Job growth in the US was weaker than expected last month, raising concern that the world's largest economy is starting to stumble under the weight of higher interest rates. Employers added 142,000 jobs in August, less than the roughly 160,000 analysts had forecast, the Labor Department said. It also said job gains in the previous two months were lower than initially estimated. However, the unemployment rate fell back, dropping to 4.2% from 4.3% in July.

The report is one of the most important gauges of the US economy and comes at a critical time, as voters weigh presidential candidates for the November election and the US central bank debates its first cut to interest rates in four years. Analysts said the latest figures kept the Federal Reserve on track for a rate cut at its meeting this month, but would do little to resolve questions about the direction of the US economy or how big a cut it should make.

"Rarely has there been such a make or break number – unfortunately, today’s jobs report doesn’t entirely resolve the recession debate," said Seema Shah, chief global strategist at Principal Asset Management.

The August employment report confirmed that the job market is cooling. With a 142,000 increase in August and downward revisions of the June and July numbers, job growth has slowed to an average 116,000 over the past three months. That is likely not enough to keep the unemployment rate from rising further. It was little changed at 4.2% in August, but we do expect it will increase over the next year, perhaps as getting as high as 5%.

There were job losses in the manufacturing sector in August but relatively modest job gains in the services sector. This is consistent with a cooling of demand or workers from companies across the board. The JOLTS report this week added to this picture with data showing an ongoing decline in job openings. Average hourly earnings picked up last month to a 3.8% annual change from 3.6% in July.

“Federal Reserve officials have recently pivoted from a primary focus on inflation to a more balanced view, with concerns both about inflation and employment. This report highlights that such a pivot makes sense, and that a 25-basis-point cut at its September meeting is a sensible first step at this time.”

A Closer Look at the Numbers

Hiring by America’s employers picked up a bit in August from July’s tepid pace, and the unemployment rate dipped for the first time since March in a sign that the job market may be cooling but remains sturdy. Employers added a modest 142,000 jobs last month, up from a scant 89,000 in July, the Labor Department said Friday. The unemployment rate ticked down to 4.2% from 4.3% in July, which had been the highest level in nearly three years. Hiring in June and July, though, was revised sharply down by a combined 86,000, and July’s job gain was the weakest since the pandemic.

The weakening jobs figures underscore why the Federal Reserve is set to cut its key interest rate when it next meets Sept. 17-18, with inflation falling steadily back to its target of 2%. Yet Friday’s mixed report deepens the question of how large a cut the Fed will announce. The central bank could reduce its benchmark rate by a typical quarter-point or by a larger-than-usual half-point.

Collectively, Friday’s figures depict a job market slowing under the pressure of high interest rates but still growing. Many businesses appear to be holding off on adding jobs, in part because of uncertainty about the outcome of the presidential election and about how fast the Fed will reduce its benchmark rate in the coming months.

Daniel Zhao, lead economist at the career website Glassdoor, said some of the details in the August jobs report indicate that businesses’ demand for workers is slowing. The number of Americans who are working part time but would prefer full-time work rose, extending a year-long trend.

“When you look under the hood, you’re seeing numbers that confirm that the job market is on that cooling trajectory, Zhao said.

America’s labor market is now in an unusual place: Jobholders are mostly secure, with layoffs low, historically speaking. Yet with the pace of hiring having weakened, landing a job has become harder.

A Cooling Job Market

The U.S. economy added 142,000 jobs in August and the unemployment rate ticked down slightly to 4.2%, the Bureau of Labor Statistics said Friday, fresh data that does little to assuage concerns about a slowdown in an otherwise solid labor market. Economists had expected a slightly stronger jobs report, looking for 161,000 added jobs. And while the unemployment rate hardly budged, Friday's report also included significant downward revisions to June and July jobs numbers.

