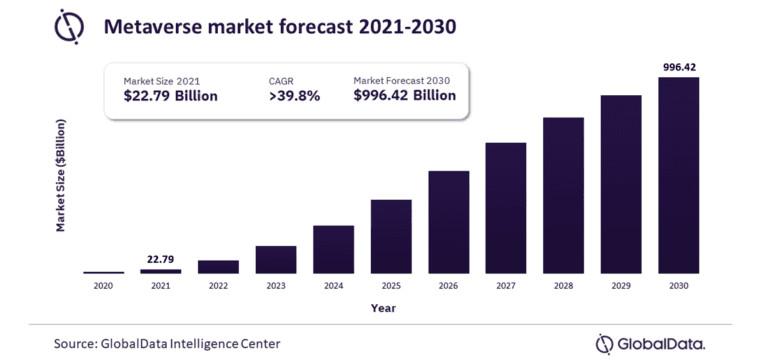

The metaverse has taken a backseat in the past few years as shinier technologies like artificial intelligence (AI) have taken over the headlines. However, the sector continues to grow, and according to one report, it will be a $1.2 trillion market by 2033.

According to the report by Brainy Insights, a Pune, India-based market research company, the metaverse market was worth $62.22 billion in 2023. The report credited the COVID-19 pandemic with fuelling the growth of the technology through the rise of remote working and interactive distance learning.

The post-COVID period witnessed accelerated growth for the metaverse as some of the biggest companies battled to dominate the new frontier. Meta (NASDAQ: META) was the biggest entrant, with Mark Zuckerberg announcing a pivot from a purely social media model to focus on the new tech, complete with a name change.

Zuckerberg predicted that the metaverse would reach a billion people over the next decade, host hundreds of billions in digital commerce, and give jobs to millions of content creators. Microsoft (NASDAQ: MSFT) Founder Bill Gates was just as optimistic, predicting in 2021 that over the next three years, “most virtual meetings will move from 2D camera image grids to the metaverse, a 3D space with digital avatars.”

Meanwhile, Omniscape CEO and Co-Founder Robert Rice believes that the metaverse is well positioned to mature in the next six months.

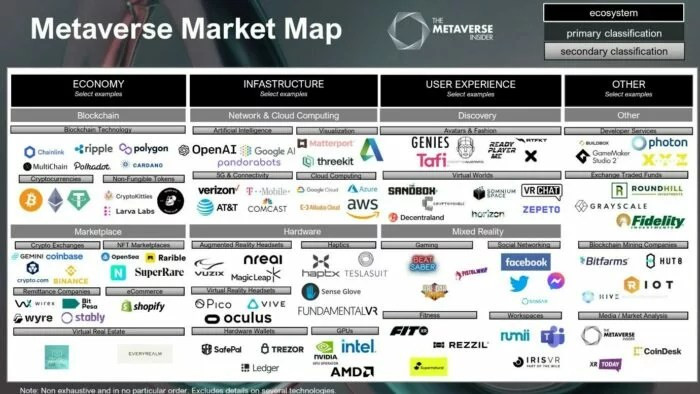

“[Metaverse] is not just [about] VR, it’s not just AR. We’re like the only industry that can encompass every other industry [like AI and blockchain],” Rice told CoinGeek Weekly Livestream. “So now that AI is kind of percolating down, it’s still hot, but now metaverse is kind of coming back… Again, when you have these huge hype things, people just throw money at whatever with no real substance to it; it goes away. But people who are actually building stuff are keeping their heads out of the craziness; we almost always survive, and now it’s our time to hit the hockey stick.”

The Brainy Insights report found North America dominates the sector and will lead in the forecasted period. The region is home to key market players, boasts a more robust infrastructure, and has the most favorable regulatory conditions.

In the metaverse industry, the software segment is the largest, with a 35% market share in 2023. Augmented reality is the dominant technology ahead of virtual and mixed realities.

Gaming has continued to dominate the metaverse and is unlikely to be dislodged over the next decade, the report found. Even before the blockchain-powered metaverse blew up globally, gamers were already engaging in immersive digital worlds through VR headsets, making the transition easier for them.

