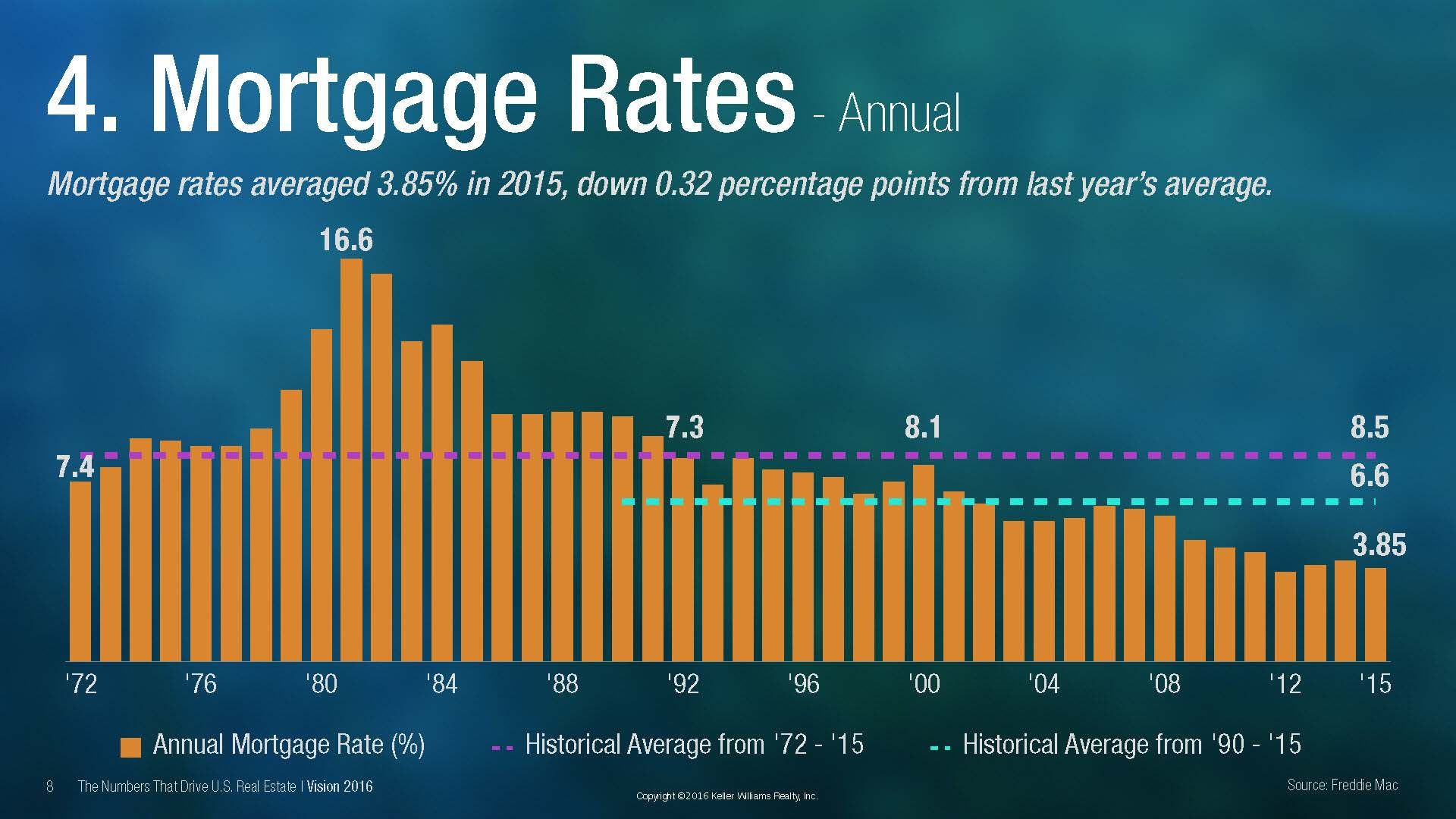

Mortgage Rates Dip: A Ray of Hope for Homebuyers and Refinancers?

Mortgage rates have taken a slight dip this week, offering a glimmer of hope for prospective homebuyers and those looking to refinance. The average rate on a 30-year fixed mortgage has fallen to 6.75 percent, down 11 basis points from last week. This comes as a welcome change after months of rates hovering around 7 percent.

Factors Influencing Rate Fluctuations

Mortgage rates are constantly in flux, influenced by a complex interplay of economic indicators.

The Federal Reserve's Role

The Federal Reserve (Fed) plays a crucial role in setting interest rates. The Fed's monetary policy decisions, such as adjusting its benchmark interest rate, can have a ripple effect on mortgage rates.