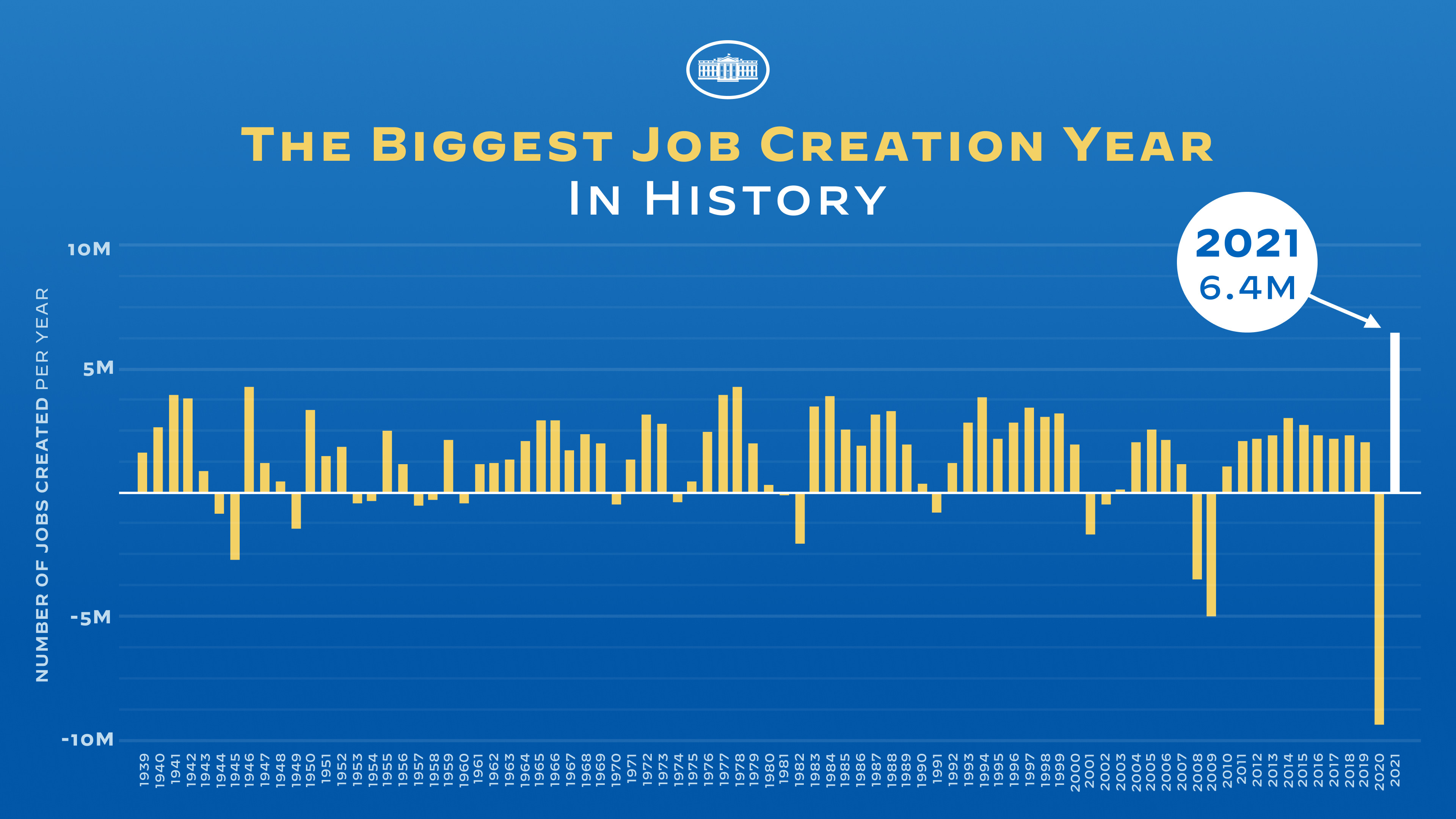

Unemployment remains low but has been on an upward trajectory for most of this year following a jobs boom the U.S. experienced as part of its broader economic recovery following the Covid pandemic.

“The chief worry among Americans has been high prices, the result of inflation,” Mark Hamrick, senior economic analyst at Bankrate, said in a note following Friday’s release. “The state of the job market is now competing for their attention.”

The monthly jobs report — always closely watched by economists and analysts — was under even more intense scrutiny due to expectations that the Federal Reserve will soon cut interest rates in an effort to provide a boost to economic growth. Economic issues are also at the forefront of the presidential campaigns of Vice President Kamala Harris and former President Donald Trump. After Friday, there will be just two more monthly jobs reports before Election Day.

Markets responded negatively to the news, with stock futures ticking downward and U.S. Treasury yields falling, the latter a sign that investors are seeking assets deemed safer and less risky.

The economy is producing mixed signals. Earlier this week, two measures of manufacturing came in weak, fueling fears that the economy is slowing faster than hoped for. On Wednesday, the BLS reported that job openings continued a sharply downward trend, though they still remain above pre-pandemic levels. But it showed that the hiring rate for professional and business services workers — who tend to enjoy higher salaries — has reached lows not seen since the Great Recession in 2009.

