Microsoft Stumbles After Azure Cloud Computing Growth Disappoints

Microsoft delivered mixed earnings late Tuesday, surpassing estimates for earnings per share and revenue but falling short on its Azure cloud computing growth projection. Investors reacted negatively, sending Microsoft's stock price plummeting in after-hours trading.

Earnings Beat, But Azure Falls Short

The software behemoth reported earnings of $2.95 per share on revenue of $64.7 billion for the fiscal fourth quarter ended June 30. These figures exceeded analyst expectations, with earnings slightly above the projected $2.94 per share and revenue marginally higher than the anticipated $64.4 billion.

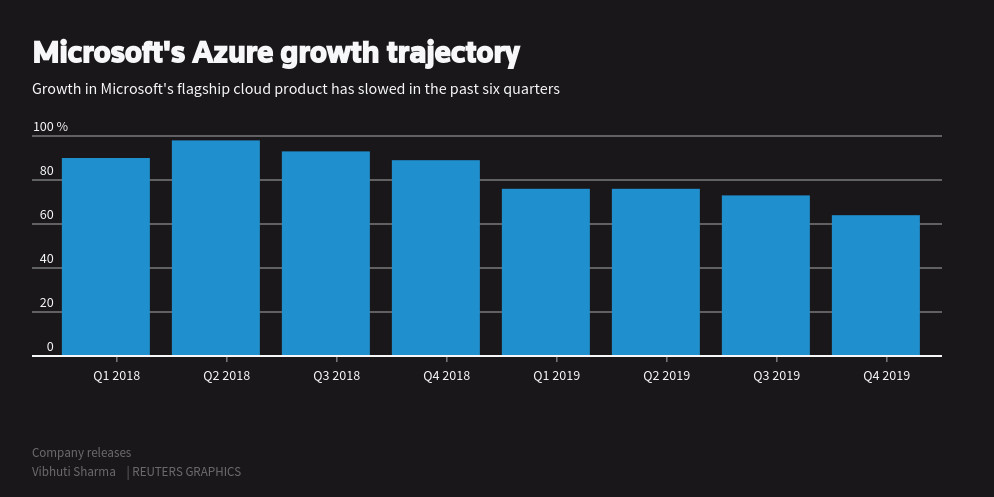

However, Microsoft's Azure cloud infrastructure business, a key growth driver, saw a 30% increase in constant currency during the quarter, falling short of the anticipated 31.3% growth. This also marked a slowdown from the 31% growth recorded in the March quarter.

Azure Guidance Lags Expectations

For the current quarter, Microsoft forecast Azure revenue growth of 28% to 29% in constant currency, below the consensus estimate of 30.6%. This added to concerns among investors, further driving down Microsoft's stock price.