Media and entertainment are the next largest sectors for the metaverse, with a 20.11% market share in 2023.

While high development costs remain a challenge, the report predicts that the expansion of the metaverse beyond entertainment offers massive room for growth. The technology is now being used in education, healthcare, remote work, tourism, aerospace, and more.

The use of the metaverse in more critical sectors comes with the risk of cyber attacks, which could hinder the technology’s growth, the report acknowledged.

Metaverse Stocks: 3 Companies Leading The Charge

The metaverse is rapidly becoming a cornerstone of the digital economy. As this immersive virtual universe expands, it promises to revolutionize the way we interact, work, think, and live, blending the physical and digital worlds into a seamless experience.

According to Statista, the metaverse market is expected to reach $74.40 billion in 2024. The market is further projected to grow at a CAGR of 37.7%, resulting in a volume of $507.80 billion by 2030. Significant advancements in augmented reality (AR), virtual reality (VR), mixed reality (MR), and 3D visualization drive market growth.

With major tech companies investing heavily in metaverse infrastructure, the market is poised for exponential growth, offering unprecedented opportunities for investors. For those looking to capitalize on this trend, identifying companies not just participating but leading the charge in the metaverse is crucial.

Thus, three stocks META, ADSK, and NET, which are at the forefront of the metaverse revolution, could be ideal buys. Let’s discuss the fundamentals of these feature stocks in detail.

Meta Platforms, Inc. (META)

META develops products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality headsets, and wearables globally. The company operates in two segments: Family of Apps and Reality Labs.

META’s trailing-12-month gross profit margin of 81.49% is 59.8% higher than the industry average of 50.99%. Its trailing-12-month EBIT margin of 41.21% is 329% higher than the industry average of 9.61%. Likewise, the stock’s trailing-12-month net income margin of 34.34% is considerably higher than the industry average of 3.33%.

For the second quarter that ended June 30, 2024, META’s revenue increased 22.1% year-over-year to $39.07 billion. Its income from operations rose 58.1% from the year-ago value to $14.85 million. The company’s net income and EPS came in at $13.47 billion or $5.16, up 72.9% and 73.2% from the previous year’s quarter, respectively.

Analysts expect META’s revenue and EPS for the third quarter (ending September 2024) to increase 17.5% and 19.1% year-over-year to $40.11 billion and $5.23, respectively. In addition, the company has topped the consensus revenue and EPS estimates in each of the trailing four quarters, which is impressive.

META’s shares have gained 9.4% over the past month and 45.5% year-to-date to close the last trading session at $519.10.

META’s POWR Ratings reflect its promising prospects. The stock has an overall rating of B, which translates to a Buy in our proprietary system. The POWR Ratings assess stocks by 118 different factors, each with its own weighting.

META has an A grade for Quality and Sentiment. The stock is ranked #15 out of 51 stocks in the B-rated Internet industry.

Autodesk, Inc. (ADSK)

ADSK provides 3D design, engineering, and entertainment technology solutions. The company’s products include AutoCAD Civil 3D, Autodesk Build, Autodesk BIM Collaborate Pro, AutoCAD, Revit, Flow Production Tracking, Maya, ShotGrid, and 3ds Max.

On May 21, ADSK announced the acquisition of Wonder Dynamics, makers of Wonder Studio, which is a cloud-based 3D animation and VFX solution combining AI with established tools. With this acquisition, Autodesk aims to enhance 3D content creation across the media and entertainment industries by offering cloud-based AI technology.

On April 24, ADSK signed an interoperability agreement with the Nemetschek Group to advance open collaboration and efficiencies for the architecture, engineering, construction, and operations (AECO) and media and entertainment (M&E) industries.

The strategic agreement will strengthen the existing interoperability between the companies' industry cloud and desktop products, facilitating smoother information exchange across their solutions.