Yet layoffs remain largely subdued, even after jumping last month, as does the number of individuals filing for unemployment. Businesses are "laying off workers like it's a boom and hiring like it's a recession," Dario Perkins, managing director at TS Lombard financial firm, said in a post on X Wednesday.

The cross-currents come as Americans have mostly spent down their pandemic-era cash piles, while borrowing remain restrained by the high interest rate environment. And even as the rate of inflation has largely been tamed back to the Federal Reserve's 2% target, consumers are still reeling from four years of surging prices.

The Fed’s Dilemma

Soaring prices in 2022 prompted the Federal Reserve to raise its key lending rate to 5.3%, a roughly 20-year high. Faced with higher borrowing costs for homes, cars and other debt, the economy has slowed, helping to ease pressures that were fuelling inflation, but adding to market jitters. As inflation has subsided, falling to 2.9% in July, the Fed is now under pressure to cut rates and ward off further economic slowing. The job gains in August, although below estimates, were higher than July, when a slowdown sparked fears and prompted several days of stock market turmoil. Construction and health care firms led the hiring last month, while manufacturers and retailers got rid of roles.

Ms Shah said the data in Friday's report was mixed, but contained enough worrying signs that the Fed should make a bigger cut. “On balance, with inflation pressures subdued, there is no reason for the Fed not to err on the side of caution and frontload rate cuts,” she said. But others said the gains were just steady enough to warrant a 0.25 percentage point cut, as markets have long predicted - though it might be a sign of more cuts than expected in the months ahead. The Fed's decision would be “close run”, said Paul Ashworth, chief North America economist for Capital Economics. “The labour market is clearly experiencing a marked slowdown,” he said, adding that the latest figures were “overall still consistent with an economy experiencing a soft landing rather than plummeting into recession”.

The 2024 Election

The concerns about the economy are a key issue in the US election. Polls suggest that a majority of Americans already believe the US is experiencing a recession, despite solid 2.5% growth last year. Donald Trump has claimed that the economy is headed for a “crash” and his campaign quickly seized on the latest figures to attack vice president Kamala Harris, issuing a press release titled “warning lights flash as Kamala's economy keeps weakening”. Democrats have defended their record, arguing that the US weathered the pandemic and inflation better than many other countries. They say that the slowdown is a sign of an economy returning to a more sustainable pace of growth after the post-pandemic boom. “Although hiring has slowed, the US job market continues to generate solid job gains and wage growth that is consistently beating inflation,” the White House Council of Economic Advisors said in a blog.

The Road Ahead

Despite these headwinds, there's been talk throughout the summer of the U.S. economy having achieved a “soft landing” of relatively low unemployment and relatively low inflation. Stocks, too, remain near all-time highs despite some recent turbulence. Mark Zandi, chief economist at Moody's Analytics group, told NBC News that, as long as the unemployment rate remains at current levels, he believes a soft landing can be sustained. But he said that sunny picture could easily be ruined. “It wouldn’t take a whole lot to upset that story and see companies start pulling back and laying off,” Zandi said. “The labor market is good, but it feels like a fragile good.”

The current unemployment rate still implies more than 7 million Americans are out of work and looking for a job. Among them is Cassandra Kelly, a 38-year-old New Jersey resident and mother of two who told NBC News she has now been on the job market for more than a year. An operations specialist with experience in communications and social media, Kelly said she's been getting by thanks to a settlement payment from her landlord, financial support from her partner and occasional independent contract work. But none of it has been enough to cover her expenses. The full-time roles she's seeing posted in her field now pay as little as $45,000 — hardly enough to qualify for an apartment in the New York City area, Kelly said, adding that some of the positions come with no benefits, something that she needs in order to support hers and her family's medical needs. “Even when I’m willing to go down to $45,000 or $50,000, the amount of work they're asking for this tiny bit of money is not fair,” she said. “It breeds resentment. There have been times I've wanted to give up.”

There's hope that the Federal Reserve's widely expected interest-rate cut later this month will ease the brakes on growth and loosen financial conditions. When it does so, the cost of borrowing on everything from autos to credit cards will decline. Mortgage rates, too, are likely to fall, although the Fed does not directly control those. Whatever financial relief may come, the Fed's policy actions won't have an immediate effect — especially given that the current rate of 5.5% is already so high. “It's not a game-changing event,” Zandi said, meaning it will take time for the economy to adjust to a September rate cut and any future cuts that may come in November, December and beyond.