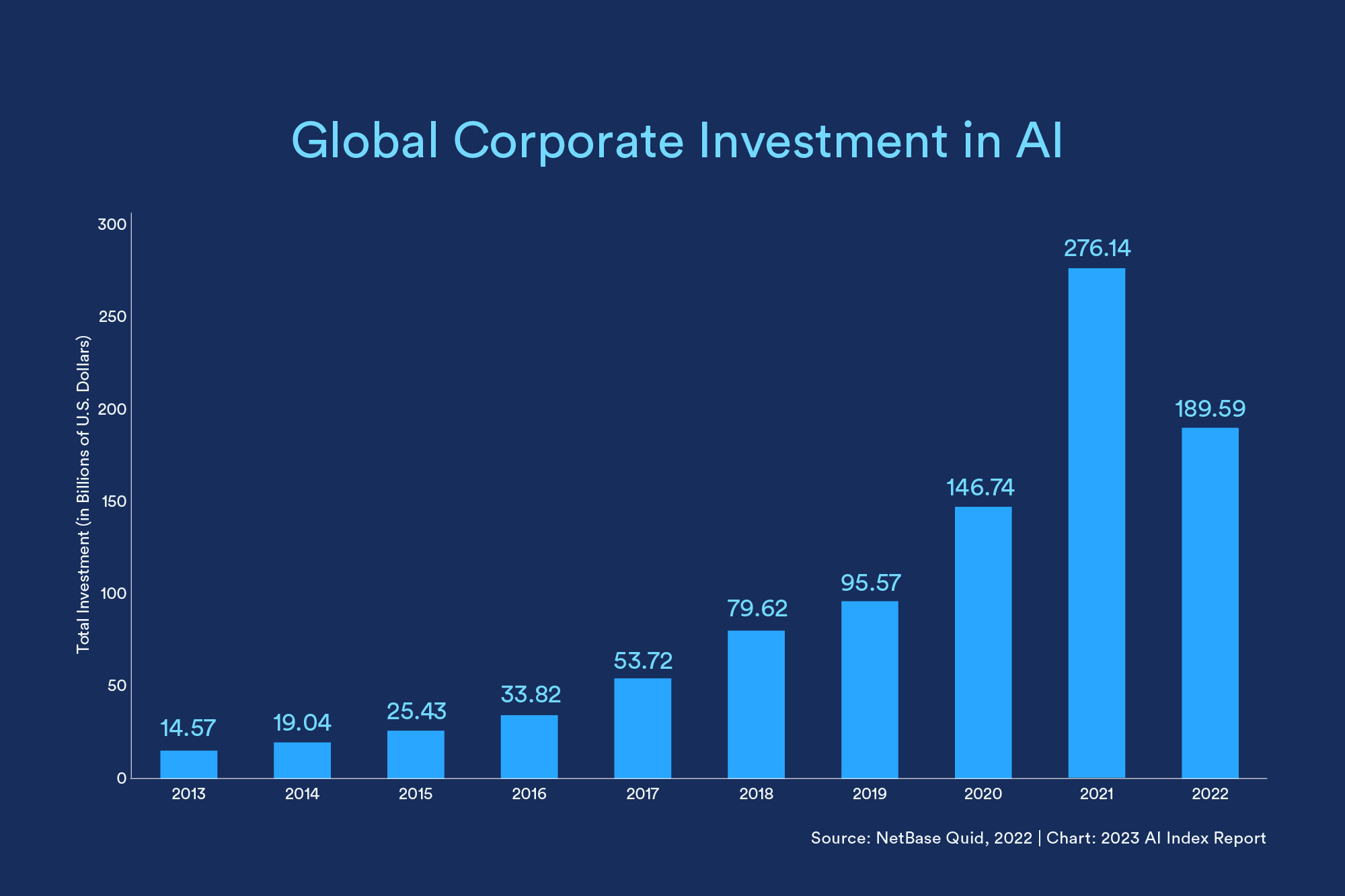

AI Spending Weighs on Sentiment

Microsoft's capital expenditures, primarily for AI data centers, were higher than expected in the June quarter, noted Angelo Zino, an analyst at CFRA Research. This higher spending may have contributed to the negative market reaction.

Revenue Growth Across Business Units

Despite the Azure disappointment, Microsoft's Intelligent Cloud unit led the way in growth for the June quarter, with revenue increasing 19% to $28.5 billion. This unit includes server products and cloud services like Azure.

The Productivity and Business Processes unit saw sales rise 11% to $20.3 billion, driven by Office productivity software and LinkedIn. The More Personal Computing unit, which includes Windows PC software, Xbox video games, Surface computers, internet search, and advertising, reported a 14% revenue increase to $15.9 billion.

Investor Optimism Fades

Microsoft's stock has faced a significant downturn since reaching a record high of $468.35 on July 5. The current drop adds to a steeper decline that began amid a shift in investor sentiment away from tech stocks.

Conclusion

Microsoft's latest earnings report highlights the challenge it faces in maintaining its growth trajectory amid intensifying competition in the cloud computing market. While the tech giant remains a dominant player, investors will be scrutinizing its ability to sustain Azure's rapid growth, particularly as AI investments continue to impact its bottom line. The next few quarters' performance will be critical in shaping investor confidence and determining Microsoft's future direction.