shift towards renewable energy is fueling demand for critical minerals like lithium, cobalt, and nickel, which are essential components of electric vehicles and renewable energy systems.

- Supply Chain Disruptions: Ongoing supply chain disruptions, particularly in the metals and mining industry, are contributing to elevated prices and creating opportunities for materials producers.

- Technological Advancements: Innovation in materials science is creating new applications and driving demand for advanced materials, further supporting sector growth.

The materials sector's quiet rally is a testament to its long-term growth potential and its ability to navigate the complexities of the global economy.

Embracing the Future: The Materials Sector's Enduring Relevance

The materials sector is not merely a provider of raw materials; it is a crucial engine of global economic growth and a catalyst for innovation. The sector's commitment to sustainability and its role in driving the transition towards a greener future make it an essential element of the global economy.

The materials sector is poised to play a pivotal role in shaping the future, providing the building blocks for a more sustainable and prosperous world. As the world continues to grapple with the challenges of climate change, resource scarcity, and population growth, the materials sector will remain at the forefront of innovation and economic development.