In the fiscal 2025 first quarter that ended April 30, 2024, ADSK’s total revenue increased 11.7% year-over-year to $1.42 billion. Its non-GAAP income from operations rose 21.3% from the year-ago quarter to $490 million. The company’s net income grew 56.5% from the prior year’s period to $252 million.

Further, the company’s non-GAAP net income per share increased 20.6% year-over-year to $1.87. Autodesk’s free cash flow was $487 million for the quarter.

Analysts expect ADSK’s revenue for the second quarter (ended July 2024) to increase 10.2% year-over-year to $1.48 billion. Its EPS for the same quarter is expected to grow 4.9% year-over-year to $2. Moreover, the company surpassed consensus revenue and EPS estimates in all four trailing quarters.

Shares of ADSK have surged 4.7% over the past month and 17.5% over the past year to close the last trading session at $256.99.

ADSK’s sound fundamentals are reflected in its POWR Ratings. The stock has an overall rating of B, which translates to a Buy in our proprietary system.

ADSK has a B grade for Quality, Growth, and Sentiment. It is ranked #26 out of 129 stocks in the Software – Application industry.

Cloudflare, Inc. (NET)

NET operates as a cloud services provider that delivers various services to businesses. It offers an integrated cloud-based security solution to protect various platforms, including public cloud, private cloud, software-as-a-service applications, and IoT devices; and website and application security products, SSL/TLS encryption, and rate limiting products.

On May 30, NET acquired BastionZero, a Zero Trust infrastructure access platform, to further strengthen remote access to core IT systems for customers of Cloudflare One, the company’s secure access service edge (SASE) platform.

Matthew Prince, co-founder and CEO of Cloudflare, said, “Incorporating BastionZero into Cloudflare One gives IT teams access to an organization's most critical inner workings securely, wherever they are. Millions of organizations around the world trust Cloudflare to protect their systems and data so they can focus on their business and their customers. The addition of BastionZero is just one more way we can protect them like no one else can.”

Also, on the same day, NET and CrowdStrike Holdings Inc. (CRWD) expanded their strategic partnership to secure networks and power the AI-native Security Operations Center (SOC).

By integrating cloud-native, market-leading Zero Trust protection and connectivity from Cloudflare One™ with best-in-class AI-native cybersecurity from CrowdStrike Falcon® Next-Gen SIEM, joint channel partners can drive vendor consolidation while reducing costs and operational complexity for customers globally.

During the second quarter that ended June 30, 2024, NET’s revenue increased 30% year-over-year to $401 million, and its non-GAAP gross profit was $316.60 million, up 32.1% from the prior year’s quarter. The company’s non-GAAP income from operations grew 180.8% from the prior year’s quarter to $57 million.

Additionally, the company’s non-GAAP net income came in at $69.50 million, or $0.20 per share, increases of 106.2% and 100% from the previous year’s quarter, respectively.

Street expects NET’s revenue and EPS for the third quarter (ending September 2024) to increase 26.4% and 13% year-over-year to $424.12 million and $0.18, respectively. Further, the company surpassed the consensus revenue and EPS estimates in all four trailing quarters, which is remarkable.

NET’s stock has soared 1.8% over the past month and 29.4% over the past year to close the last trading session at $81.26.

WRB’s sound fundamentals are reflected in its POWR Ratings. The stock has an overall rating of B, equating to a Buy in our proprietary rating system.

The stock has an A grade for Growth and a B for Sentiment. NET is ranked #17 among 23 stocks in the B-rated Software-Security industry.

What To Do Next?

Discover 10 widely held stocks that our proprietary model shows have tremendous downside potential. Please make sure none of these “death trap” stocks are lurking in your portfolio:

10 Stocks to SELL NOW! >

META shares were trading at $516.00 per share on Wednesday afternoon, down $3.10 (-0.60%). Year-to-date, META has gained 46.08%, versus a 18.25% rise in the benchmark S&P 500 index during the same period.

Mangeet’s keen interest in the stock market led her to become an investment researcher and financial journalist. Using her fundamental approach to analyzing stocks, Mangeet’s looks to help retail investors understand the underlying factors before making investment decisions.