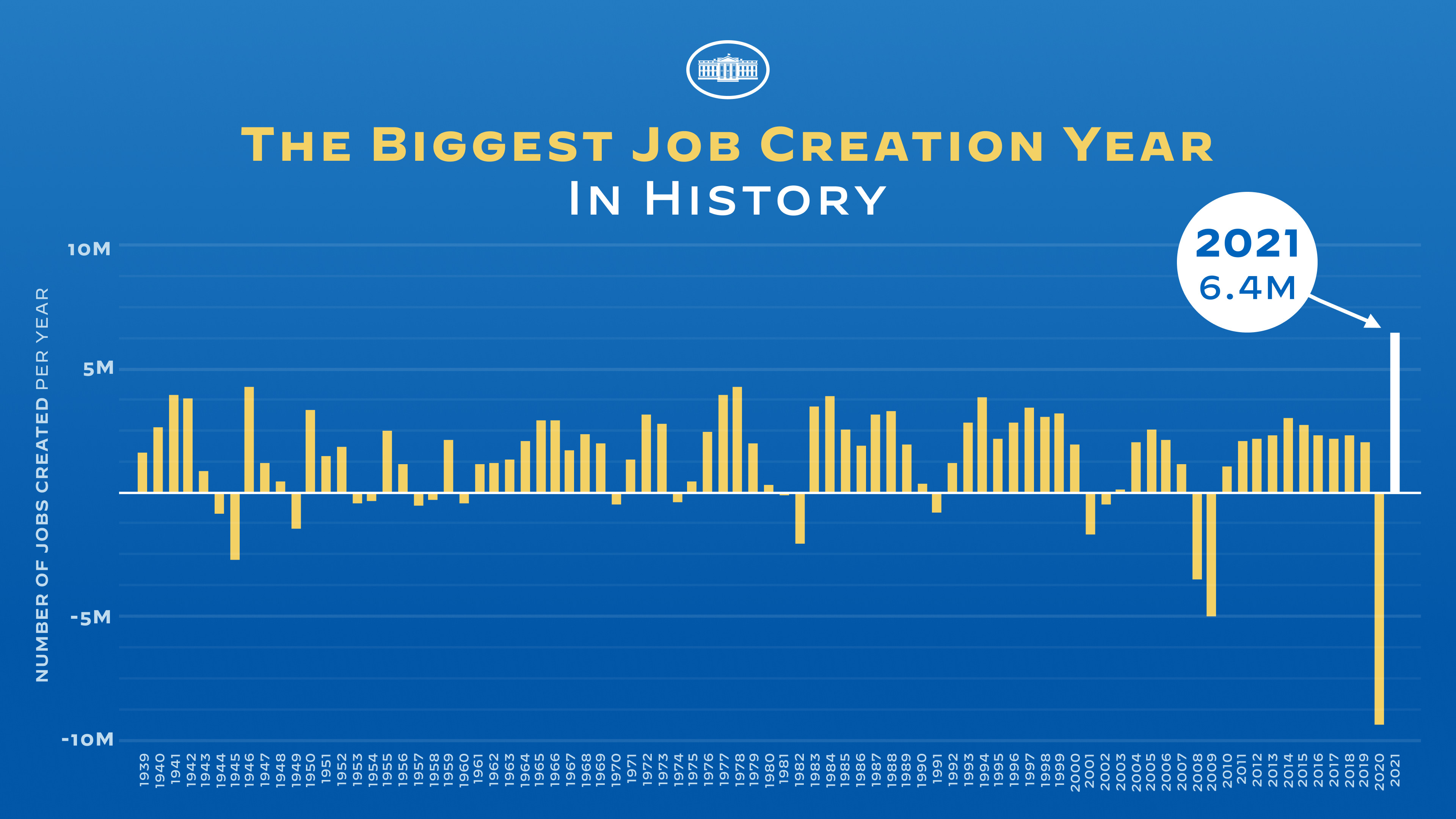

Inflation and Economic Growth

Inflation and economic growth are also significant factors. When inflation is high, lenders tend to demand higher interest rates to compensate for the decreased value of their money. Conversely, a strong economy can lead to higher demand for loans, potentially pushing rates up.

Investor Sentiment

Investor sentiment and market conditions also influence rates. When investors are optimistic about the economy, they may be more likely to invest in bonds, which can drive down mortgage rates.

Is This Just a Temporary Dip?

While this week's dip in mortgage rates is positive news, it's unclear whether this trend will continue.

Experts' Forecasts

Experts are predicting that mortgage rates will remain relatively stable, with the possibility of further small declines in the coming months. However, there are also concerns that the Fed's ongoing efforts to combat inflation could lead to further interest rate hikes, potentially pushing mortgage rates back up.

Economic Uncertainty

The global economy is facing several challenges, including geopolitical tensions, supply chain disruptions, and the ongoing impact of the COVID-19 pandemic. These uncertainties can add volatility to the mortgage market.

Should You Buy or Refinance Now?

The decision of whether to buy a home or refinance now is a complex one. Here are some key factors to consider:

Your Financial Situation

First and foremost, assess your financial situation. Do you have a stable income and sufficient savings for a down payment and closing costs?

Interest Rate Trends

Consider the current and projected interest rate trends. If rates are expected to rise in the near future, locking in a lower rate now might be advantageous.

Housing Market Conditions

Evaluate the housing market in your area. Are prices stable or trending upward? If prices are rising quickly, waiting might make sense.

Personal Needs

Ultimately, the decision comes down to your individual needs and circumstances. If you need to move for work or family reasons, it might be better to buy now regardless of the interest rates.

Navigating the Market

The current mortgage market is still somewhat unpredictable, but there are steps you can take to navigate it effectively:

Shop Around

Get quotes from multiple lenders to compare rates and terms.

Improve Your Credit Score

Work on improving your credit score, as this can help you qualify for lower interest rates.

Consider a Mortgage Rate Lock

If you're concerned about interest rates rising, consider locking in a rate for a certain period.

Conclusion: A Time for Strategic Action

The recent dip in mortgage rates presents a potentially advantageous opportunity for homebuyers and refinancers. However, it's essential to approach this market with a strategic mindset, carefully weighing your financial circumstances, market conditions, and personal goals. By understanding the factors influencing rates and taking proactive steps, you can make informed decisions that align with your financial aspirations.